Gold Elliott Wave Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Likely Double Zigzag

Position: Wave 4

Direction: Wave 4 is still in play

Details: Gold count adjusted to fit the sideways structure emerging for wave 4. The structure still supports further rallies.

Gold has remained in a sideways range since the decline on April 12th, 2024. Despite this consolidation, the metal is poised for more gains and potentially a fresh all-time high. Gold is in a long-term bullish trend, with no significant bearish correction expected until the impulse cycle from September 2023 completes.

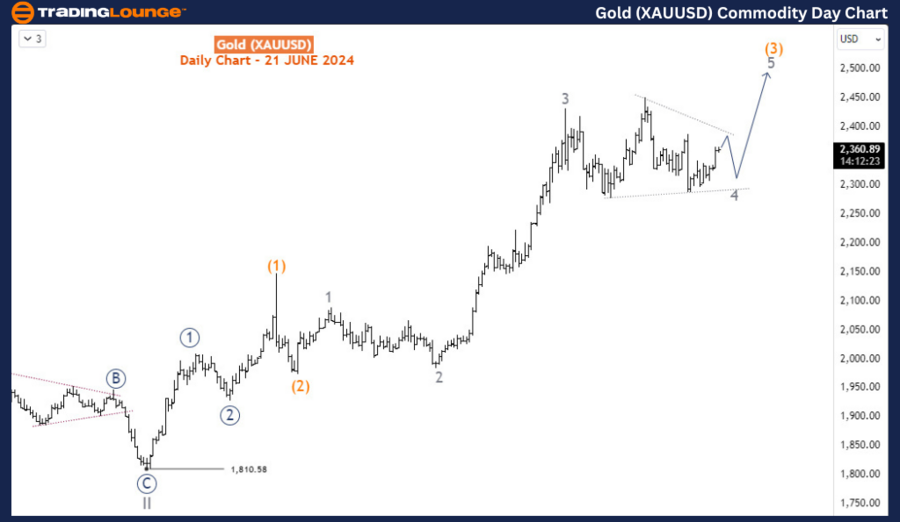

Daily Chart Analysis

Gold prices have been largely bullish, with a cycle degree impulse wave III emerging from 1810.5 in September 2023. Currently, the price is in a minor degree wave 4, which initially appeared to be a zigzag structure. However, the sustained sideways price action suggests this is a triangle structure for wave 4. Before the eventual breakout to the upside, Gold might make one more leg lower within the range. The goal now is wave 5.

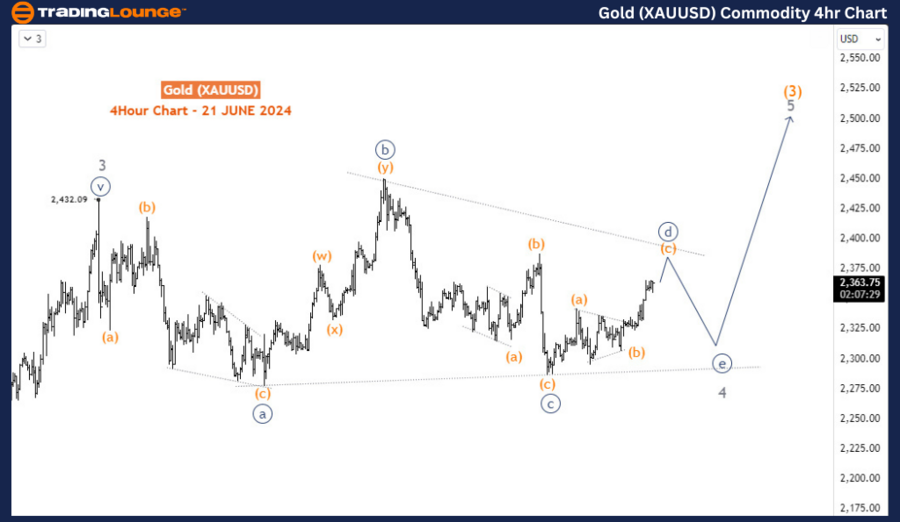

H4 Chart Analysis

The H4 chart shows the sub-waves of the emerging triangle structure, which is currently on the fourth leg - wave d (circled). Wave e (circled) should follow, but it should stay above 2286 to avoid invalidating the triangle structure. Thus, the invalidation level for this setup is 2286. Provided the price remains above that level, the potential for more upside is far greater. Wave 5 should reach at least the 2500 key psychological level.

Summary

- Gold has been in a sideways range since the decline on April 12th, 2024, but is expected to make further gains and potentially reach a new all-time high.

- The long-term trend is bullish, with no significant bearish correction expected until the impulse cycle from September 2023 ends.

- On the daily chart, Gold is in a cycle degree impulse wave III from 1810.5, with the current minor degree wave 4 forming a triangle structure.

- On the H4 chart, wave d (circled) of the triangle is in progress, with wave e (circled) expected next.

- The triangle structure remains valid as long as the price stays above 2286. If this level holds, the potential for more upside increases, with wave 5 likely to reach at least the 2500 level.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support