Trading Lounge Commodity Insight: Coffee Elliott Wave Analysis

Function: Counter-Trend

Mode: Correction

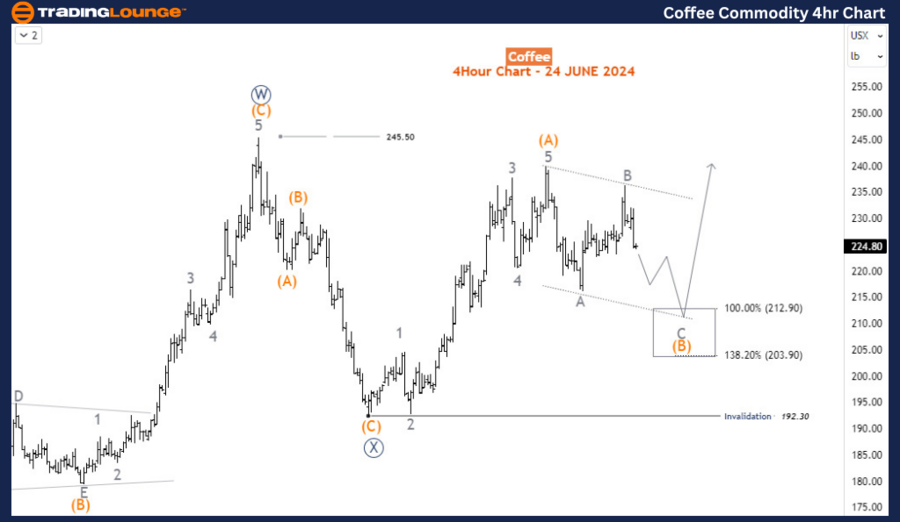

Structure: Double Zigzag for blue Y

Position: Wave C of (B)

Direction: Wave C of (B) is still in progress

Details: Coffee has been recounted on all time frames. We expect an upward movement after completing the zigzag wave (B) around the Fibonacci reversal zone of 212.9-203.9. The invalidation level is at 192.30.

Coffee Elliott Wave Technical Analysis

Overview: Long-term Coffee prices have been bullish since October 2023. Despite several pullbacks, each previous top has been consistently breached. The last top was made in April 2024 at 245.5, followed by a decline to 192.3 within three weeks, extending to May 7th. Notable recoveries started from there. However, prices have yet to breach 245.5 to confirm the continuation of the bullish sequence from October 2023.

Daily Chart Analysis:

Since January 2023, a double zigzag structure has been unfolding. Wave W (circled) finished on April 18th at 245.5, and the corresponding wave X (circled) was completed at 192.3 on May 7th, where wave Y (circled) began. Wave (A) of Y appears to have concluded with the impulse surge to the current peak in June 2024. Prices are now correcting into wave (B). If wave (B) completes above 192.3, buyers should gain the advantage to push prices higher, especially above the 245.5 top.

H4 Chart Analysis:

On the H4 chart, wave (B) is subdividing into a zigzag structure, potentially completing around the 212.9-203.9 Fibonacci zone before turning upside in wave (C) above 245.5. Alternatively, prices might move sideways between the 245.5 and 192.3 extremes, suggesting a triangle structure for wave X (circled).

Summary: In conclusion, Coffee prices remain bullish with potential for further gains, contingent on the completion of the current corrective wave (B).

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support