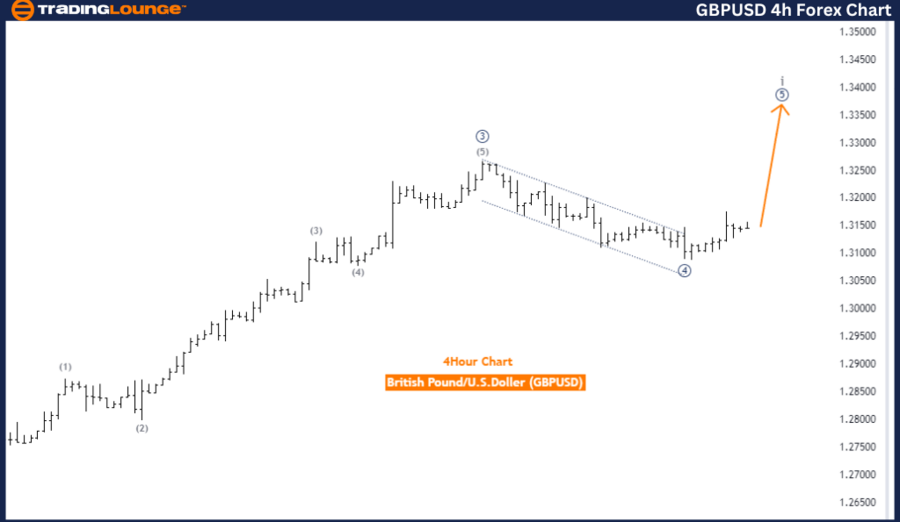

GBPUSD Elliott Wave Analysis Trading Lounge Day Chart

British Pound/U.S. Dollar (GBPUSD) Day Chart Analysis

GBPUSD Elliott Wave Technical Analysis

The GBPUSD daily chart analysis shows the British Pound to US Dollar pair trending impulsively. The current market structure suggests a strong directional move, following an impulsive wave pattern. The key wave in focus is gray wave 1, part of a larger wave cycle.

At this point, the market is in orange wave 3, a crucial phase of the ongoing wave pattern. With the completion of orange wave 2 of 3, gray wave 1 of 3 has initiated. This development typically indicates significant price movements, marking the early phase of the current wave.

The analysis indicates that orange wave 2 of 3 has likely concluded, transitioning into gray wave 1 of 3. This suggests continued upward movement in line with the prevailing trend.

Summary

The GBPUSD pair continues its impulsive trend, with gray wave 1 of 3 unfolding. The completion of orange wave 2 of 3 signals the transition to gray wave 1 of 3, pointing to sustained upward momentum. This wave analysis is crucial for traders, highlighting potential opportunities as the market moves into the next wave cycle.

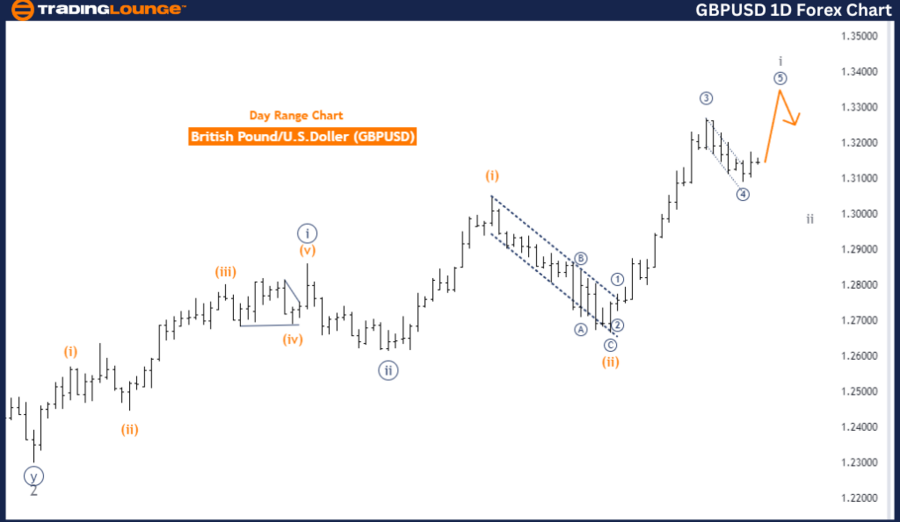

GBPUSD Elliott Wave Analysis Trading Lounge 4-Hour Chart

British Pound/U.S. Dollar (GBPUSD) 4-Hour Chart Analysis

GBPUSD Elliott Wave Technical Analysis

The GBPUSD 4-hour chart analysis reveals the currency pair is in a strong impulsive wave trend. The current market structure highlights micro navy blue wave 5, which forms part of a broader wave movement.

Currently, the pair is positioned in gray wave 1, marking the early stage of a larger wave cycle. Following the conclusion of this phase, gray wave 2 is expected to unfold.

An important observation is that micro navy blue wave 4 of 1 seems to have completed. The market is now advancing through micro navy blue wave 5 of 1, which represents the final movement in this impulse wave sequence, signaling the nearing completion of wave 1.

Summary

The GBPUSD pair remains in an impulsive trend, with micro navy blue wave 5 of 1 currently progressing. The completion of micro navy blue wave 4 points to the final phase of this sequence, with gray wave 2 expected to follow. Traders should monitor wave 5 closely for signs of a potential shift into the next phase of the wave cycle.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: British Pound/Japanese Yen (GBPJPY) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support