COCHLEAR LIMITED (COH) Elliott Wave Technical Analysis | TradingLounge

Overview:

This Elliott Wave technical outlook for COCHLEAR LIMITED (ASX:COH) provides an updated analysis of the stock's structure on the Australian Stock Exchange. Our current wave count identifies the conclusion of a corrective ABC wave, signaling the potential start of a bullish impulse wave. This forecast outlines prospective price targets, expected market direction, and essential invalidation levels to sustain the bullish scenario in COH shares.

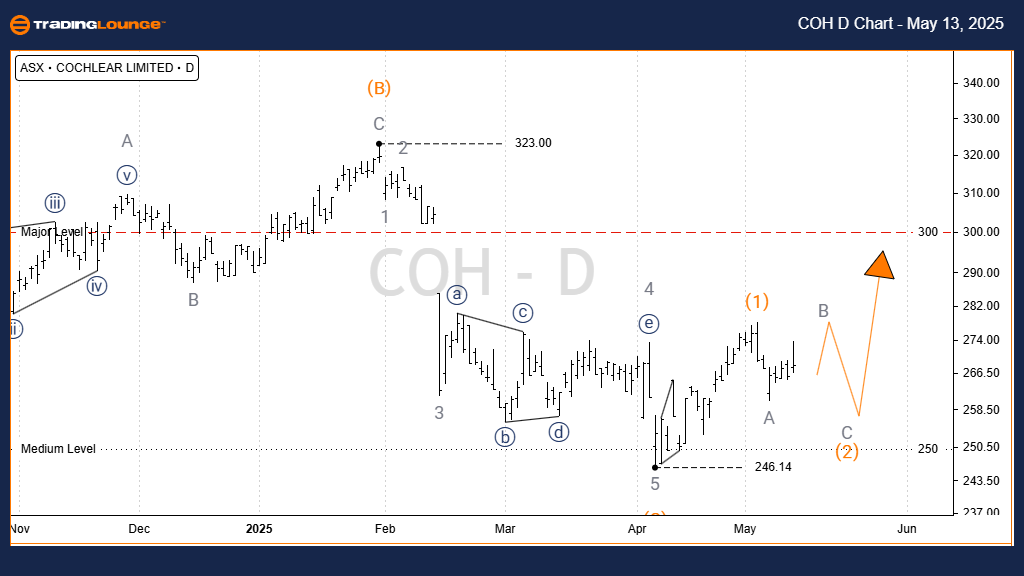

COCHLEAR LIMITED – COH | 1d Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 5)) - navy

Technical Insight:

The chart analysis indicates that Wave 4)) - navy has likely completed its corrective formation, marked A, B, and C) - orange. The breakout suggests the beginning of an upward trend forming Wave 5)) - navy. Based on this structure, Cochlear stock may revisit the previous peak at Wave 3)) - navy, targeting the $350.00 area.

Invalidation Point: 246.14

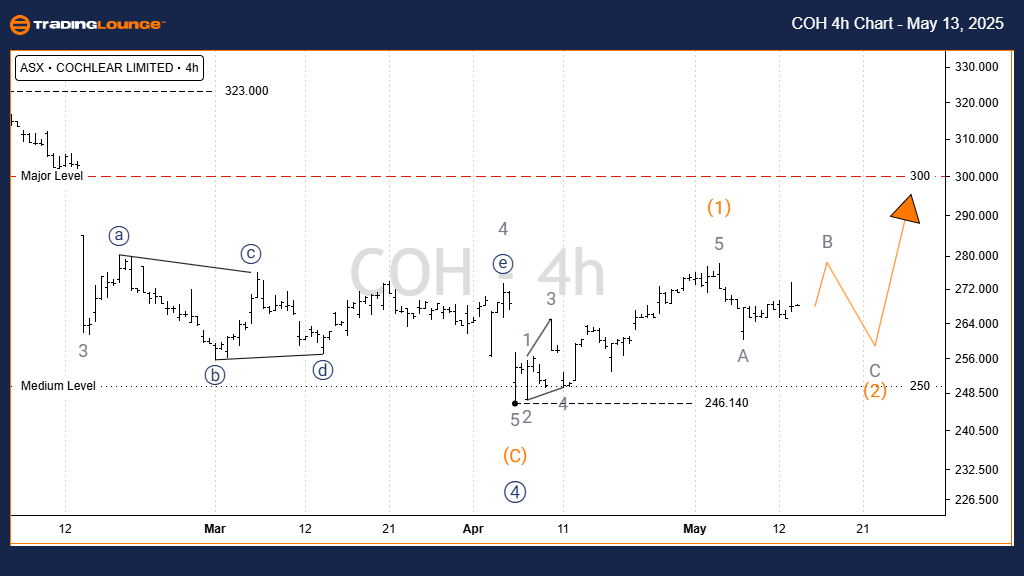

COCHLEAR LIMITED COH Elliott Wave Technical Analysis | TradingLounge (4-Hour Chart)

Chart Details:

Function: Major Trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave B - grey of (Wave 2) - orange

Technical Insight:

After the price found a base at 246.140, Wave 1) - orange shaped a Leading Diagonal. This configuration suggests that Wave 2) - orange could show a deep retracement. With Wave A of 2) completed, attention now turns to the development of Wave B and C - grey. A final decline is expected through Wave C - grey, setting the stage for a strong upside move in Wave 3) - orange.

Invalidation Point: 246.140

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Cochlear stock Elliott Wave analysis integrates short-term technical signals with larger market trends, offering guidance for ASX:COH traders and investors. Key validation and invalidation zones are emphasized to enhance the reliability of this wave-based market projection. Our goal is to deliver a clear, professional COH price outlook aligned with established Elliott Wave principles.