AMCOR PLC (AMC) Elliott Wave Technical Analysis

ASX Stock Forecast, Elliott Wave Count & Trend Insights

Greetings,

Today’s Elliott Wave analysis for AMCOR PLC (ASX: AMC) highlights a key structural shift in price action. Our updated wave count suggests that AMC has completed a corrective phase—specifically a Double Zigzag pattern—marking the end of wave (2). This positions the stock at the start of a bullish third wave, setting the stage for a potential sustained rally. Below is our detailed technical breakdown.

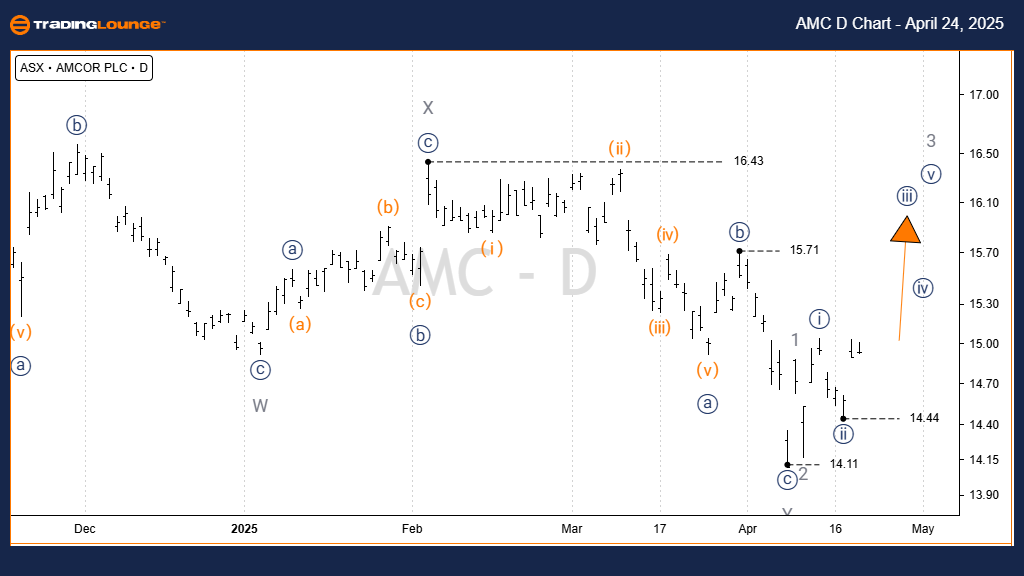

AMCOR PLC (AMC) Elliott Wave Analysis – TradingLounge 1D Chart

Technical Analysis Summary – 1D Chart (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave (3) – Orange

Elliott Wave Insights:

- Wave (1) – Orange has already been completed.

- Wave (2) – Orange finalised as a Double Zigzag (W-X-Y, Grey), marking the end of correction.

- Wave (3) – Orange is now initiating, suggesting bullish momentum is gaining strength.

Key Invalidation Level: 14.11 AUD

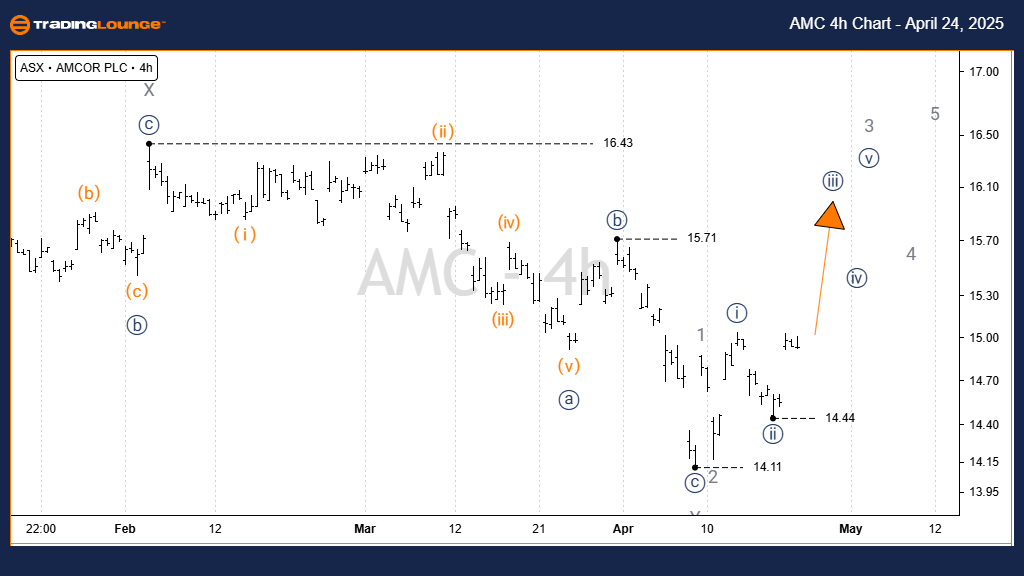

AMCOR PLC – AMC Elliott Wave Analysis – TradingLounge (4-Hour Chart)

4-Hour Chart Breakdown

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Wave Position: Wave i)) – Navy of Wave 3 – Grey of Wave (3) – Orange

Detailed Outlook:

- The Y – Grey wave of Wave (2) – Orange concluded as a Zigzag, confirming the end of the correction.

- Post-14.11 AUD, upward structure unfolds through waves 1, 2, and 3 – Grey, confirming trend reversal.

- Current development of Wave 3 – Grey is expanding through subwaves i)) to v)) – Navy, highlighting strong bullish momentum.

Key Invalidation Level: 14.44 AUD

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for AMCOR PLC (ASX: AMC) reveals a bullish setup following the completion of corrective wave structures. With wave (3) now in play, traders can anticipate potential upward price action. This technical outlook combines both long-term and short-term Elliott Wave forecasts, offering high-probability trade setups and precise validation levels.