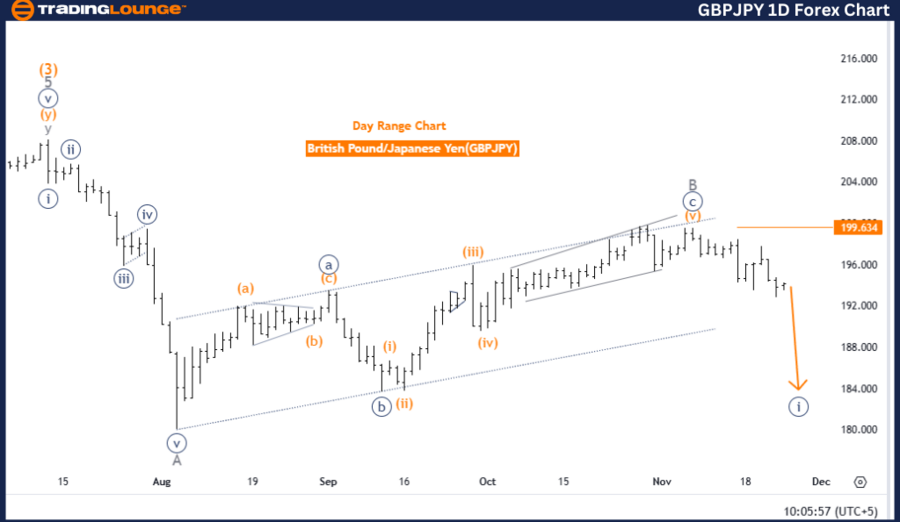

GBPJPY Elliott Wave Analysis Trading Lounge Day Chart

British Pound/Japanese Yen (GBPJPY) Day Chart Analysis

GBPJPY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Navy blue wave 1

Position: Gray wave C

Next Higher Degree Direction: Navy blue wave 2

Details:

- The analysis indicates that gray wave B has likely completed, with navy blue wave 1 of gray wave C currently underway.

Invalidation Level: 199.634

Analysis Summary

This Elliott Wave analysis examines the GBPJPY currency pair on a daily chart, highlighting a counter-trend movement. The impulsive mode indicates robust directional action within a broader corrective structure.

Key Points:

- Navy blue wave 1 commenced after gray wave B’s completion, signaling a new corrective pattern phase.

- The pair is moving within gray wave C, a corrective wave in the overall structure.

- Navy blue wave 2, a corrective phase, is expected to follow the impulsive wave 1 movement.

Critical Benchmark for Validation:

The analysis establishes 199.634 as the invalidation level. If the price breaches this benchmark, the wave count and outlook will be invalidated. This level is crucial for risk management and trend validation.

Conclusion

GBPJPY is currently in a counter-trend phase. Navy blue wave 1 within gray wave C is developing, initiated by gray wave B’s completion. As long as the price remains below the invalidation level of 199.634, the trend is valid. Traders should anticipate continued activity within this counter-trend structure, followed by a corrective phase marked by navy blue wave 2.

GBPJPY Elliott Wave Technical Analysis 4-Hour Chart

Function: Bearish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 1

Next Higher Degree Direction: Orange wave 4

Details:

- Orange wave 2 has completed, with orange wave 3 now progressing.

Invalidation Level: 197.847

Analysis Summary

This analysis focuses on GBPJPY using Elliott Wave theory on a 4-hour chart, identifying a bearish trend. The impulsive mode underscores significant downward momentum within the broader corrective structure.

Key Highlights:

- Orange wave 3 began after orange wave 2’s completion, marking the onset of a sustained bearish phase.

- The pair is currently in navy blue wave 1, the initial phase of downward movement within orange wave 3.

- The next anticipated phase is orange wave 4, a corrective wave expected after orange wave 3 concludes.

Critical Benchmark for Validation:

An invalidation level of 197.847 is specified. Breaching this price point would invalidate the current wave count and analysis, serving as a vital tool for risk control and trend confirmation.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

GBPJPY is in a bearish phase, with orange wave 3 actively unfolding. The completion of orange wave 2 confirms the trend’s beginning, supported by the impulsive characteristics of the movement. As long as the price stays below 197.847, the bearish outlook remains intact. Traders can expect ongoing downward momentum, with a potential transition to the corrective phase, orange wave 4.