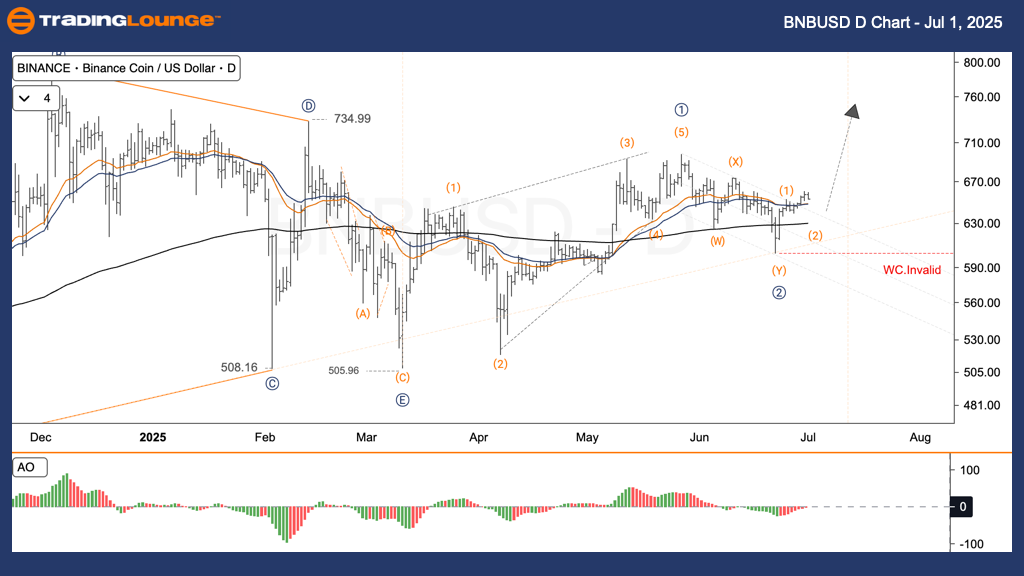

Binance / U.S. Dollar (BNBUSD) Elliott Wave Analysis – TradingLounge Daily Chart

BNBUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Position: Wave 2

Next Higher Degree Direction: Advancing into Wave IV (Impulse)

Invalidation Level: $597

BNBUSD Daily Trading Strategy

Binance Coin (BNBUSD) is potentially completing a corrective phase, with Wave ② likely ending near the 50% - 61.8% Fibonacci retracement level. This price zone signals the initiation of a new bullish wave ③, possibly marking the start of a sustained upward trend.

Trading Strategies

✅ Swing Trading Opportunity

Traders can look for bullish price action near $633 to enter a long position targeting Wave ③ development.

🟥 Invalidation Level Alert

If the market breaks below $597, the current wave count is invalid, and the Elliott Wave analysis should be reassessed.

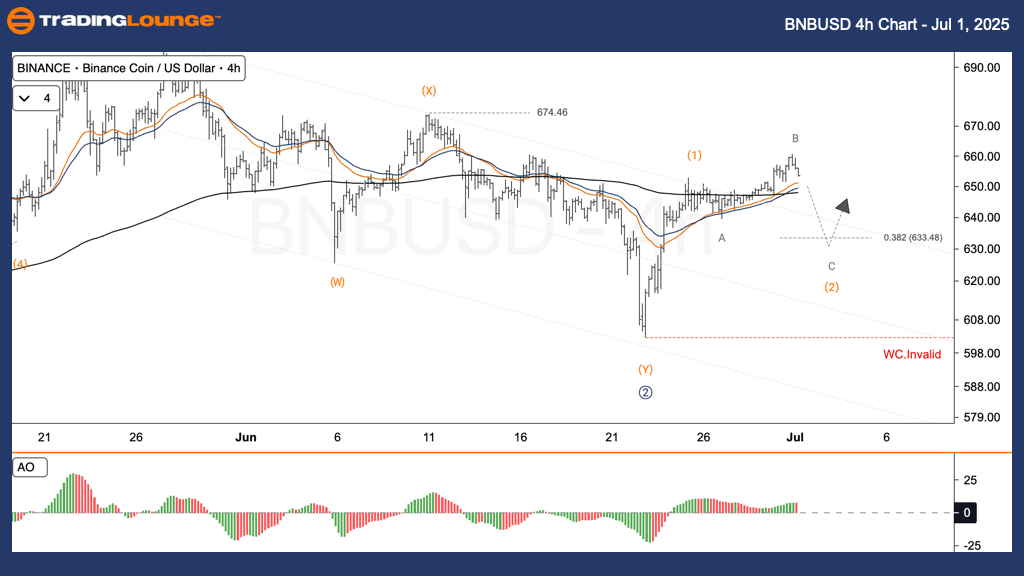

Binance / U.S. Dollar (BNBUSD) Elliott Wave Analysis – TradingLounge H4 Chart

BNBUSD Elliott Wave Technical Analysis

Function: Trend Continuation

Mode: Motive

Structure: Impulse

Current Position: Wave 2

Next Higher Degree Direction: Advancing into Wave IV (Impulse)

Invalidation Level: $597

BNBUSD H4 Trading Strategy

The H4 chart for BNBUSD reflects the likely conclusion of corrective Wave ② around the 50% - 61.8% Fibonacci retracement range. This indicates the beginning of Wave ③, with price movement suggesting a bullish shift.

Trading Strategies

✅ Swing Trade Setup

A potential bullish reversal around $633 could be used to enter long positions in anticipation of a medium-term rally.

🟥 Wave Count Checkpoint

Should the price fall below $597, the current Elliott Wave setup must be reviewed to adjust strategy accordingly.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support