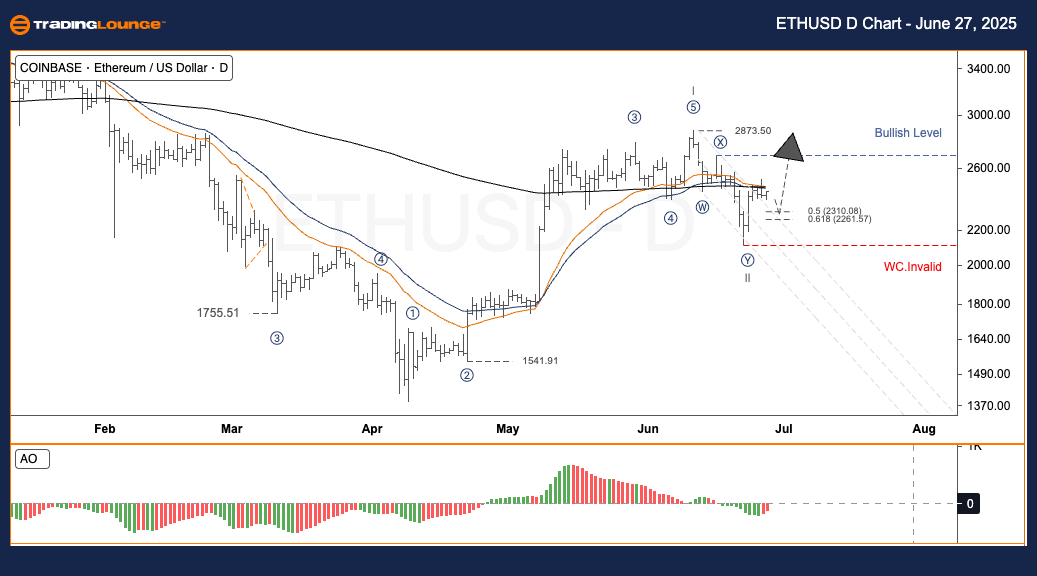

Ethereum (ETHUSD) Elliott Wave Analysis – TradingLounge – Daily Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction (Next Higher Degrees): –

Wave Cancel/Invalidation Level: –

Ethereum (ETHUSD) Trading Strategy

Ethereum price analysis using Elliott Wave theory suggests the asset has completed wave I near 2,873.50 USD and is now progressing through a corrective wave II. This pullback is typical before a bullish wave III impulse. The projected retracement zone for wave II lies between the 0.5 and 0.618 Fibonacci levels, or 2,295 to 2,250 USD. A confirmed breakout above 2,873.50 would validate the initiation of wave III, likely leading to a strong upward trend.

Trading Strategies

- Strategy Type: Swing Trade (Short-Term Traders)

✅ Monitor Ethereum’s price movement in the 2,295–2,250 range to identify potential entry points for wave III

🟥 Risk Management: Use a Stop Loss below 2,060 USD to limit potential losses

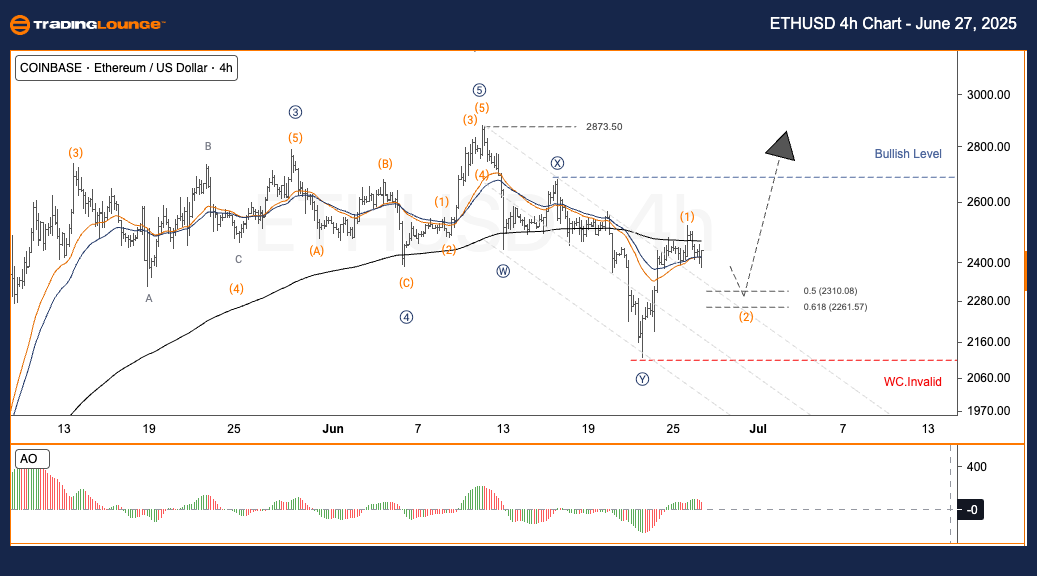

Ethereum (ETHUSD) Elliott Wave Analysis – TradingLounge – H4 Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction (Next Higher Degrees): –

Wave Cancel/Invalidation Level: –

Ethereum (ETHUSD) Trading Strategy

On the H4 timeframe, the ETHUSD chart supports the broader wave structure. Ethereum remains in wave II, with a retracement target zone between 2,295 and 2,250 USD. A sustained breakout beyond 2,873.50 would confirm the beginning of wave III, indicating a strong bullish trend continuation.

Trading Strategies

- Strategy Type: Swing Trade (Short-Term Traders)

✅ Look for Ethereum price consolidation within the 2,295–2,250 zone to consider buying positions for wave III

🟥 Risk Management: Place Stop Loss below 2,060 USD to manage risk exposure

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: LINKUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support