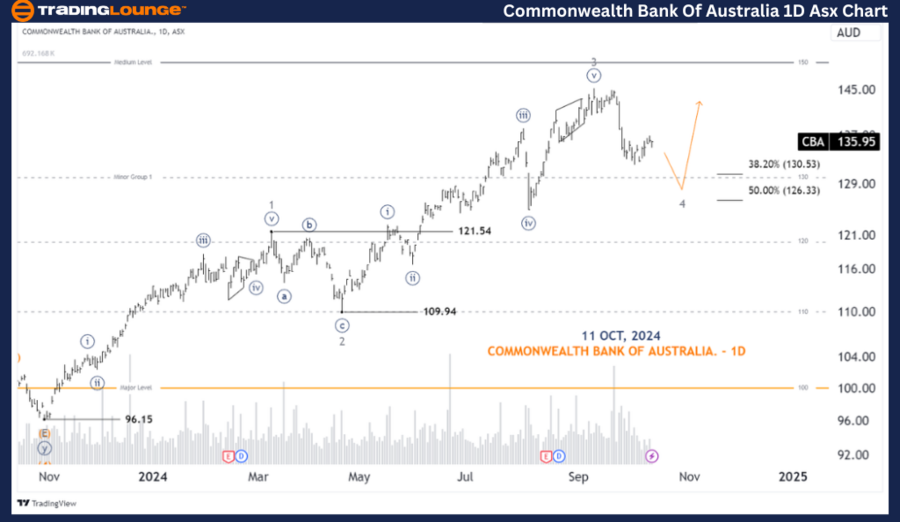

Commonwealth Bank of Australia (CBA) – TradingLounge 1D Chart

Greetings, today’s Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with an update on Commonwealth Bank of Australia (CBA). According to our analysis, CBA is poised to enter wave 5, which could push the stock higher, although more time is needed to complete wave 4.

ASX: Commonwealth Bank of Australia – CBA 1D Chart (Semilog Scale) Analysis

CBA Elliott Wave Technical Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave 4-Grey

Details: Wave 3-Grey has concluded as a five-wave structure, and Wave 4-Grey is currently unfolding, which may push the price lower. The potential target for this decline could be near the 130.53 area. After completing this move, Wave 5-Grey could emerge, pushing the stock higher again. Further analysis will be conducted on the 4-hour chart for a more detailed outlook.

Invalidation Point: 121.54

ASX: Commonwealth Bank of Australia – CBA 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((c))-Navy of Wave 4-Grey

Details: We see further detail in Wave 4-Grey, which may have one more push lower to meet its target. In the near term, a potential push higher with Wave ((b)) or Wave 5-Grey is anticipated. We’ll assess whether this upward movement is strong enough to be considered as Wave 5-Grey or if it’s just Wave ((b))-Navy, indicating a possible lower leg to follow.

Invalidation Point: 121.54

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: CAR GROUP LIMITED - CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis of the Commonwealth Bank of Australia (CBA) on the ASX provides insights into current market trends, emphasizing how traders can take advantage of these movements. The outlined price points serve as key validation and invalidation markers for the wave count, boosting confidence in our forecast. By integrating these elements, we aim to deliver an objective and professional assessment of the market trends for CBA.