ASX: ANZ GROUP HOLDINGS LIMITED - ANZ Elliott Wave Technical Analysis

Greetings, and welcome to our Elliott Wave analysis. Today, we delve into the Australian Stock Exchange (ASX) focusing on ANZ GROUP HOLDINGS LIMITED (ASX:ANZ). Our insights indicate a strong likelihood of ASX:ANZ experiencing significant downside movement in the near future.

ASX: ANZ GROUP HOLDINGS LIMITED - ANZ 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ((a))-navy of Wave 4-orange

Details:

- The recent completion of Wave (3)-orange suggests the beginning of Wave (4)-orange, which appears to be heading significantly lower, with a potential target around 27.25.

- This development poses a risk to prior long trades, warranting a reconsideration of exit strategies with tighter stop-losses than initially planned.

Invalidation Point:

- The end of Wave (3)-orange serves as the critical invalidation level for this analysis.

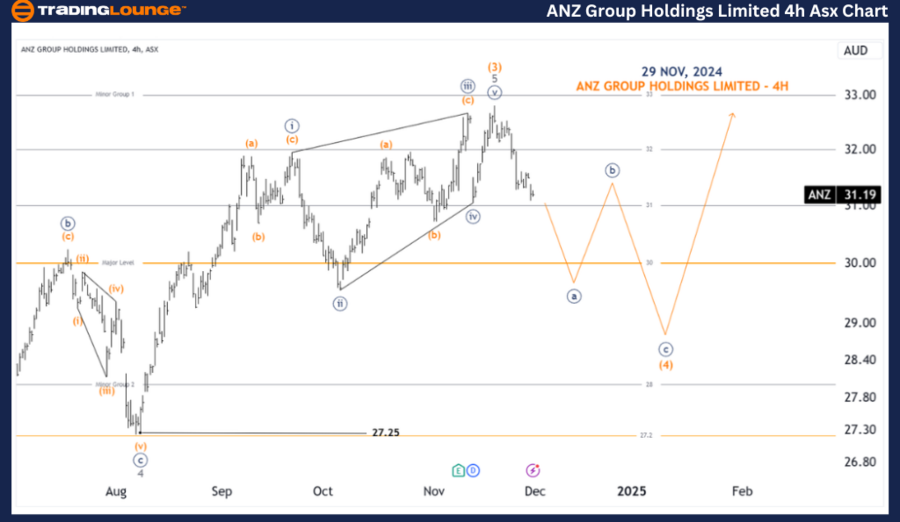

ASX: ANZ GROUP HOLDINGS LIMITED - ANZ 4-Hour Chart Analysis

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave ((a))-navy of Wave (4)-orange

Details:

- The prolonged and weak development of the 5-grey wave suggests a Diagonal Ending pattern, further strengthening the probability of a sharp decline in ASX:ANZ prices.

- The projected target remains near the 27.25 low, consistent with the daily chart's outlook.

Invalidation Point:

- Similar to the daily chart, the end of Wave (3)-orange marks the invalidation threshold.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Sonic Healthcare Limited - SHL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: ANZ GROUP HOLDINGS LIMITED highlights key contextual and short-term trends, offering actionable insights for traders. Specific price targets and invalidation points aim to increase confidence in our wave count, enhancing decision-making. Combining these elements ensures a clear and objective perspective on market dynamics, empowering traders to navigate trends effectively.