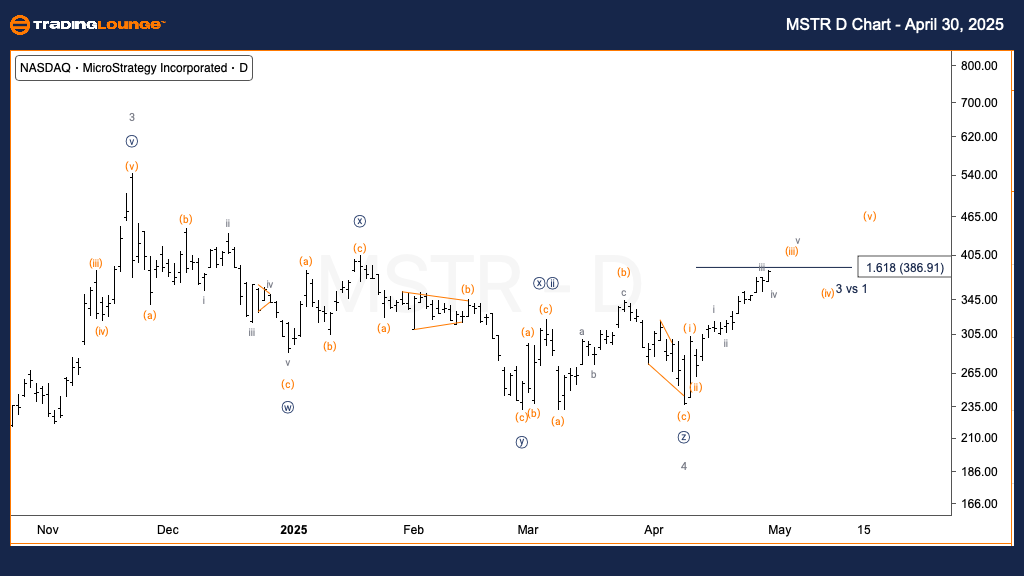

MicroStrategy Inc. (MSTR) – Elliott Wave Technical Analysis & TradingLounge Daily Chart

MSTR Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave (iii) of {i}

DIRECTION: Upside in wave {i}

DETAILS: MicroStrategy (MSTR) continues to advance in a classic five-wave Elliott Wave structure, pushing toward its all-time high. This bullish move may represent the final stages of wave {i} of 5, or potentially conclude wave 5 within a larger impulsive uptrend, supporting a strong long-term bullish outlook.

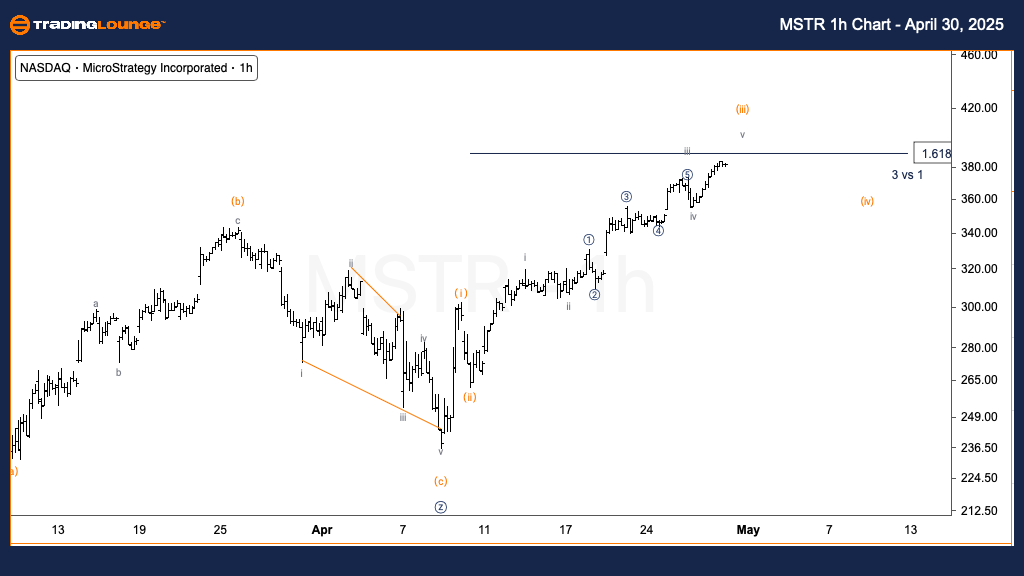

MicroStrategy Inc. (MSTR) – 1H Chart Elliott Wave Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave v of (iii)

DIRECTION: Top in wave (iii)

DETAILS: Short-term Elliott Wave analysis indicates a maturing wave (iii), with wave v extending near the key 1.618 Fibonacci level of wave (i). This suggests a probable near-term top and an expected wave (iv) corrective pullback before further upside resumes in wave (v).

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Costco Wholesale Corp. (COST) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support