Bovespa Index Elliott Wave Analysis - Day Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Direction Next Higher Degrees: Orange Wave 1 (started)

Details: Orange Wave C of 2 looks completed. Now, Orange Wave 1 of 3 is in play.

Wave Cancel Invalid Level: 96790.18

The Bovespa Index Elliott Wave analysis on the daily chart focuses on the current market trend using Elliott Wave theory, specifically analyzing an impulsive wave mode. This analysis highlights the orange wave 1 within the broader context of navy blue wave 3, signaling the beginning of a new upward trend phase.

In Elliott Wave theory, an impulsive mode represents a strong, directional movement in line with the primary trend. Here, the structure being examined is orange wave 1, part of the larger navy blue wave 3. The anticipated direction for the next higher degrees is the continuation of orange wave 1, indicating the start of a significant upward movement.

The detailed analysis shows that orange wave C of navy blue wave 2 is likely completed, suggesting a shift in the market's direction. With orange wave C of 2 looking finished, the market is now entering orange wave 1 of navy blue wave 3. This transition marks the beginning of a new impulsive phase, expected to drive the market higher in the short to medium term.

A crucial aspect of this analysis is the wave cancel invalid level, set at 96790.18. This level is essential for confirming the current wave count and ensuring the accuracy of the Elliott Wave structure. If the market price drops below this level, it would invalidate the present wave analysis, necessitating a reassessment and potentially altering the market forecast.

In summary, the Bovespa Index daily chart analysis indicates that the market is transitioning from a completed corrective phase, represented by orange wave C of navy blue wave 2, into a new impulsive phase, represented by orange wave 1 of navy blue wave 3. This shift suggests a new upward trend, with the wave cancel invalid level at 96790.18 serving as a critical marker for validating the current Elliott Wave structure and guiding future market expectations.

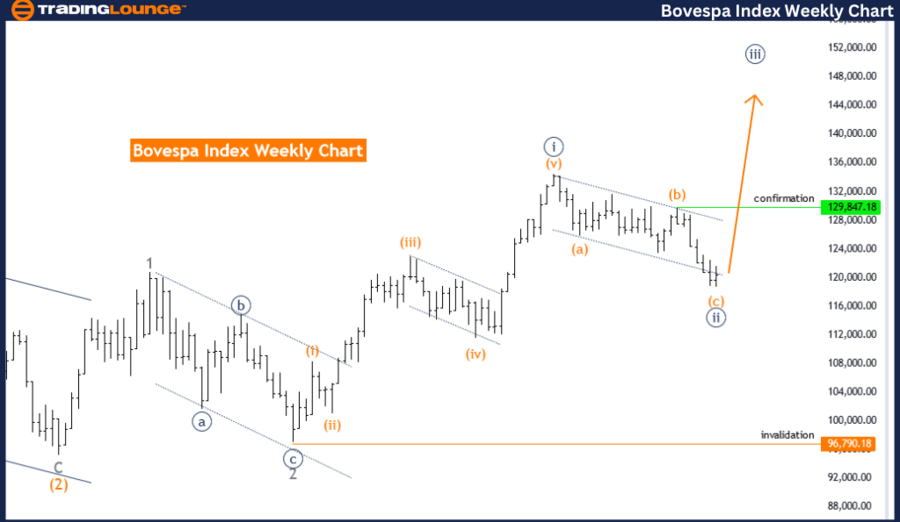

Bovespa Index Elliott Wave Analysis - Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3 (started)

DETAILS: orange wave C of 2 looking completed, now navy blue wave 3 is in play.

Wave Cancel invalid level: 96790.18.

The Bovespa Index Elliott Wave analysis on the weekly chart highlights the current market trend using the Elliott Wave theory, focusing on an impulsive wave mode. This analysis examines the navy blue wave 3, which is part of a larger upward movement within the market. Specifically, it looks at gray wave 3, indicating a continuation of the current bullish trend.

In Elliott Wave theory, an impulsive mode signifies a strong, directional move that aligns with the primary trend. In this case, the structure being analyzed is navy blue wave 3. This wave is in the gray wave 3 position, showing that the market is in the midst of an extended upward trend phase. The anticipated direction for the next higher degrees continues to be navy blue wave 3, suggesting that the market is expected to maintain its upward trajectory.

The analysis provides details that orange wave C of 2 appears to be completed. This completion indicates a shift from a corrective phase to a new impulsive phase. As orange wave C of 2 finishes, the market has now moved into navy blue wave 3, marking the start of a significant upward trend in the weekly timeframe.

A critical aspect of this analysis is the wave cancel invalid level, set at 96790.18. This level is crucial for confirming the validity of the current wave count and ensuring the accuracy of the Elliott Wave structure. If the market price falls below this level, it would invalidate the current wave analysis, requiring a reassessment and potentially altering the market forecast.

In summary, the Bovespa Index weekly chart analysis indicates that the market is transitioning from a completed corrective phase, represented by orange wave C of 2, into a new impulsive phase, represented by navy blue wave 3. This shift suggests a continuation of the upward trend, with the wave cancel invalid level at 96790.18 serving as a key marker for validating the current Elliott Wave structure and guiding future market expectations.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: DAX Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support