Natural Gas Elliott Wave Technical Analysis

Natural Gas Elliott Wave Analysis

The natural gas market's late October recovery remains steady, with the commodity in a sideways price structure since April 2023. Currently, there’s potential for prices to test the highs from October and June 2024, aiming to retest peak levels observed in January 2024 and October 2023.

Long-Term Analysis: Bearish Impulse Wave and Correction

Natural gas concluded a significant bearish impulse wave sequence from a high of $10 in August 2022, dropping sharply to around $1.5 in February 2024. This massive decline aligns with Elliott Wave principles, where a 5-wave trend is typically followed by a 3-wave correction. Based on this, the current correction could push prices up to a potential range of $4.79–$5.8, retracing the bearish trend from August 2022.

Natural Gas Commodity Daily Chart Outlook: Zigzag Correction Structure

On the daily timeframe, the corrective phase began at a low of 1.522, forming a primary degree zigzag structure. Wave ((A)) completed as an impulse, reaching 3.16 in June 2024. Following this, a sideways movement has taken shape, indicating a potential triangle structure for wave ((B)). Once wave ((B)) finalizes, wave ((C)) could push towards $4 or higher, extending the corrective rally.

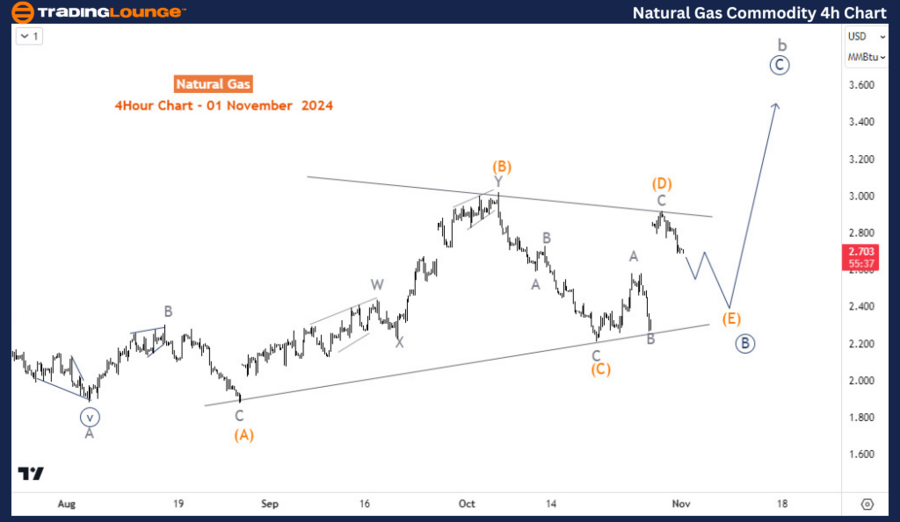

Natural Gas Commodity H4 Chart: Completing Wave (E) of ((B))

The H4 chart suggests wave (E) of ((B)) remains unfinished, indicating that a pullback from late October may dip further into the 2.47–2.35 range before completing wave (E). Upon this wave’s completion, prices are expected to resume the upward correction that began in February, aligning with bullish momentum for the next phase.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Commodity Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support