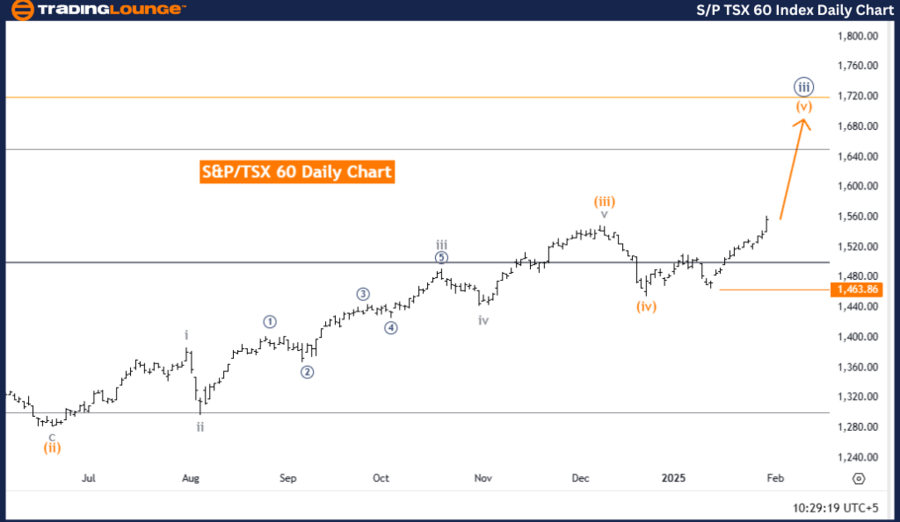

S&P/TSX 60 Elliott Wave Analysis – TradingLounge Daily Chart

S&P/TSX 60 Index Daily Chart Analysis

S&P/TSX 60 Elliott Wave Technical Analysis

S&P/TSX 60 Index Technical Overview

- Function: Trend

- Mode: Impulsive

- Structure: Orange Wave 5

- Position: Navy Blue Wave 3

- Direction Next Lower Degrees: Navy Blue Wave 4

Details:

- Orange Wave 4 has likely completed.

- Orange Wave 5 is currently forming.

- Wave cancellation invalid level: 1,463.86

S&P/TSX 60 Elliott Wave Analysis Overview

The S&P/TSX 60 Elliott Wave Analysis on the daily chart provides a structured technical outlook on the index’s price trend and wave pattern, offering insights for traders.

Market Trend & Structure

Key Observations

✔ Orange Wave 4 has concluded, leading to the development of Orange Wave 5, signaling continued bullish momentum.

✔ Next expected move: Navy Blue Wave 4, typically a corrective phase after an impulsive wave.

✔ Traders should closely watch Orange Wave 5, as its completion could mark the beginning of Navy Blue Wave 4.

✔ Wave cancellation invalidation level: 1,463.86 – If the price drops below this point, the current wave count becomes invalid, requiring a new analysis.

Conclusion

The S&P/TSX 60 remains in an impulsive trend, with Orange Wave 5 progressing within Navy Blue Wave 3. The completion of Orange Wave 4 has set the market up for continued bullish movement.

Traders should monitor wave progression closely and pay attention to the invalidation level of 1,463.86 to confirm the integrity of the current Elliott Wave structure. This analysis offers a systematic framework to assess the market’s trend direction and potential price movements.

S&P/TSX 60 Elliott Wave Analysis – TradingLounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

S&P/TSX 60 Technical Overview

- Function: Trend

- Mode: Impulsive

- Structure: Orange Wave 5

- Position: Navy Blue Wave 3

- Direction Next Lower Degrees: Navy Blue Wave 4

Details:

- Orange Wave 4 appears completed.

- Orange Wave 5 is currently forming.

- Wave cancellation invalid level: 1,463.86

S&P/TSX 60 Elliott Wave Analysis Overview

The S&P/TSX 60 Elliott Wave Analysis on the weekly chart provides a broader technical outlook on the current trend direction and wave positioning.

Market Trend & Structure

Key Observations

✔ Orange Wave 4 has concluded, and Orange Wave 5 is advancing, suggesting continued upward movement.

✔ The next expected move at a lower degree is Navy Blue Wave 4, a corrective phase that typically follows an impulsive wave.

✔ Traders should monitor Orange Wave 5’s progress, as its completion could signal the beginning of Navy Blue Wave 4.

✔ Wave invalidation level: 1,463.86 – If the price moves below this level, the wave count must be reassessed.

Conclusion

The S&P/TSX 60 remains in a strong impulsive phase, with Orange Wave 5 progressing inside Navy Blue Wave 3. The completion of Orange Wave 4 has set the stage for further upside.

Traders should keep a close watch on wave progression and validate the structure by ensuring the price remains above the invalidation level of 1,463.86. This analysis offers a structured market approach, enabling traders to anticipate future movements and potential trend reversals.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Euro Stoxx 50 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support