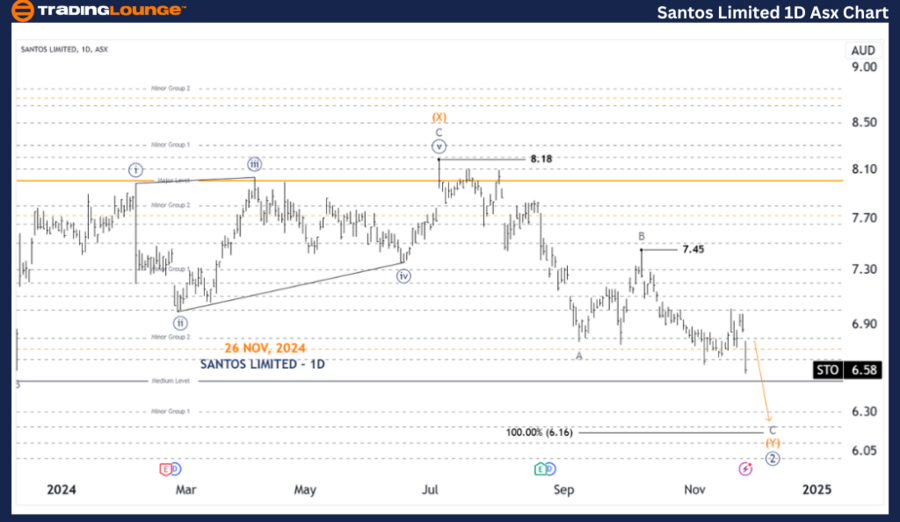

ASX: SANTOS LIMITED - STO Elliott Wave Analysis TradingLounge 1D Chart

Greetings! Today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX), specifically SANTOS LIMITED (ASX: STO). Our analysis indicates that ASX: STO is likely to push lower before initiating an upward movement with the ((3))-navy wave.

ASX: SANTOS LIMITED - STO 1D Chart (Semilog Scale) Analysis

SANTOS LIMITED - STO Elliott Wave Technical Analysis

Function: Major Trend (Minor Degree, Gray)

Mode: Motive

Structure: Impulse

Position: Wave C-gray of Wave (Y)-orange of Wave ((2))-navy

Details: Wave ((2))-navy continues to extend longer than initially anticipated. However, we foresee one more downward push before wave ((3))-navy begins its upward trajectory. The target remains around 6.16, where Wave C-gray equals Wave A-gray.

Invalidation Point: 7.45

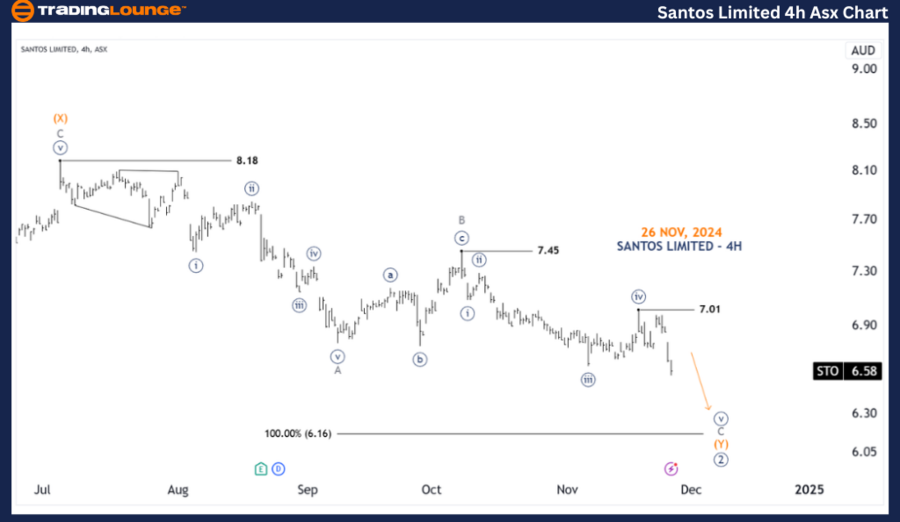

ASX: SANTOS LIMITED - STO 4-Hour Chart Analysis

Function: Counter-Trend (Primary Degree, Navy)

Mode: Corrective

Structure: Double Zigzag

Position: Wave (v)-navy of Wave C-gray of Wave (Y)-orange of Wave ((2))-navy

Details:

Since reaching the 7.45 high, Wave C-gray is progressing lower as a five-wave sequence from wave ((i))-navy to wave ((v))-navy. The movement is likely to continue downward, targeting the 6.16 low. However, price must remain below 7.01 to maintain this outlook. Breaking above 7.01 would be the first indication of wave ((3))-navy potentially unfolding.

Invalidation Point: 7.01

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WOODSIDE ENERGY GROUP LTD - WDS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis delivers an in-depth perspective on ASX: SANTOS LIMITED - STO's Elliott Wave trends. By outlining critical price points as validation and invalidation signals, we enhance confidence in our wave count forecast. Our objective is to empower readers with actionable insights into current market dynamics, helping them navigate opportunities with clarity and precision.