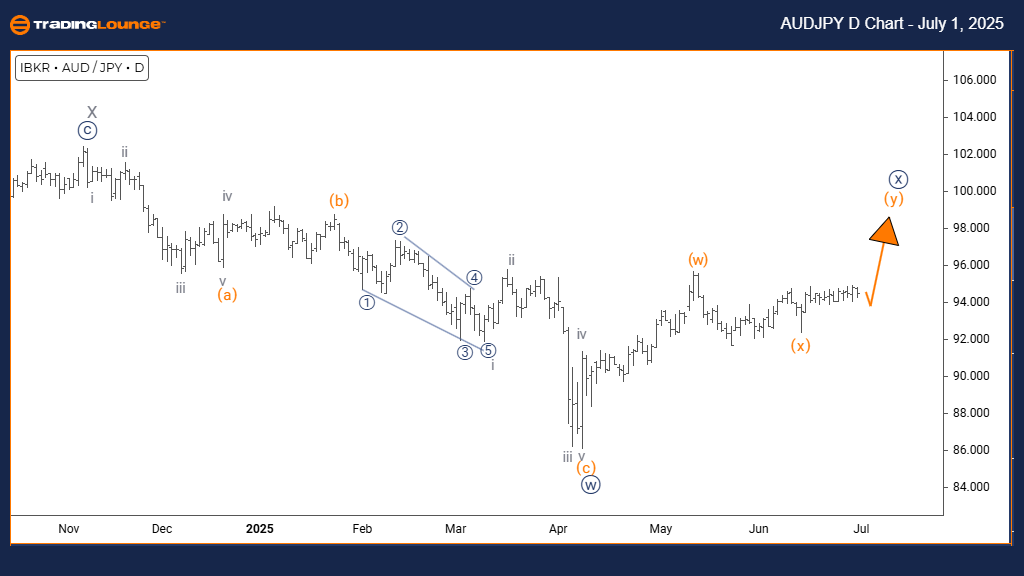

AUDJPY Elliott Wave Analysis – TradingLounge Daily Chart

AUDJPY Elliott Wave Technical Overview

Function: Counter-Trend

Mode: Impulsive

Structure: Navy Blue Wave X

Position: Gray Wave Y

Direction (Lower Degrees): Navy Blue Wave Y

Details: Completion seen in Navy Blue Wave W; Navy Blue Wave X is now underway.

Daily Chart Summary

The AUDJPY Elliott Wave forecast on the daily timeframe highlights a counter-trend formation. The current movement is impulsive, pushing opposite the prevailing trend. The present wave is labeled as Navy Blue Wave X, part of a larger corrective pattern within Gray Wave Y. This indicates a potential continuation or evolution of the corrective structure.

Wave W to X Transition

With Navy Blue Wave W finalized, the pair has initiated Navy Blue Wave X. Typically part of a complex correction, this wave may evolve into a combination structure. Following this, Navy Blue Wave Y is expected to emerge once Wave X completes.

Technical Outlook

From an AUDJPY technical analysis standpoint, the pair is within a corrective phase. Wave X's impulsive character suggests strong price movement. Nonetheless, this is still corrective action and not the beginning of a new bullish or bearish trend.

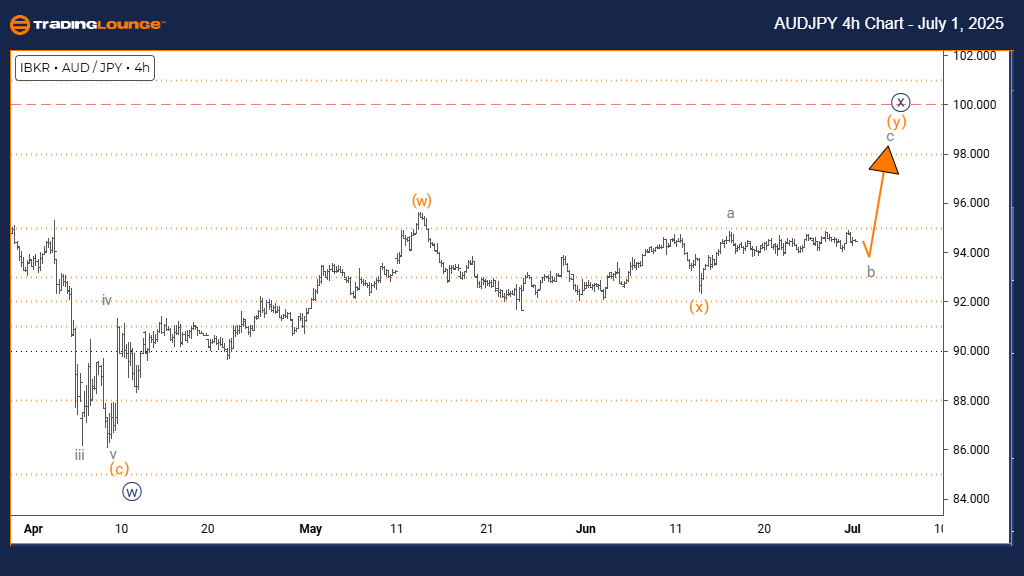

AUDJPY Elliott Wave Analysis – TradingLounge 4-Hour Chart

AUDJPY Elliott Wave Technical Overview

Function: Counter-Trend

Mode: Impulsive

Structure: Orange Wave Y

Position: Navy Blue Wave X

Direction (Higher Degrees): Orange Wave Y (Continuing)

Details: Orange Wave X appears to have ended; Orange Wave Y is now developing.

4-Hour Chart Summary

On the 4-hour chart, the AUDJPY Elliott Wave analysis also reflects a counter-trend scenario. Price action remains impulsive and moves strongly against the dominant trend. The current structure is Orange Wave Y, which forms part of the broader Navy Blue Wave X correction. This setup points toward an extended corrective leg.

Wave x to Y Shift

With Orange Wave x now complete, the focus turns to the ongoing development of Orange Wave Y within the larger Wave X. This segment often forms into recognizable structures such as zigzags or combinations.

Technical Outlook

The Forex trading signals derived from the structure indicate that AUDJPY remains in a counter-trend correction with Orange Wave Y active. Post-Wave x momentum appears strong, yet it's still within a corrective context—not signaling a trend change. Caution is advised while observing upcoming moves in the pattern.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPJPY Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support