GBPJPY Elliott Wave Forecast – TradingLounge Daily Chart Update

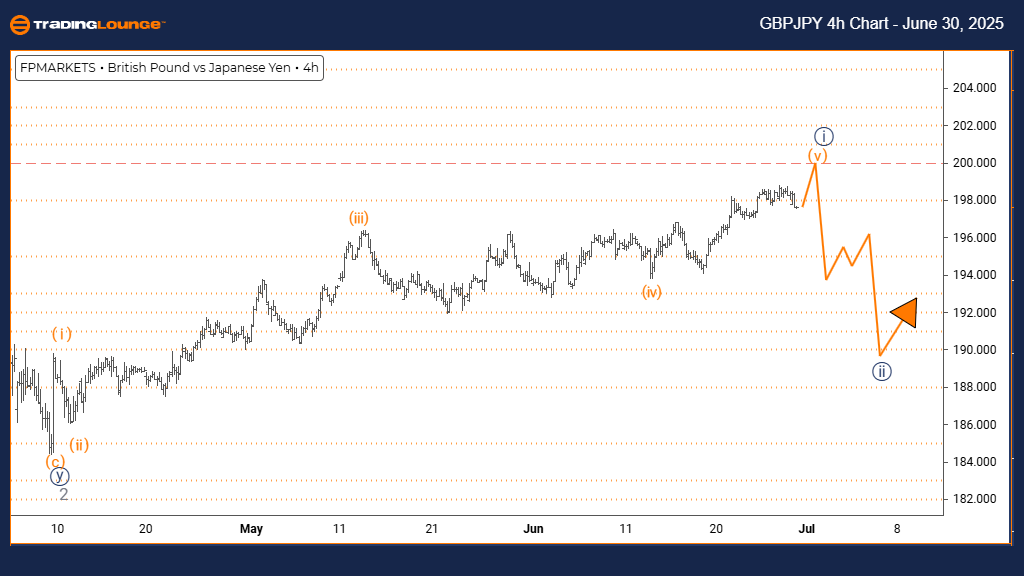

British Pound / Japanese Yen – Daily Chart

GBPJPY Technical Overview and Elliott Wave Forecast

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION (Next Lower Degree): Navy Blue Wave 2

DETAILS: Navy Blue Wave 1 is active and approaching final stages.

The GBPJPY daily chart remains in a bullish Elliott Wave structure, where price action is progressing through an impulsive move. This momentum is aligned with Navy Blue Wave 1 unfolding within the broader Gray Wave 3 trend, reflecting a medium-term upward bias in GBPJPY trading.

Wave structure analysis confirms that Navy Blue Wave 1 is nearing its termination point within Gray Wave 3. As the initial wave in an impulsive sequence, it often initiates a broader bullish trend. The upcoming phase is projected to be Navy Blue Wave 2, which generally reflects a corrective pullback following Wave 1's completion.

Overall, the Elliott Wave outlook for GBPJPY on the daily timeframe points to ongoing strength as Wave 1 progresses inside Wave 3. The impulsive price action signals institutional buying interest and suggests further gains before a potential retracement begins.

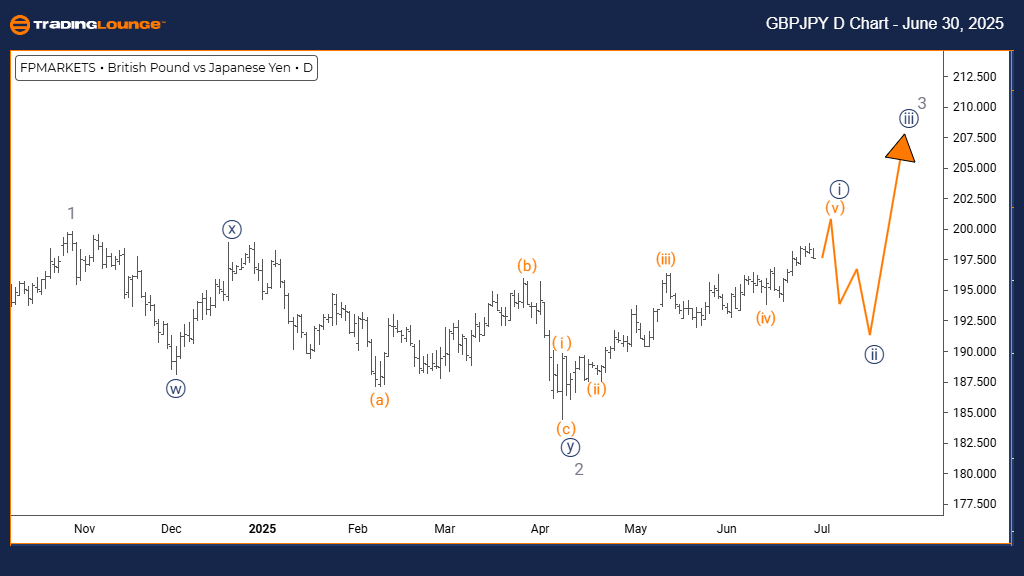

British Pound / Japanese Yen – 4-Hour Chart Technical Overview

Technical Overview – Short-Term Elliott Wave Projection

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION (Next Lower Degree): Navy Blue Wave 2

DETAILS: Orange Wave 4 appears complete; Orange Wave 5 is underway.

On the GBPJPY 4-hour chart, the Elliott Wave model supports a bullish trend within an impulsive framework. Currently, the pair is advancing through Orange Wave 5, which serves as the concluding leg of Navy Blue Wave 1 in this upward sequence.

Recent wave completion of Orange Wave 4 sets the stage for the active development of Orange Wave 5. Typically, this phase involves accelerated price movement. Following this wave, the market is likely to enter Navy Blue Wave 2, a corrective phase expected after the five-wave impulse finishes.

The short-term structure signals that GBPJPY may soon reach a local peak, with Orange Wave 5 in progress. While bullish momentum continues, traders should prepare for a possible shift toward corrective behavior as Wave 2 comes into view.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support