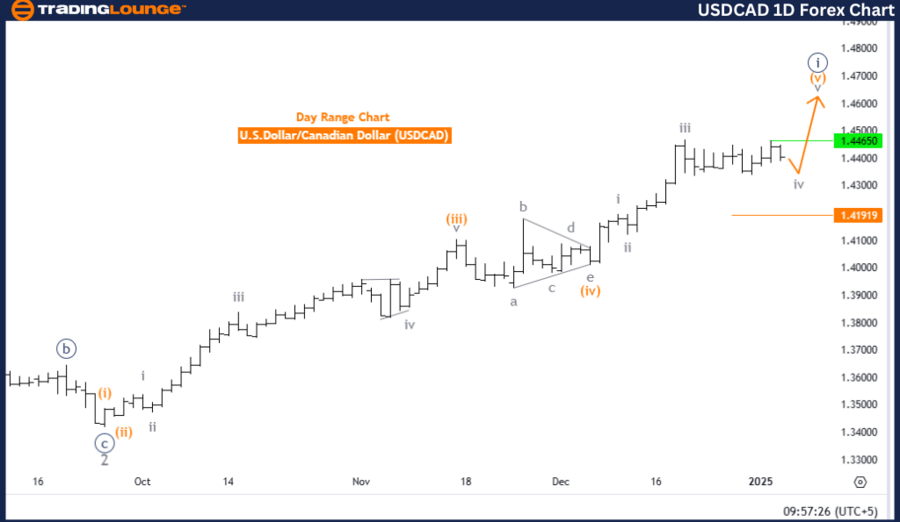

U.S. Dollar / Canadian Dollar (USDCAD) Elliott Wave Analysis – Trading Lounge Day Chart

USDCAD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 5

Position: Navy Blue Wave 1

Direction Next Lower Degrees: Navy Blue Wave 2

Details

Current Status:

- Orange wave 4 appears to be complete.

- Orange wave 5 of navy blue wave 1 is now in progress.

Invalidation Level: 1.41919

Analysis Summary

The USDCAD daily chart showcases an impulsive trend structure using Elliott Wave principles. The focus remains on orange wave 5, which forms part of the broader navy blue wave 1 sequence, signaling continued upward momentum after the completion of the orange wave 4 corrective phase.

Current Progression

- Orange wave 4 has concluded, signifying the transition to orange wave 5, the final impulsive wave within navy blue wave 1.

- This phase illustrates a strong bullish trend, aiming to finalize this Elliott Wave cycle.

Larger Trend Context

- The broader trend positions within navy blue wave 1, the opening wave of a larger impulsive sequence.

- Once orange wave 5 concludes, attention will shift to navy blue wave 2, a corrective phase before resuming the overarching bullish trend.

Invalidation Level

- The invalidation threshold for this analysis is 1.41919.

- Price movements above this level invalidate the current wave count, necessitating a reevaluation of the structure.

- This critical level ensures adherence to the Elliott Wave framework while maintaining analytical accuracy.

Conclusion

The USD/CAD daily chart represents a bullish impulsive trend, with orange wave 5 of navy blue wave 1 currently in progress. The recent completion of orange wave 4 provides a foundation for sustained upward movement. The invalidation level of 1.41919 is vital for confirming the wave count and ensuring alignment with Elliott Wave analysis principles.

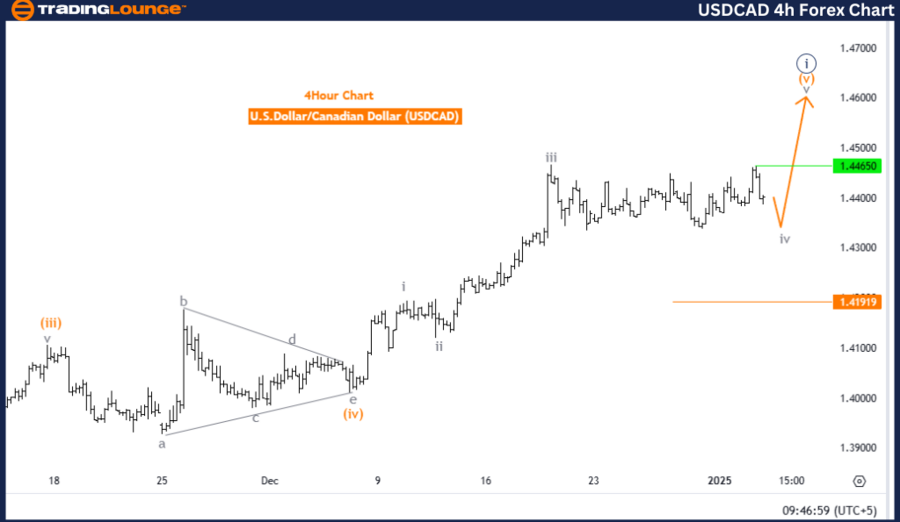

U.S. Dollar / Canadian Dollar (USDCAD) Elliott Wave Analysis – Four-Hour Chart

USDCAD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Gray Wave 4

Position: Orange Wave 5

Direction Next Higher Degrees: Gray Wave 5

Details

Current Status:

- Gray wave 3 has completed.

- Gray wave 4 is currently developing.

Invalidation Level:

1.41919

Analysis Summary

The USDCAD four-hour chart highlights a counter-trend corrective wave structure within the Elliott Wave framework. Attention is centered on gray wave 4, which forms part of the larger gray wave 5 sequence, suggesting a temporary pause or retracement in the broader impulsive trend.

Current Progression

- Gray wave 3 has ended, marking the conclusion of a significant impulsive phase.

- Gray wave 4 is unfolding, often a corrective wave before the next impulsive phase begins.

Larger Trend Context

- The next higher degree indicates gray wave 5, pointing toward potential bullish movement once gray wave 4 concludes.

- This phase represents a consolidation within the trend, laying the groundwork for the upcoming impulsive wave.

Invalidation Level

- The invalidation threshold is 1.41919.

- Any price movement beyond this point invalidates the wave count and requires reassessment.

- This level plays a crucial role in maintaining the integrity of the wave structure.

Conclusion

The USDCAD four-hour chart reflects a corrective counter-trend phase, with gray wave 4 currently forming after the completion of gray wave 3. As part of the larger gray wave 5 structure, this stage establishes the basis for future bullish continuation. The invalidation level of 1.41919 is essential for preserving the wave count’s reliability and maintaining adherence to Elliott Wave principles.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: U.S. Dollar / Swiss Franc (USDCHF) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support