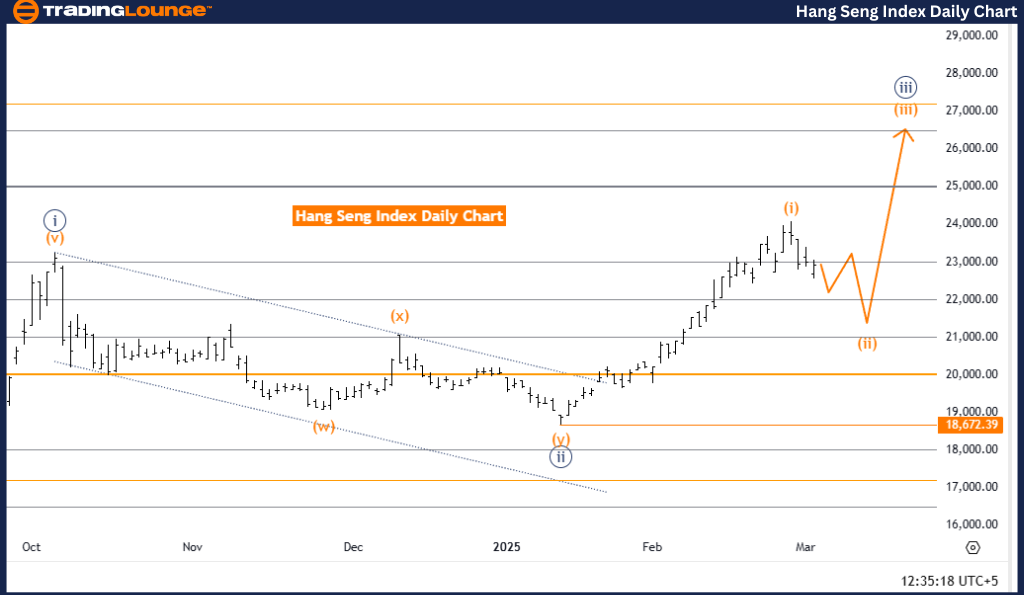

Hang Seng Index Elliott Wave Analysis – Trading Lounge Day Chart

Hang Seng Index Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Direction Next Higher Degree: Orange Wave 3

Details: Orange Wave 1 appears completed, and Orange Wave 2 is currently in play.

Invalidation Level: 18,672.39

Analysis Overview

The Hang Seng Index daily chart analysis indicates an ongoing corrective wave structure in a counter-trend movement. Currently, Orange Wave 2 is unfolding after the completion of Orange Wave 1, signaling a retracement phase before the potential continuation of the broader market trend.

The positioning within Navy Blue Wave 3 further emphasizes the corrective nature of the market. The next anticipated higher-degree wave, Orange Wave 3, is expected to begin after the current retracement concludes. This wave structure suggests that the market is experiencing a temporary pullback before a possible trend reversal.

The invalidation level is set at 18,672.39, serving as a crucial benchmark. If the price moves beyond this level, the current wave count will be invalidated, requiring a reevaluation of the Elliott Wave structure.

Conclusion

The Hang Seng Index remains in a corrective phase, with Orange Wave 2 developing after Orange Wave 1. The market is currently experiencing a retracement period before transitioning into Orange Wave 3. Traders should monitor critical price levels to determine potential trend continuation or reversal.

Hang Seng Index Elliott Wave Analysis – Trading Lounge Weekly Chart

Hang Seng Index Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Direction Next Higher Degree: Orange Wave 3

Details: Orange Wave 1 appears completed, and Orange Wave 2 is currently in play.

Invalidation Level: 18,672.39

Analysis Overview

The Hang Seng Index weekly chart analysis highlights a corrective wave pattern, indicating a counter-trend movement. The market is progressing through Orange Wave 2, following the completion of Orange Wave 1. This retracement suggests that the index is temporarily consolidating before potentially resuming its broader trend.

The position within Navy Blue Wave 3 confirms the corrective structure. The next anticipated higher-degree wave, Orange Wave 3, is likely to emerge once the current retracement in Orange Wave 2 is completed. This implies that the market is in a temporary pullback before a potential shift in momentum.

The invalidation level of 18,672.39 is a key reference point. A price movement beyond this level would require a reevaluation of the Elliott Wave structure to reassess market conditions.

Conclusion

The Hang Seng Index continues its corrective phase, with Orange Wave 2 unfolding after Orange Wave 1. The market remains in a retracement stage, setting up for the transition into Orange Wave 3. Traders should keep a close watch on critical price levels to gauge potential trend continuation or reversal.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NASDAQ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support