EURUSD Elliott Wave Analysis – Trading Lounge Day Chart

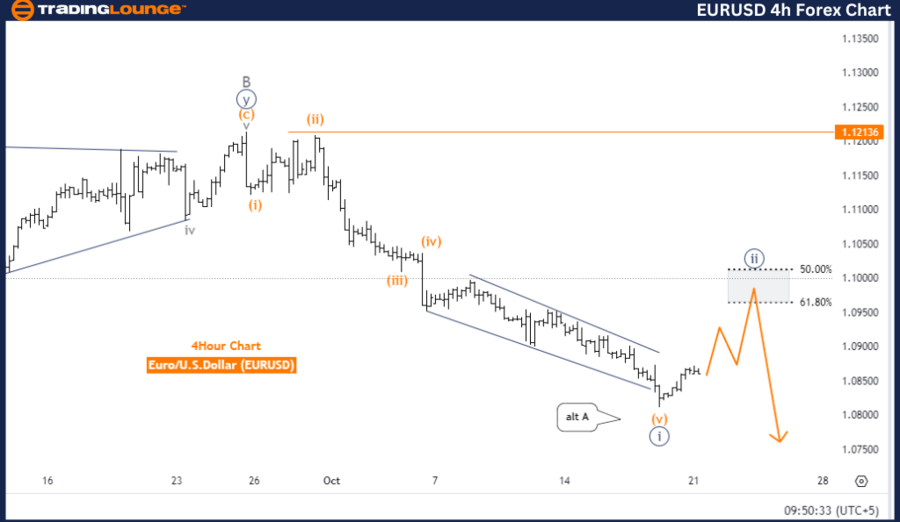

Euro / U.S. Dollar (EURUSD) – Day Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave C

Direction Next Lower Degrees: Navy Blue Wave 3

Details: Navy Blue Wave 1 appears completed, and Navy Blue Wave 2 is currently developing.

Wave Cancel Invalid Level: 1.12136

The EURUSD Elliott Wave analysis on the daily chart indicates that the market is in a corrective phase. Currently, Navy Blue Wave 2 is unfolding after the completion of Navy Blue Wave 1. This corrective phase represents a counter-trend movement, suggesting a temporary pullback or consolidation before the main trend resumes.

At this stage, the market is positioned within Gray Wave C, a part of the corrective structure. The ongoing correction is expected to continue until Navy Blue Wave 2 completes. Once this correction concludes, Navy Blue Wave 3 is likely to begin, which could signal a stronger impulsive move. The direction of this impulsive move, whether upwards or downwards, will depend on how the market reacts at that point.

A key level to watch is 1.12136, the wave cancellation point. If the price dips below this level, the current Elliott Wave count will be invalid, requiring a reassessment of the wave structure.

Summary

- Current Phase: Corrective phase within Navy Blue Wave 2, positioned in Gray Wave C.

- Next Move: After the completion of Wave 2, Navy Blue Wave 3 is anticipated to begin.

- Invalidation Level: 1.12136—if breached, the current wave structure is no longer valid.

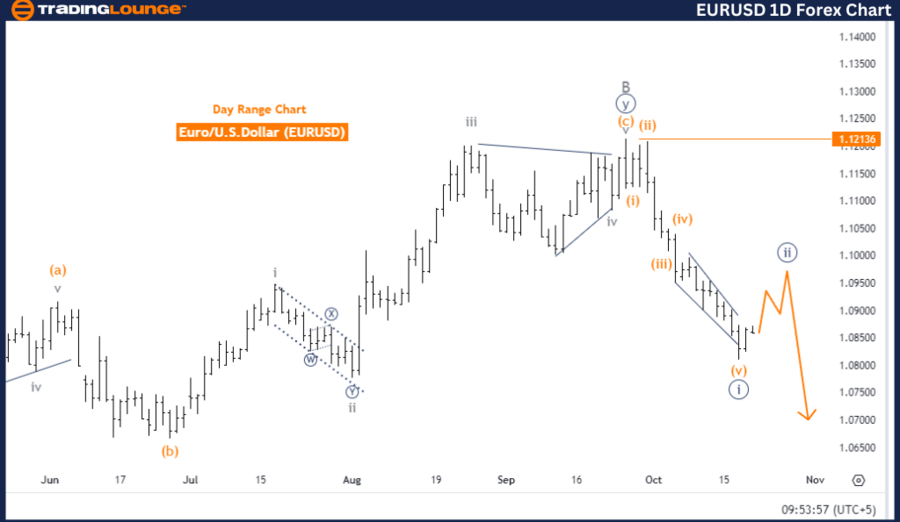

Euro / U.S. Dollar (EURUSD) – 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave C

Direction Next Lower Degrees: Navy Blue Wave 3

Details: Navy Blue Wave 1 has concluded, and Navy Blue Wave 2 is now in progress.

Wave Cancel Invalid Level: 1.12136

The EURUSD 4-hour chart also reflects a counter-trend correction. Following the completion of Navy Blue Wave 1, the market is now within Navy Blue Wave 2. Similar to the daily chart analysis, the market is currently positioned within Gray Wave C, part of the broader corrective phase.

This phase suggests a temporary pullback or consolidation, typically before the main trend resumes. Once Navy Blue Wave 2 completes, Navy Blue Wave 3 is expected to emerge, possibly marking a new impulsive move in either direction, depending on how the market evolves.

For traders, the critical level to monitor is 1.12136, which serves as the wave cancellation point. If the price drops below this level, the current wave structure will become invalid, and the wave count will need to be reassessed.

Summary

- Current Phase: The market is in Navy Blue Wave 2, positioned in Gray Wave C.

- Next Move: Navy Blue Wave 3 is expected after Wave 2 ends.

- Invalidation Level: 1.12136—if breached, the current wave structure will be invalid.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:U.S. Dollar / Canadian Dollar (USDCAD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support