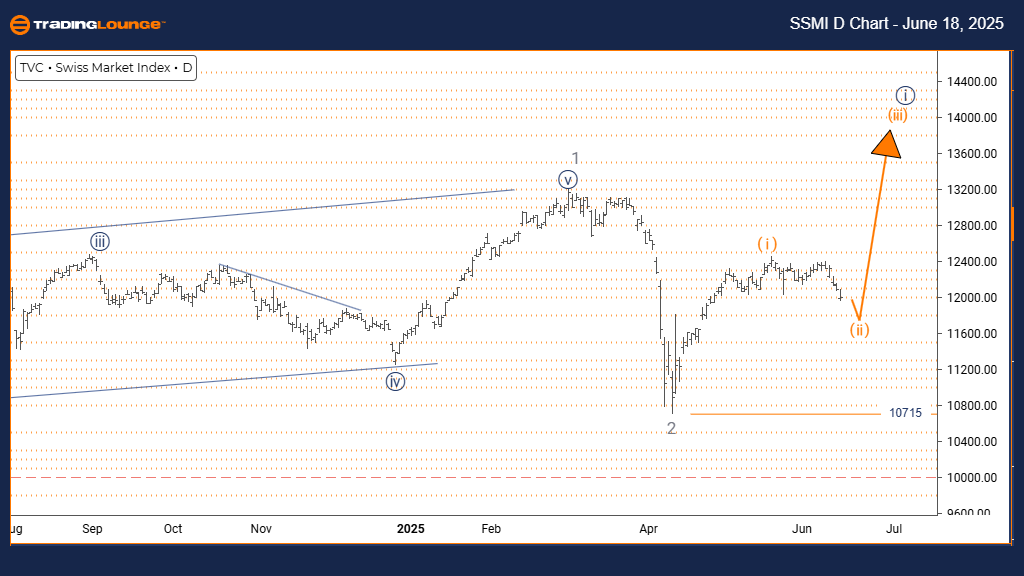

SWISS MARKET INDEX Elliott Wave Analysis | Trading Lounge Day Chart

SWISS MARKET INDEX Wave Technical Analysis

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange Wave 1 appears completed; Orange Wave 2 is currently active.

Wave Cancel Invalid Level: 10715

The SWISS MARKET INDEX (SMI) daily chart shows a corrective pattern within a counter-trend setup. Price activity signals a retracement forming as part of the larger bullish structure. The development of Orange Wave 2 under Navy Blue Wave 1 suggests a short-term pullback within a longer uptrend.

With Orange Wave 1 likely completed, the market now enters the Orange Wave 2 phase. Typically, this wave corrects a portion of the prior advance before giving way to Orange Wave 3—expected to continue the primary bullish trend.

Currently, SMI is progressing through Orange Wave 2. This correction may include sideway moves or minor declines. The key support level remains at 10715; a break below this point would invalidate the existing wave count. Until that occurs, the technical structure supports a brief corrective period followed by a bullish continuation.

SWISS MARKET INDEX Elliott Wave Analysis | Trading Lounge Weekly Chart

SWISS MARKET INDEX Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 appears completed; Navy Blue Wave 1 of 3 is forming.

Wave Cancel Invalid Level: 10715

The SWISS MARKET INDEX weekly chart indicates a strong bullish trend. After completing Gray Wave 2, the index has initiated Navy Blue Wave 1 of Gray Wave 3—signaling the beginning of a larger impulsive wave sequence.

Within this phase, Orange Wave 2 is unfolding as a corrective segment of Navy Blue Wave 1. This typically includes limited downside or sideways price action. The 10715 level is vital for maintaining this bullish interpretation. A drop below this level would challenge the wave count.

Upon finishing Orange Wave 2, the next leg—Orange Wave 3—is expected to start. Historically, Wave 3 is the most powerful phase in an Elliott Wave cycle. Traders should monitor the market for signs of Wave 2 conclusion to capture the potential surge in Wave 3.

Despite the current consolidation, the long-term outlook remains positive. As long as 10715 holds, the bullish structure remains intact, and further upward momentum is anticipated.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Shanghai Composite Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support