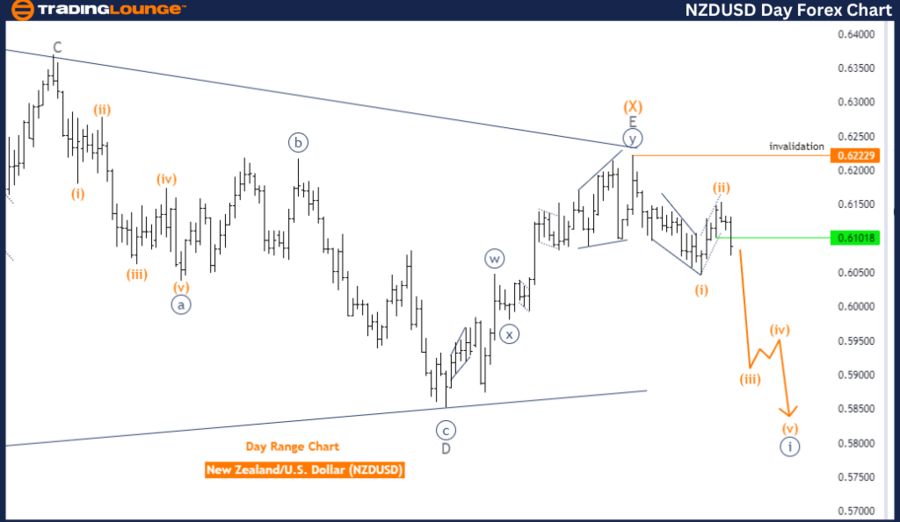

NZDUSD Day Chart Description

NZDUSD Elliott Wave Analysis - Trading Lounge Day Chart

New Zealand Dollar/U.S. Dollar (NZDUSD)

NZDUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 1

Direction Next Higher Degrees: Orange wave 4

Details: Orange wave 2 completed, now orange wave 3 of 1 in play.

Wave Cancel Invalid Level: 0.62229

The NZDUSD Elliott Wave Analysis on the day chart provides a comprehensive look at the current market trend and wave structure for the currency pair. This analysis aims to identify the trend direction, which is classified as impulsive, indicating a strong market movement often linked to significant price changes.

The wave structure under examination is orange wave 3, signifying a robust phase within the market cycle. The current position is navy blue wave 1, part of the larger orange wave 3, suggesting the currency pair is in the early stages of a powerful upward trend.

The next higher degree direction is orange wave 4, implying that after the current wave, the market will transition to the next phase. This phase is expected to maintain the upward momentum established in previous waves.

Key details include the completion of orange wave 2, ending the corrective phase before the current impulsive movement. Presently, orange wave 3 of 1 is active, reflecting a significant upward trajectory. The wave cancel invalid level is set at 0.62229, meaning if the currency pair drops below this level, the current wave analysis would be invalidated.

In summary, the NZDUSD currency pair is in an impulsive trend on the day chart, with orange wave 3 progressing. Following the completion of orange wave 2, the pair has entered orange wave 3 of 1, indicating strong upward momentum. This analysis aids traders in predicting market behavior, anticipating continued robust upward movement. The wave cancellation invalid level at 0.62229 is crucial for validating the ongoing wave analysis.

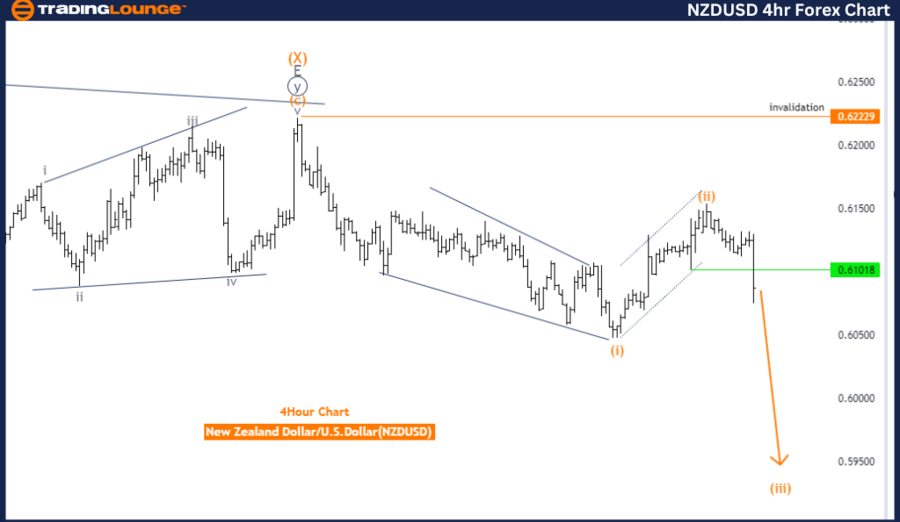

NZDUSD 4-Hour Chart Description

NZDUSD Elliott Wave Analysis - Trading Lounge 4-Hour Chart

New Zealand Dollar/U.S. Dollar (NZDUSD) 4-Hour Chart Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 1

Direction Next Lower Degrees: Orange wave 3 (started)

Details: Orange wave 2 completed, now orange wave 3 of 1 in play.

Wave Cancel Invalid Level: 0.62229

The NZDUSD Elliott Wave Analysis on the 4-hour chart provides insights into the current trend and wave structure of the currency pair. The analysis identifies the trend function as impulsive, indicating strong market action.

The wave structure being reviewed is orange wave 3, signifying a dynamic phase within the market. The specific position is navy blue wave 1, part of the larger orange wave 3, indicating the currency pair is in the early stages of a vigorous upward movement.

The next lower degree direction is orange wave 3, suggesting that after the current wave, the market will continue its upward momentum within this wave sequence.

Details highlight the completion of orange wave 2, ending the prior corrective phase. Currently, orange wave 3 of 1 is active, indicating a strong upward movement. The wave cancel invalid level is set at 0.62229, meaning if the currency pair moves below this level, the current wave analysis would be invalidated.

In summary, the NZDUSD currency pair is in an impulsive trend on the 4-hour chart, with orange wave 3 active. After completing orange wave 2, the pair has transitioned into orange wave 3 of 1, showing significant upward momentum. Traders use this analysis to forecast market behavior, anticipating continued strong upward movement. The wave cancel invalid level is set at 0.62229, a critical point for validating the current wave analysis.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USD/JPY Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support