Corn Commodity Elliott Wave Technical Analysis

Corn is currently in a retracement phase from the decline that began on October 2nd. If the price does not break above the high of October 2, the commodity may experience further downward movement in the coming weeks, continuing the broader bearish cycle that started in May 2024. If the current rebound fails to surpass the October 2 high and breaks below the October 17 low, sellers are likely to dominate the market for weeks or even months.

Long-Term Elliott Wave View on Corn

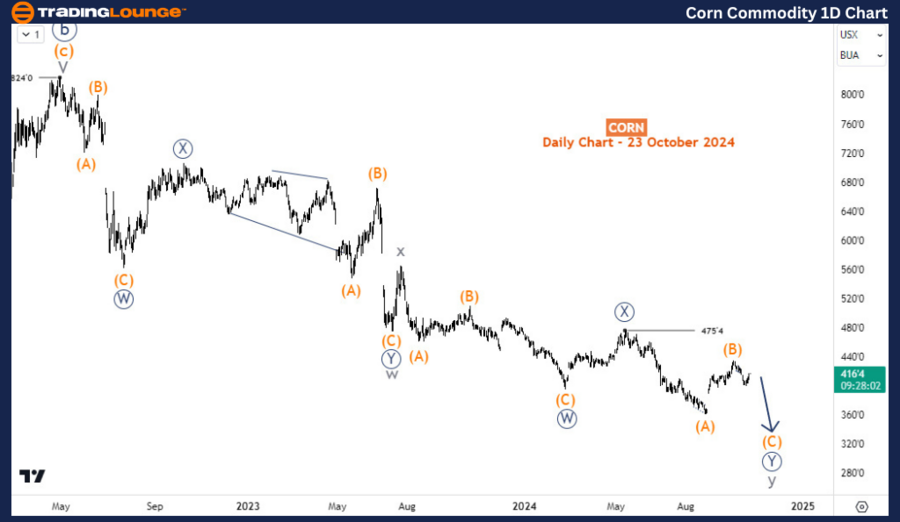

In the long term, Corn prices are in a bearish corrective phase that began in July 2012. This phase is correcting the diagonal 5-wave sequence that started in the 1970s. Corrective structures, apart from triangles, are typically composed of three waves. The first wave of this corrective phase completed in April 2020, followed by strong rallies that completed the second wave in April 2022. The current decline, starting from April 2022, is expected to represent the third wave, which could extend to $295. Therefore, the corrective phase remains incomplete, and further price declines are anticipated.

Corn Commodity Daily Chart Analysis

On the daily chart, the focus is on the third wave, which began from the 824 level. This wave appears to be evolving into a double zigzag pattern, labeled in the cycle degree. After completing waves W and X in the cycle degree, Corn is now in wave Y. However, wave Y is still incomplete, as it is currently in wave (C) of ((Y)) of Y. Wave (B) could still extend higher but is expected to remain below the 475 level. To confirm the end of wave (B), traders need to see the first lower low sequence on the H4 chart.

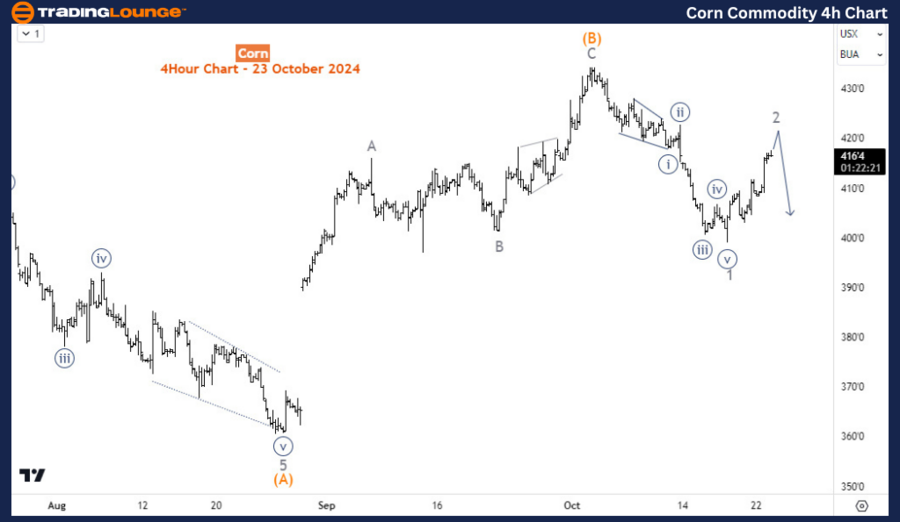

Corn Commodity H4 Chart Outlook

On the H4 chart, a five-wave bearish reaction has emerged following the completion of wave (B). The current rally represents wave 2 of (C). For confirmation that wave (B) will not push higher, wave 3 needs to begin below the high of wave (B) and break below the low of wave 1, which occurred on October 17.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support