ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis

Introduction

Welcome to today's Elliott Wave analysis for the Australian Stock Exchange (ASX) and ASX LIMITED (ASX).

Our latest technical assessment highlights a strong bullish potential, especially within the third wave of the third wave, indicating a high-probability growth phase for ASX LIMITED. This analysis outlines key market trends, validation points, and potential trend shifts to support informed trading decisions.

ASX: ASX LIMITED – ASX 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 3 - grey

Analysis Details:

The third wave of the third wave continues to develop, reinforcing significant bullish momentum. Wave 3 - grey appears to be an extended wave, with Wave ((iii)) - navy advancing higher, further strengthening the uptrend projection.

- Key Resistance Target: Continuation of Wave ((iii))

- Invalidation Point: 60.20 (Break below this level negates the current wave count)

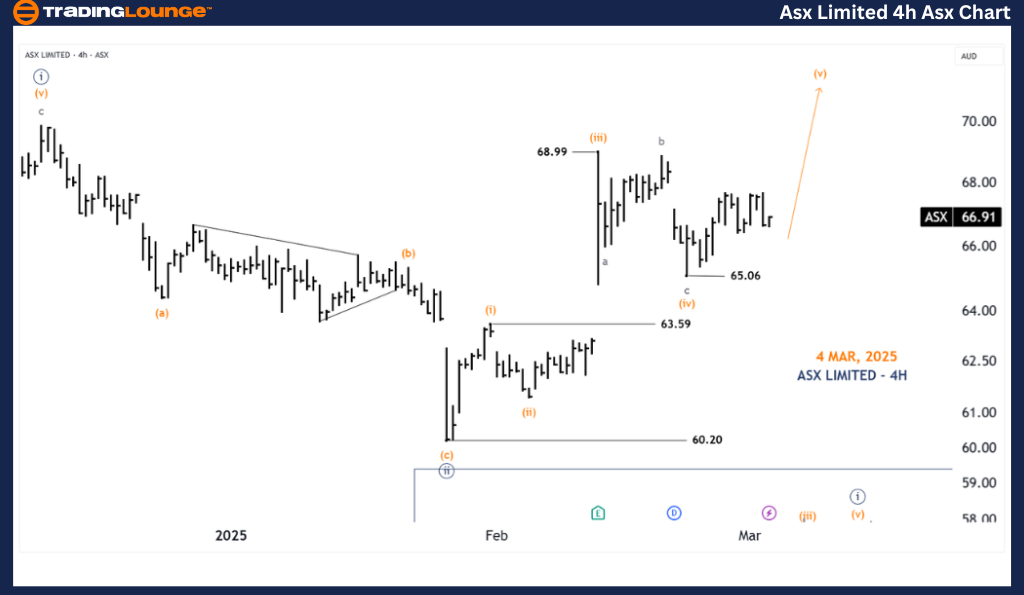

ASX: ASX LIMITED – ASX 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (v) - orange of Wave ((iii)) - navy

Analysis Details:

The 4-hour chart provides a refined outlook on wave progression. The completion of wave (iv) - orange signals a move higher, with wave (v) - orange targeting 68.99 or higher.

- Critical Support Level: Price must hold above 65.06 to sustain the bullish momentum

- Invalidation Point: 65.05 (Break below this level invalidates the wave count)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: INSURANCE AUSTRALIA GROUP LIMITED (IAG) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis presents a structured outlook on ASX LIMITED (ASX), defining key market trends and validation levels to enhance trading confidence.

By maintaining a data-driven approach, we provide traders with actionable insights and potential trade setups, ensuring they can capitalize on high-probability opportunities while managing risk effectively.