Welcome to Our Latest Elliott Wave Analysis for NVIDIA Corp. (NVDA)

This analysis delves into NVIDIA Corp.'s (NVDA) price movements utilizing Elliott Wave Theory. Our goal is to help traders identify potential trading opportunities based on the latest trends and market structure. We will explore both the daily and 1-hour charts to provide a comprehensive overview of NVDA's market behavior.

NVDA Elliott Wave Analysis - Trading Lounge Daily Chart

NVIDIA Corp. (NVDA) Daily Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate wave (5)

Direction: Upside in wave (5)

Details: We observe a bottom in wave (4), which ended near the previous wave 4 area—a typical Elliott Wave pattern. With a breakout above the $120 level, we anticipate further upside as wave (5) continues to develop.

NVDA Elliott Wave Technical Analysis – Daily Chart

Recent price actions suggest that wave (4) has likely found its bottom, coinciding with the previous wave 4 area—a common Elliott Wave scenario. The breakout above $120 strengthens the bullish outlook as wave (5) begins to unfold. Traders should closely monitor this uptrend, as wave (5) could drive NVDA to new highs.

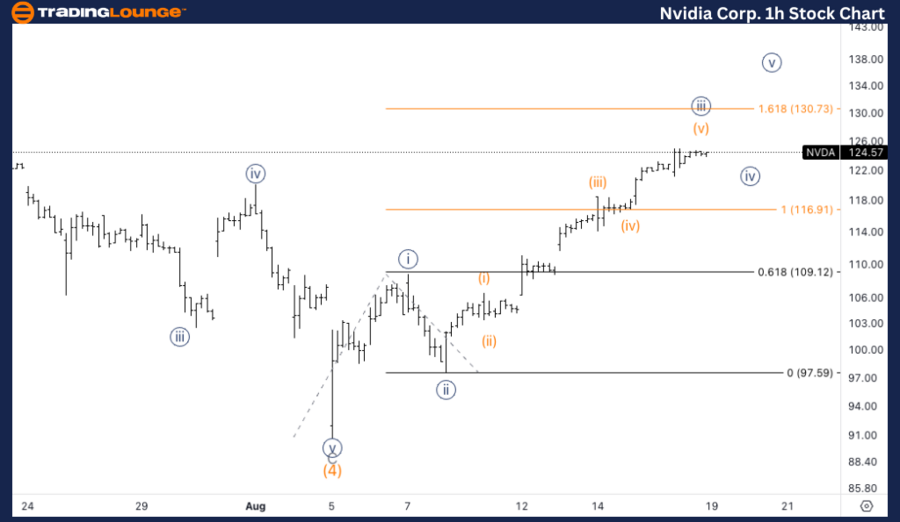

NVDA Elliott Wave Analysis - Trading Lounge 1H Chart

NVIDIA Corp. (NVDA) 1H Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute {iii}

Direction: Top in wave {iii}

Details: We anticipate an extension in wave {iii}, targeting the $130 level, which aligns with the conclusion of Minor Level 1 (MG1). The $130 level is an important resistance point, where traders should be vigilant for a potential correction in wave {iv}.

NVDA Elliott Wave Technical Analysis – 1H Chart

In the short term, NVDA is extending within wave {iii} of (5). The typical third wave target is around the $130 level, corresponding to the end of Minor Level 1 (MG1). This target may act as a resistance level, where traders should be prepared for a potential correction in wave {iv} after reaching this level.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: VanEck Semiconductor ETF (SMH) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support