Welcome to Our Elliott Wave Analysis for VanEck Semiconductor ETF (SMH) - August 16, 2024

This analysis provides insights into SMH's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on the current market structure and trends. We will examine both the daily and 1-hour charts to offer a comprehensive view of SMH's market behavior.

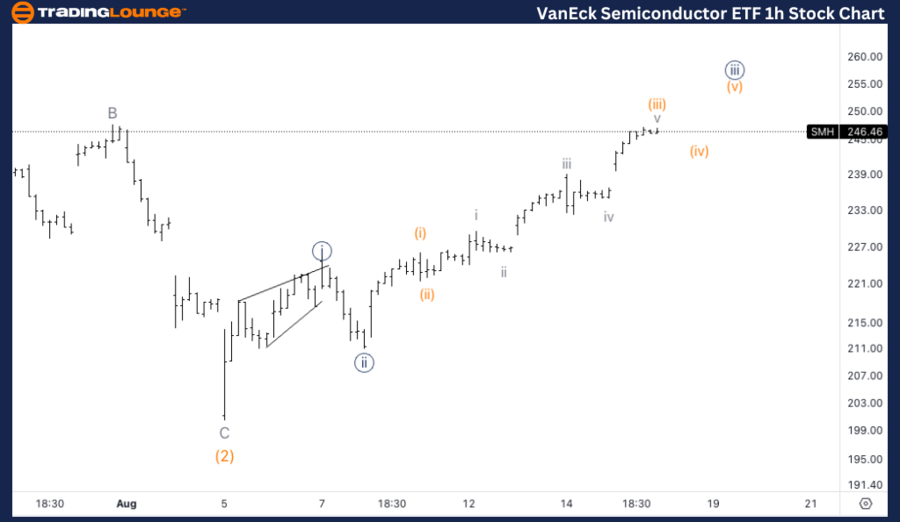

SMH Elliott Wave Analysis: Daily Chart Overview

VanEck Semiconductor ETF (SMH) Daily Chart Analysis

SMH Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 1 of (3)

Direction: Upside into wave 1

Details: We're observing a clear five-wave move from the $200 lows, which is essential for confirming the broader upside potential.

SMH Elliott Wave Technical Analysis – Daily Chart

The daily chart indicates a well-defined five-wave structure emerging from the recent $200 lows. This wave 1 of (3) is crucial in establishing the continuation of the broader upward trend. A confirmed five-wave move would bolster confidence in the ongoing trend, indicating that SMH is positioned for further gains as it moves into wave 3.

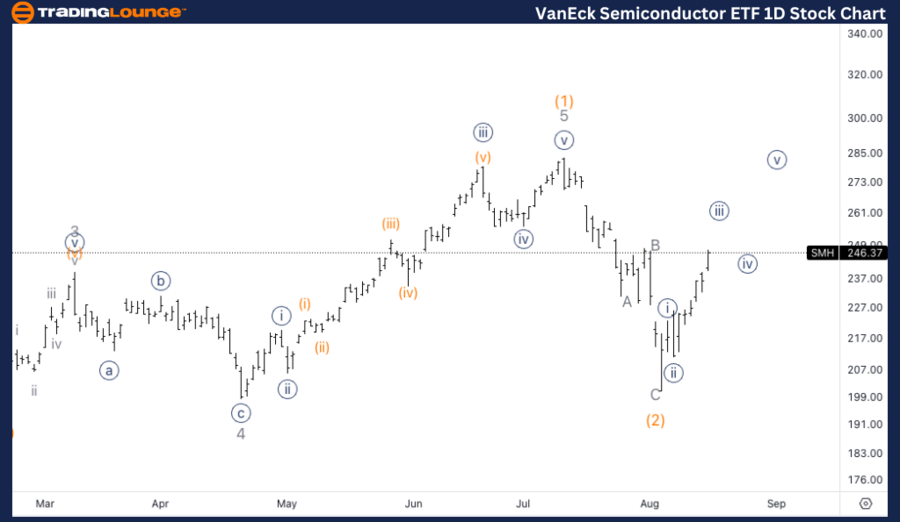

SMH Elliott Wave Analysis: 1-Hour Chart Overview

VanEck Semiconductor ETF (SMH) 1H Chart Analysis

SMH Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Upside in wave {iii}

Details: We anticipate further upside into wave {iii} as the price approaches the previous wave B level. A break above this resistance would confirm additional upside potential.

SMH Elliott Wave Technical Analysis – 1H Chart

In the short-term, SMH appears to be advancing within wave {iii} of 1. As we near the previous wave B level, a break above this resistance will provide further confirmation of the upward trend. This would reinforce the bullish outlook, signaling that wave {iii} is actively propelling the price higher.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NextEra Energy Inc., (NEE) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support