Bovespa Index Elliott Wave Analysis | Trading Lounge Day Chart

Bovespa Index Day Chart Analysis

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 4

DETAILS: Orange wave 2 appears complete; orange wave 3 is currently advancing.

Wave Cancel Invalidation Level: 122486

The daily Bovespa Index chart signals a bullish Elliott Wave trend in motion. Price action is unfolding impulsively, indicating firm upward market momentum. The prevailing structure is identified as orange wave 3, within the broader navy blue wave 1 phase. This setup aligns with the early stages of a prolonged bullish market cycle.

The preceding orange wave 2 correction has likely concluded, leading into a developing orange wave 3, known for strong directional pushes in Elliott Wave theory. A pullback into orange wave 4 is projected once the third wave matures.

An essential price threshold is 122486. If the index breaks below this, the current wave outlook will be invalidated and a reassessment will be required. So long as this level holds, the structure favors sustained upward price movement.

The technical chart highlights a bullish continuation driven by the unfolding orange wave 3, keeping the Bovespa Index positioned for ongoing gains.

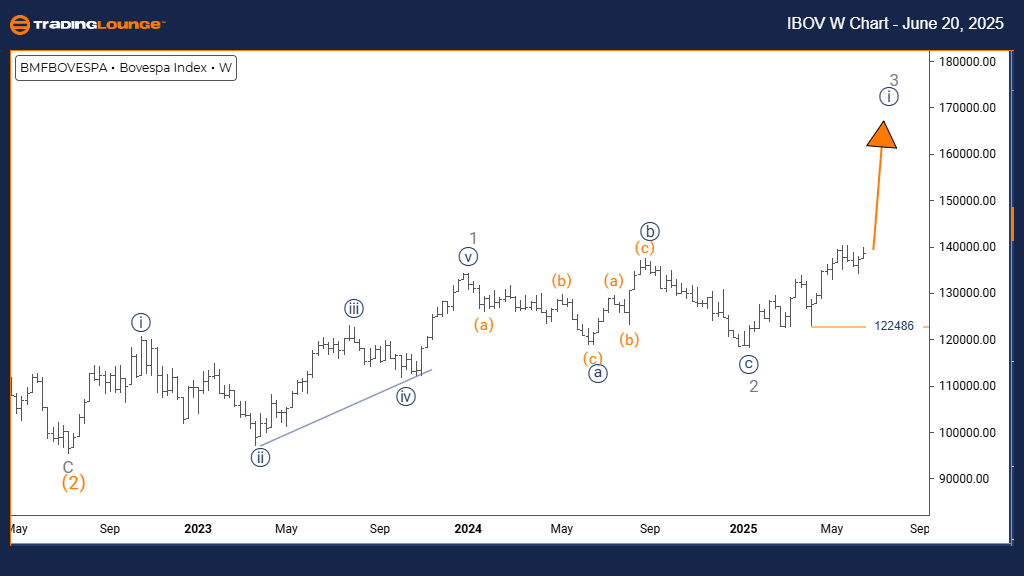

Bovespa Index Elliott Wave Analysis | Trading Lounge Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 3

DIRECTION NEXT LOWER DEGREES: Navy blue wave 2

DETAILS: Gray wave 2 appears complete; navy blue wave 1 is now active.

Wave Cancel Invalidation Level: 122486

The weekly Bovespa Index chart supports a firm bullish Elliott Wave structure. Current momentum remains impulsive, reinforcing a strong upward bias. The chart reveals navy blue wave 1, forming part of the broader gray wave 3 sequence, pointing to a longer-term uptrend initiation.

The prior gray wave 2 correction seems finalized, clearing the way for the current navy blue wave 1 to progress. Once this wave finishes, a brief corrective move as navy blue wave 2 is expected.

A key wave invalidation point is 122486. A close beneath this would nullify the wave count and necessitate a revised interpretation. Until that occurs, the structure favors a bullish advance.

Market conditions suggest active institutional buying as navy blue wave 1 unfolds. This pattern could deliver additional price strength in the near term as part of the larger gray wave 3 rally.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: IBEX 35 (Spain) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support