GX Uranium Elliott Wave Analysis

Uranium Elliott Wave Technical Analysis

Function - Counter trend

Mode - Corrective

Structure - Emerging Flat

Position - Red wave (B) of blue 4

Direction - Red wave (C) should begin

Details - Wave (B) hits above $30. Price could reach 30.80-31.39 before completing wave (B). We will have to see a sharp return below 30 to confirm the start of wave (C)

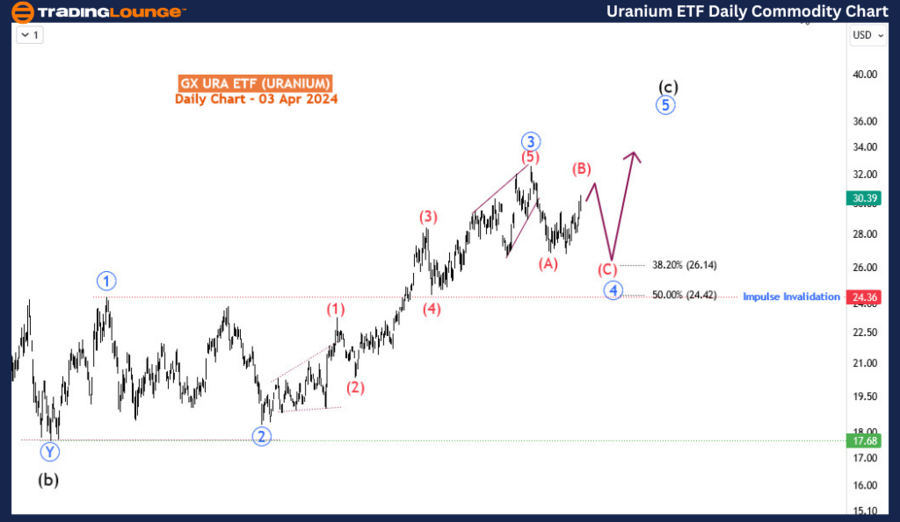

The GX Uranium ETF (URA) has been on a recovery path since March 26, 2024, albeit characterized as a corrective phase. This suggests a possibility of downside continuation to fulfil the broader retracement initiated on February 1, 2024. However, it's imperative to view this within the context of the larger trend, which indicates a continuation of the upward momentum that began on July 7, 2022, once the current pullback concludes. In today's discussion, we'll explore potential trading opportunities for both the short and medium term in URA.

Uranium Daily Chart Analysis: Analyzing the daily timeframe, the ETF has been in an impulse rally since July 2022, with waves 1 to 3 (highlighted in blue) completed before the onset of the corrective wave 4 (also circled in blue) on February 1, 2024, commencing at 32.59. This corrective wave 4 has progressed to some extent, completing sub-wave (A) on February 23, 2024, at 26.88, followed by a rebound for wave (B). Examination of the sub-waves within (B) reveals an expanding flat pattern, as evidenced by the H4 chart.

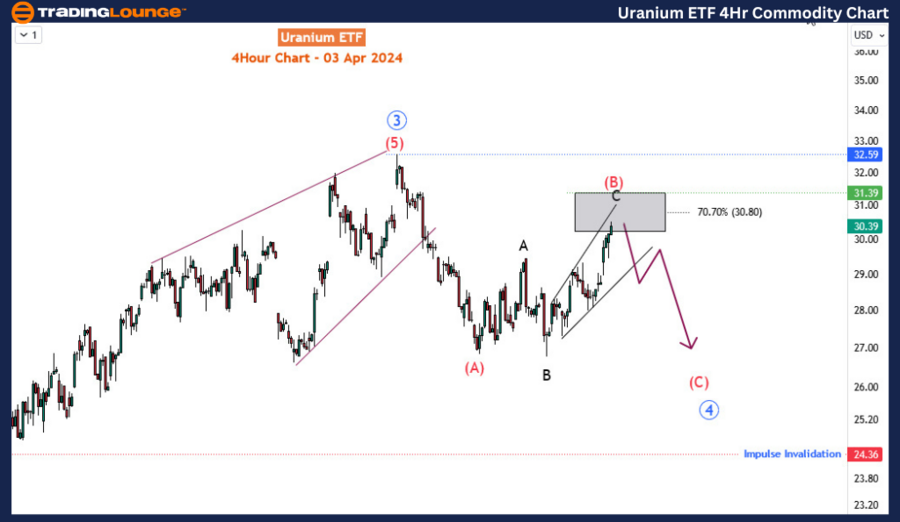

GX Uranium Elliott Wave Analysis Trading Lounge 4-Hour Chart

Uranium 4-Hour Chart Analysis:

Zooming in on the H4 timeframe, we observe that waves A and B have each completed 3-wave structures typical of flat patterns, characterized by their 3, 3, 5 structure. Currently, wave C is nearing completion, taking the form of an expanding diagonal pattern as it approaches a critical zone between 30.39 and 31.39. Anticipation of a bearish reaction from this zone is valid. However, confirmation of the initiation of wave (C) necessitates a sharp break below the lower boundary line of the diagonal. As selling pressure intensifies, wave (C) is projected to extend lower towards the 26.5-25.5 range.

Alternatively, if the ongoing rally surpasses the aforementioned zone to the upside, the likelihood of this forecast diminishes, especially as the price approaches the invalidation point at 32.59. In such a scenario, it would suggest that wave 5 (highlighted in blue) is currently unfolding, indicating that blue wave 4 has already completed at 26.79. Traders should closely monitor these key levels and adjust their strategies accordingly to capitalize on potential trading opportunities presented by URA's price action.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Corn Commodity

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE