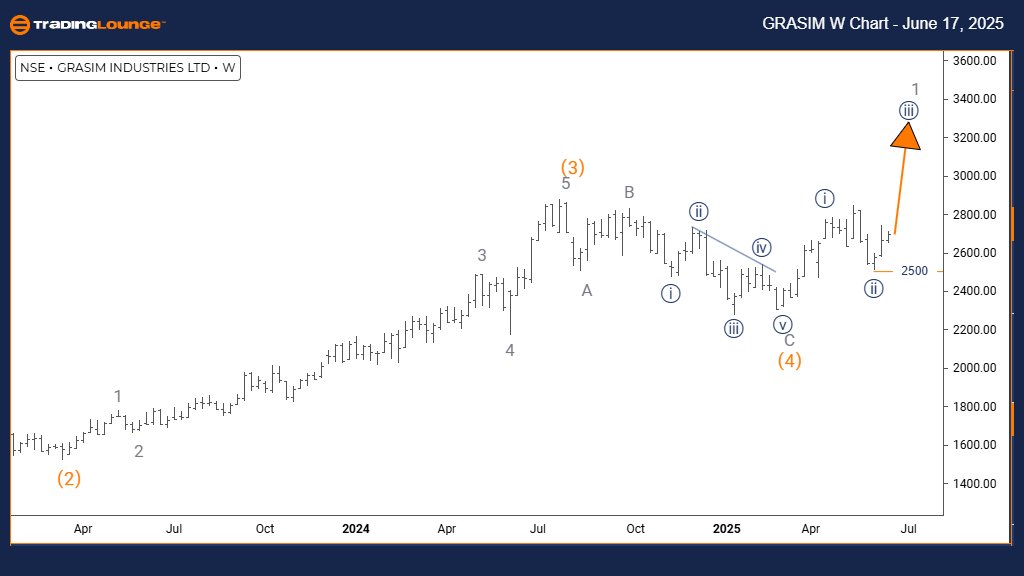

GRASIM INDUSTRIES Elliott Wave Analysis | Trading Lounge Daily Chart

GRASIM INDUSTRIES Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 1

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 3 (Initiated)

DETAILS: Navy blue wave 2 appears completed; currently unfolding navy blue wave 3 of wave 1.

Cancel Invalid Level: 2500

The Elliott Wave daily chart for GRASIM INDUSTRIES reflects a bullish Elliott Wave structure. Price momentum is clearly in an impulsive phase, reinforcing strong upward movement in the stock. The identified configuration focuses on navy blue wave 3, embedded within gray wave 1, indicating a core advancement phase in a broader market rally.

Evidence suggests navy blue wave 2 has concluded its corrective action, and the price is now advancing through navy blue wave 3 of gray wave 1. This third wave typically experiences accelerated momentum and sharp price increases, marking the most dynamic segment in an Elliott wave cycle. Current wave analysis implies that navy blue wave 3 has just begun.

A critical support level lies at 2500. Should price fall beneath this threshold, the existing wave outlook would become invalid, requiring a reevaluation of the bullish forecast. Until that occurs, the technical chart maintains a positive market bias.

From a technical standpoint, GRASIM INDUSTRIES appears poised for an extended bullish move. The transition into navy blue wave 3 signals renewed buying interest, pointing to the likelihood of continued price strength and favorable risk-to-reward dynamics.

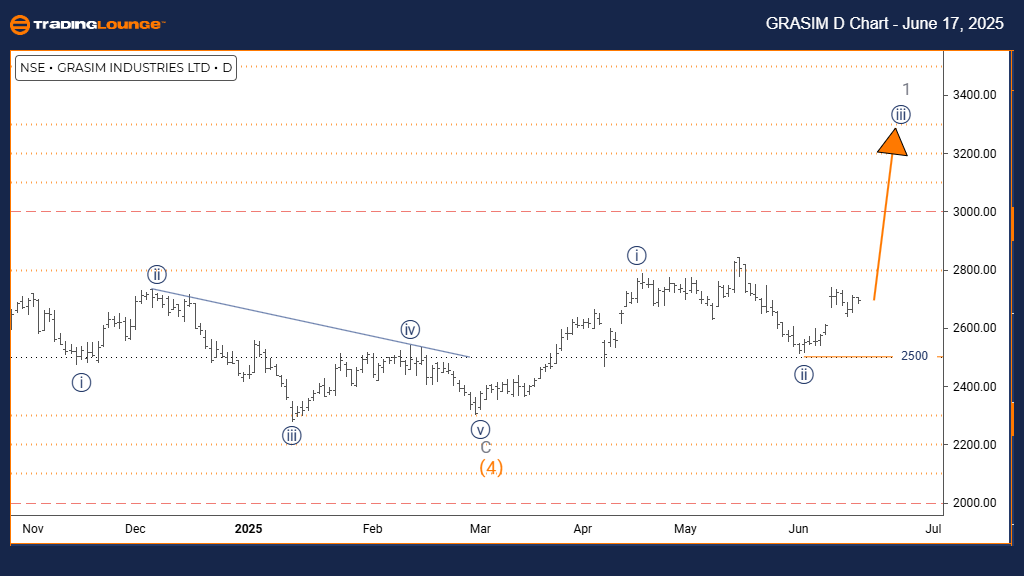

GRASIM INDUSTRIES Elliott Wave Analysis | Trading Lounge Weekly Chart

GRASIM INDUSTRIES Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 1

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 3 (Initiated)

DETAILS: Navy blue wave 2 likely completed; navy blue wave 3 of wave 1 is in progress.

Cancel Invalid Level: 2500

The weekly chart analysis for GRASIM INDUSTRIES confirms an impulsive bullish trend as per Elliott Wave Theory. The prevailing market pattern indicates upward momentum, driven by navy blue wave 3 situated within the structure of gray wave 1. This configuration signifies that the stock is currently experiencing the most forceful upward segment in its wave sequence.

Wave analysis confirms navy blue wave 2 has likely finished its correction, initiating the development of navy blue wave 3. Known for producing the steepest price increases, this wave stage tends to attract significant volume and momentum. Close observation of navy blue wave 3's evolution is essential, as it offers vital insight into the continuation of the upward cycle.

The invalid level remains established at 2500. Any move below this line would negate the current bullish pattern and prompt a reassessment. Until such a breach occurs, the technical analysis continues to favor a positive trajectory for the stock.

The Elliott Wave setup implies medium-term growth potential for GRASIM INDUSTRIES. With wave 3 developing after the end of wave 2, the setup suggests strong market sentiment and further upward movement as likely scenarios.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOW JONES - DJI Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support