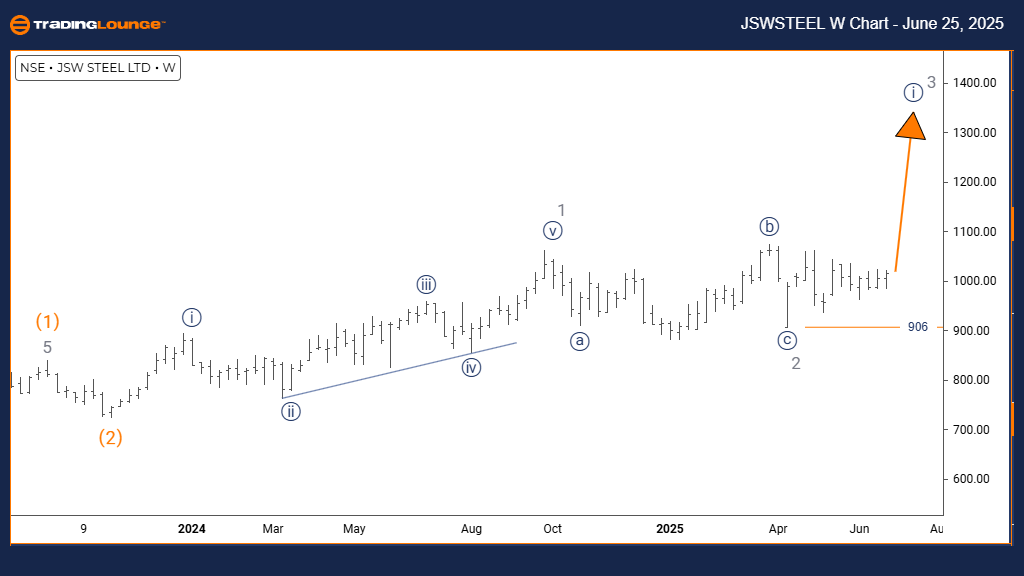

JSW STEEL Elliott Wave Analysis | Trading Lounge Daily Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (initiated)

DETAILS: Completion of Orange Wave 2 confirmed; Orange Wave 3 now developing.

Wave Cancel Invalid Level: 906

Wave Structure Overview

On the daily chart, JSW STEEL's Elliott Wave forecast indicates a bullish technical structure. Price action currently exhibits an impulsive pattern, aligning with a strong uptrend. The structure in focus is Orange Wave 3, forming within the broader Navy Blue Wave 1 context. This suggests JSW STEEL share price is gaining momentum in an advancing market environment.

Transition to Orange Wave 3

The corrective phase of Orange Wave 2 has concluded, and the formation of Orange Wave 3 has commenced. Typically, this third wave marks a powerful segment of Elliott Wave patterns, often reflecting increased investor confidence and upward price expansion. It forms part of the primary Navy Blue Wave 1 trajectory.

Key Support Level

The critical invalidation point is at 906. A drop below this level would nullify the current wave outlook, prompting a reassessment of the bullish trend. As long as prices stay above this threshold, the technical analysis supports a continued rise in JSW STEEL share price.

Outlook

JSW STEEL remains positioned for further gains. The initiation of Orange Wave 3, following the completion of Orange Wave 2, points to sustained bullish momentum. This impulsive setup favors a prolonged upside trend with strong buying signals.

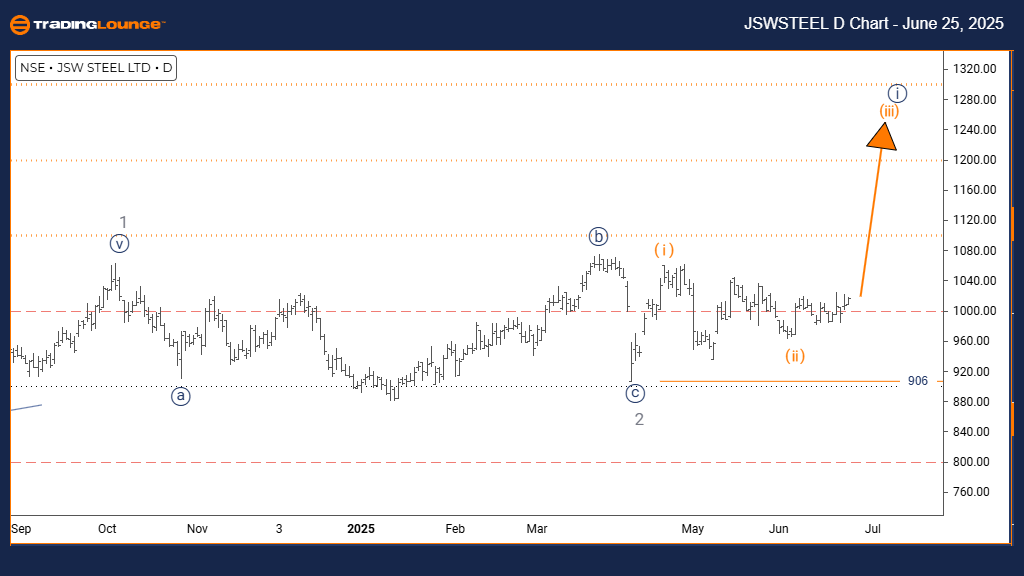

JSW STEEL Elliott Wave Analysis | Trading Lounge Weekly Chart

JSW STEEL Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 appears complete; Navy Blue Wave 1 of Gray Wave 3 is progressing.

Wave Cancel Invalid Level: 906

Wave Structure Overview

JSW STEEL’s weekly Elliott Wave analysis reflects a bullish outlook. The price is currently progressing through an impulsive wave pattern, showing persistent upward strength. The identified wave is Navy Blue Wave 1, unfolding within the larger Gray Wave 3 cycle. This setup suggests the onset of a potentially extended bullish leg in JSW STEEL’s long-term share price movement.

Initiation of Gray Wave 3

Completion of Gray Wave 2 signals the beginning of Navy Blue Wave 1 inside the broader Gray Wave 3 pattern. This aligns with the classic Elliott Wave expectation of a strong rally during the third wave. The following lower-degree wave is projected as Navy Blue Wave 2.

Key Support Level

The 906 level is crucial for maintaining this wave count. A breach below this support would invalidate the present bullish structure. Until then, the technical setup for JSW STEEL remains consistent with upward momentum and further gains.

Outlook

JSW STEEL stock appears to be entering a powerful uptrend phase. The activation of Navy Blue Wave 1 within the Gray Wave 3 context supports the potential for substantial price appreciation. The technical configuration indicates rising institutional interest and a favorable bullish scenario.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EICHER MOTORS Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support