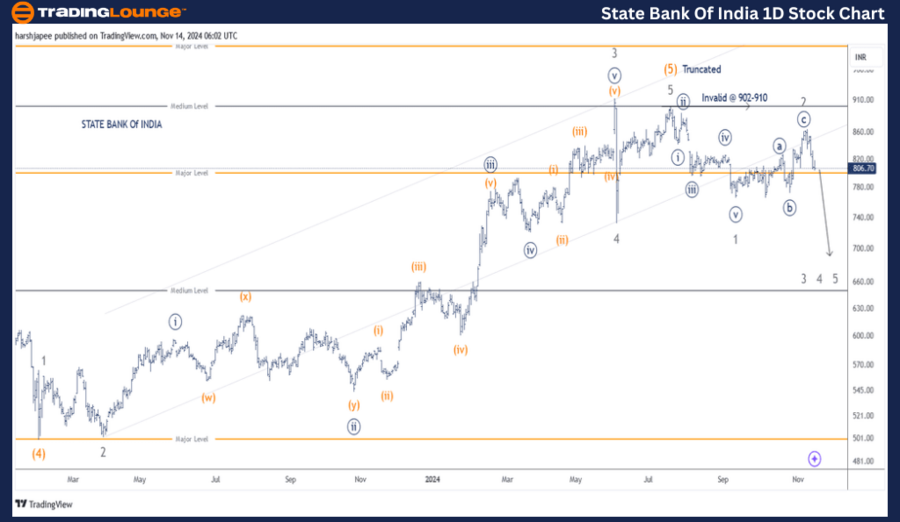

STATE BANK OF INDIA – SBIN (1D Chart) Elliott Wave Technical Analysis

SBIN Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Motive

Structure: Impulse within larger degree zigzag

Position: Minor Wave 2

Details:

Minor Wave 2 Grey may have extended to the 860 zone. If this analysis holds true, Wave 3 could be underway soon.

Invalidation Point: 910

State Bank of India Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of State Bank of India signals a potential trend reversal after reaching the 920 high, marking Intermediate Wave (5) Orange. This truncation was followed by an impulsive decline to 765, completing Minor Wave 1. Subsequently, a counter-trend rally led to the 860 high, suggesting the end of Wave 2.

If this structure remains valid, bearish momentum is likely to dominate as Wave 3 unfolds. The critical invalidation level for the bearish scenario is 920. Furthermore, a breakdown below 730 could accelerate the downward move. Alternatively, a breakout above 920 would confirm a bullish reversal.

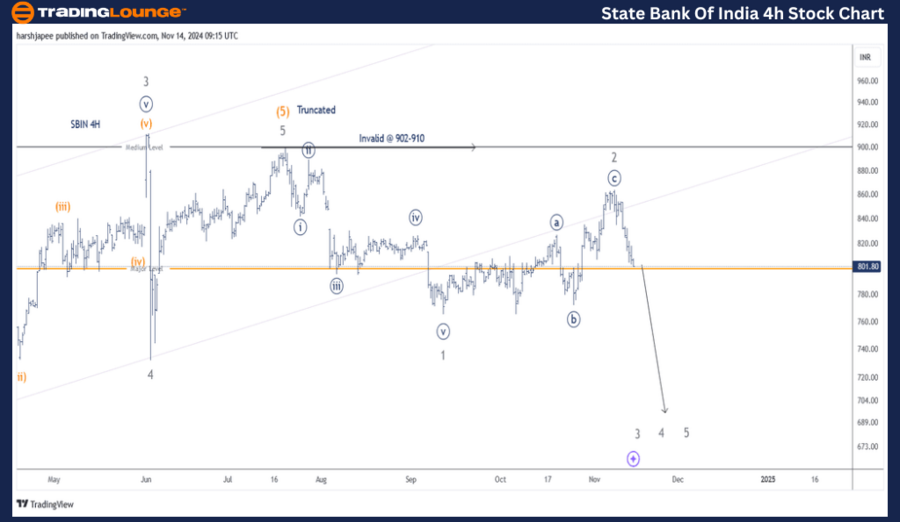

STATE BANK OF INDIA – SBIN (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Motive

Structure: Impulse within larger degree zigzag

Position: Minor Wave 2

Details:

Minor Wave 2 Grey may have extended to the 860 level. If correct, Wave 3 could now be underway. As of writing, the stock trades around 803, with bearish pressure likely to push prices further down.

Invalidation Point: 910

State Bank of India 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart of State Bank of India reflects the wave structure following the completion of Minor Wave 4 near the 730 level on June 4, 2024. Minor Wave 5 appears to have been truncated, ending around the 910 level.

An impulsive decline followed, completing Minor Wave 1 Grey, succeeded by a corrective rally (Minor Wave 2 Grey) that ended near 860. Assuming this structure is accurate, the ongoing price action represents Minor Wave 3, which could extend below the 700 mark.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: JSW STEEL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

State Bank of India appears to be moving lower within Wave 3, with a projected target near the 700 level, while 920 serves as the critical invalidation point for this bearish scenario.