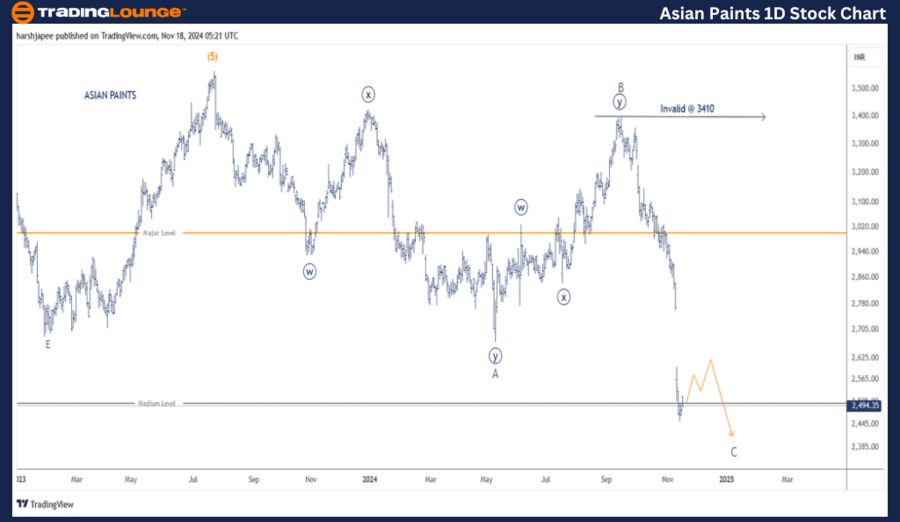

ASIAN PAINTS Elliott Wave Analysis - TradingLounge Day Chart

ASIAN PAINTS Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Flat (3-3-5)

Position: Minute Wave C

Details: A Minor degree corrective wave A-B-C is unfolding against the 3550 level, with Waves A and B already in place. The high-probability count indicates Minute Wave C is either complete or near completion.

Invalidation point: 3410

ASIAN PAINTS Daily Chart Technical Analysis and Potential Elliott Wave Counts:

If this scenario holds, bullish momentum could return soon, lifting the stock from current levels.

ASIAN PAINTS Elliott Wave Analysis - TradingLounge 4H Chart

ASIAN PAINTS Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree Grey)

Mode: Corrective

Structure: Flat (3-3-5)

Position: Minute Wave C

Details: A Minor degree corrective A-B-C wave is progressing against the 3550 resistance, with Waves A and B complete. A high-probability count shows Minute Wave C is close to finishing.

Minute Wave ((iii)) Navy within C may have extended, leading to a potential Wave ((iv)) correction before a final low to terminate Minor Wave C.

Invalidation point: 3410

ASIAN PAINTS 4H Chart Technical Analysis and Potential Elliott Wave Counts:

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI GREEN ENERGY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion: