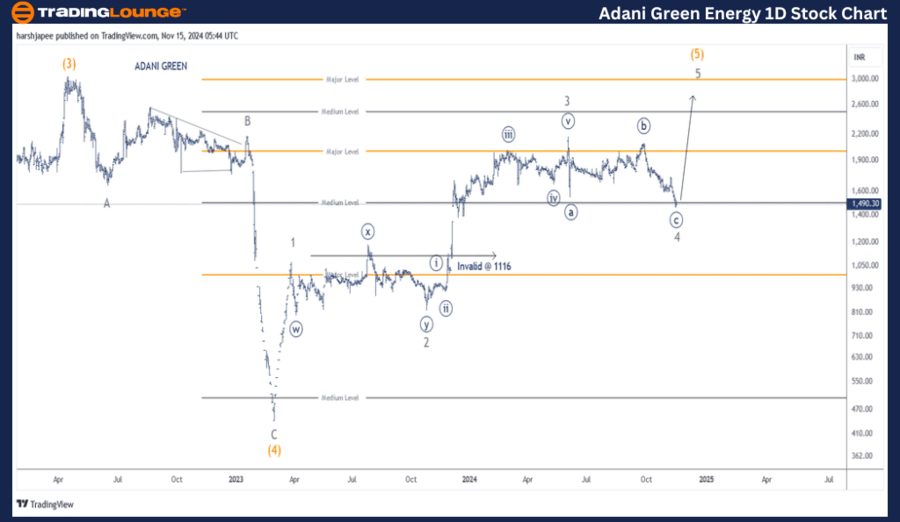

ADANI GREEN ENERGY – TradingLounge Day Chart Analysis

ADANIGREEN (1D Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4 Grey

Details:

- The counts have been revised with a potential conclusion of Minor Wave 4 Grey in the 1485-90 zone.

- If this interpretation holds, Minor Wave 5 Grey may resume its upward trend shortly, completing Intermediate Wave (5).

- Alternatively, a prolonged decline would suggest a larger degree correction is in progress.

Invalidation point: 1116

ADANI GREEN ENERGY Daily Chart Technical Analysis and Elliott Wave Counts

The daily chart for ADANI GREEN ENERGY suggests a steady rally, potentially entering the final phase of Minor Wave 5 Grey within Intermediate Wave (5) Orange. Current levels are supported at 1480, with a key invalidation threshold at 1116.

- Immediate Resistance: 1750 – A breakout above this level could confirm a bottom formation.

- Intermediate Wave (4) Orange concluded around 435 in February 2023.

- The rally has since traversed:

- Minor Wave 1: 1075

- Minor Wave 2: 824

- Minor Wave 3: 2170

- Potential Minor Wave 4: 1480

Projection:

If the above wave structure holds, bullish momentum is likely to resume soon from the current price of 1490 as Minor Wave 5 unfolds.

ADANI GREEN ENERGY – TradingLounge 4-hour Chart Analysis

ADANI GREEN ENERGY Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4 Grey

Details:

Invalidation point: 1116

ADANI GREEN ENERGY 4H Chart Technical Analysis and Elliott Wave Counts

The 4H chart emphasizes the sub-wave patterns between Minor Wave 3 and Minor Wave 4.

- The Minute Wave structure has been adjusted to a corrective ((w))-((x))-((y)) pattern, appearing to have completed near the 1480-90 range.

- Channel support has been successfully tested at these levels.

Projection:

If the wave count is correct, the stock is expected to trend higher, sustaining above the 1480 low.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: STATE BANK OF INDIA – SBIN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ADANI GREEN ENERGY is positioned for a potential upward rally from the current price of 1490 as Minor Wave 5 unfolds within Intermediate Wave (5) Orange. A break above 1750 would solidify bullish momentum and confirm the end of the corrective phase.