EURUSD Elliott Wave Analysis | Trading Lounge Daily Chart

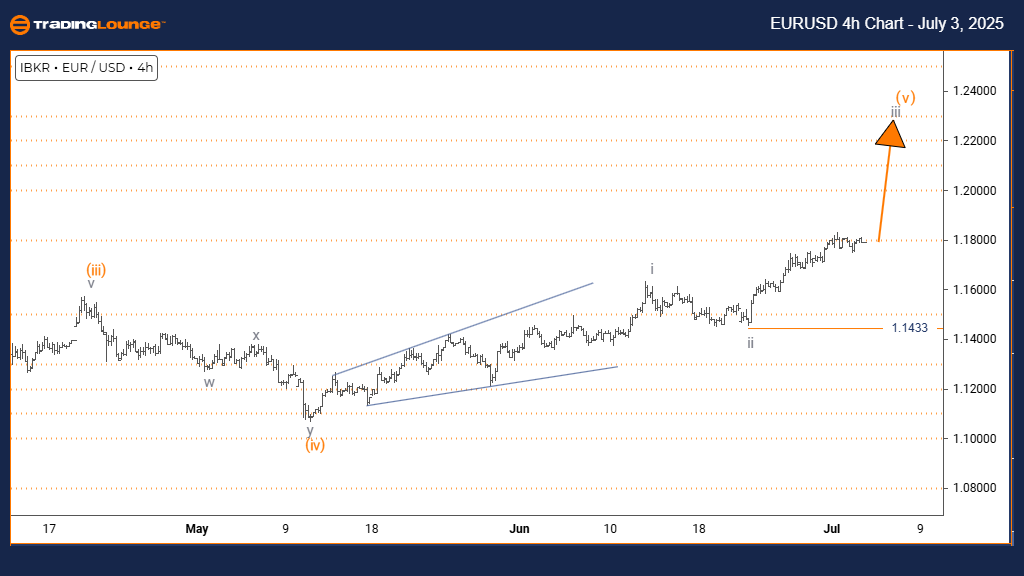

Euro/ U.S. Dollar (EURUSD) – Daily Chart Analysis

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange wave 4 appears complete; orange wave 5 is now forming.

Wave Cancel Invalid Level: 1.1433

The EURUSD daily chart analysis using Elliott Wave theory confirms a bullish market trend. Current price action is impulsive, indicating solid upward momentum. The wave count identifies this move as orange wave 5, developing within a larger wave structure—navy blue wave 1. This phase suggests that EURUSD is progressing through the final stage of an impulsive wave sequence in a broader bullish trend.

Orange wave 4 seems to have completed its corrective phase, setting the stage for orange wave 5’s development. Typically, this fifth wave in the Elliott Wave cycle carries notable strength before a corrective pattern or reversal emerges. Once orange wave 5 completes, navy blue wave 2 is expected to begin.

Traders should pay close attention to the key invalidation point at 1.1433. A price drop below this level would invalidate the current Elliott Wave scenario, requiring a reevaluation. As long as the price holds above 1.1433, the bullish forecast remains valid, reinforcing the case for continued upside movement.

The unfolding of orange wave 5 confirms strong bullish momentum following the conclusion of wave 4. With impulsive structure in place, buyers appear in control. However, traders should stay alert for signals indicating the possible end of this wave, which could mark the conclusion of the ongoing navy blue wave 1.

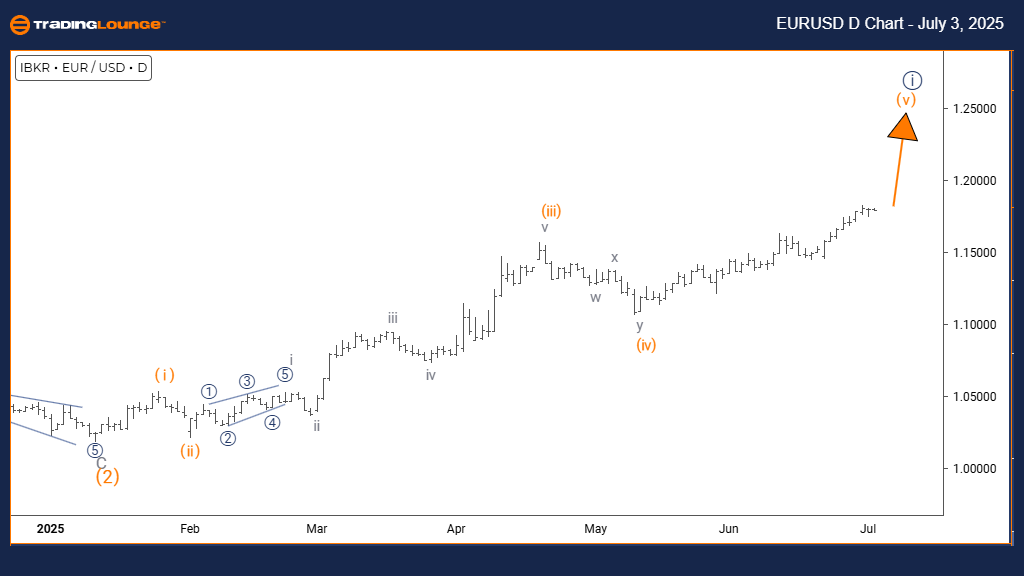

Euro/ U.S. Dollar (EURUSD) – 4-Hour Chart Analysis

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 5

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3 (Initiated)

DETAILS: Gray wave 2 appears complete; gray wave 3 is now advancing.

Wave Cancel Invalid Level: 1.1433

On the 4-hour chart, the EURUSD Elliott Wave analysis reinforces a bullish market perspective. The current market condition is impulsive, indicating upward momentum. Price movement is categorized as gray wave 3 within the broader orange wave 5 sequence. This positioning supports a continuation of the bullish trend.

Gray wave 2 has likely completed, giving way to gray wave 3—a wave often associated with the strongest momentum in the Elliott Wave cycle. This stage typically yields substantial price gains. The next target is the continuation of gray wave 3, advancing the overall bullish structure of orange wave 5.

A key technical level to monitor is 1.1433. A price move below this threshold would invalidate the existing wave count and prompt a reassessment. Until that occurs, the bullish Elliott Wave outlook remains active, with potential for further price appreciation.

The setup currently shows EURUSD positioned for further upside, as gray wave 3 develops after wave 2’s correction. The impulsive nature of this leg suggests robust market demand and room for additional gains.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support