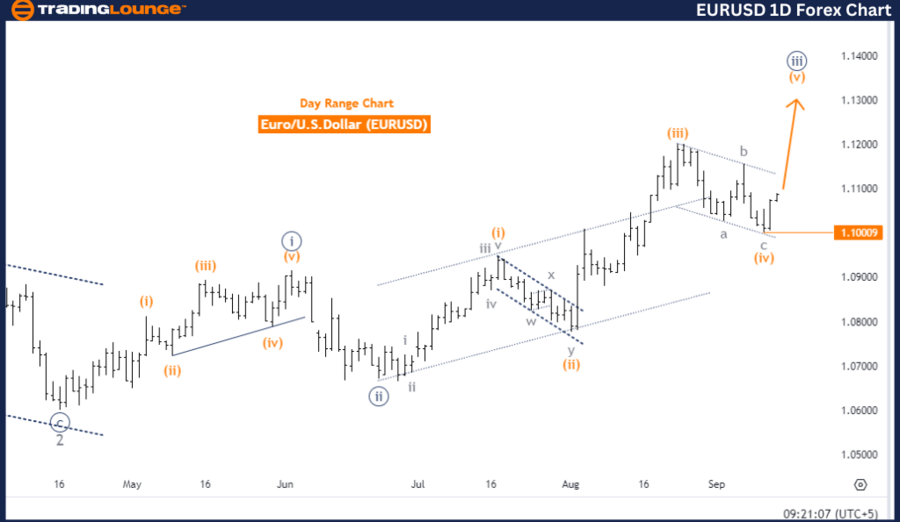

EURUSD Elliott Wave Analysis: Trading Lounge Day Chart

Euro/ U.S. Dollar (EURUSD) Day Chart Analysis

EURUSD Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Orange Wave 5

- Position: Navy Blue Wave 3

- Next Lower Degrees: Navy Blue Wave 4

- Details: Orange Wave 4 appears completed, and Orange Wave 5 is in progress.

- Cancel Invalid Level: 1.10009

The EURUSD Elliott Wave Analysis on the daily chart suggests a strong upward trend, reflecting an impulsive market mode. The focus is on Orange Wave 5, which signals continued bullish momentum. The current market position is in Navy Blue Wave 3, and the next expected shift is towards Navy Blue Wave 4.

Detailed EURUSD Forex Pair Analysis

The technical analysis indicates that Orange Wave 4 has likely concluded, and the Orange Wave 5 is now advancing, leading to a potential extension of the upward price movement. This wave count will hold if the price remains above the invalidation level of 1.10009. However, should the price drop below this point, it would invalidate the current structure, necessitating a reanalysis.

This analysis uses Elliott Wave Theory to predict future price action based on historical wave patterns. With Wave 4 completed, the upward momentum in Wave 5 is expected to continue, suggesting further gains for the EURUSD in the short term.

EURUSD Elliott Wave Analysis: Trading Lounge 4-Hour Chart

Euro/ U.S. Dollar (EURUSD) 4-Hour Chart Analysis

EURUSD Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Orange Wave 5

- Position: Navy Blue Wave 3

- Next Lower Degrees: Navy Blue Wave 4

- Details: Orange Wave 4 appears completed, and Orange Wave 5 is in progress.

- Cancel Invalid Level: 1.10009

The EURUSD Elliott Wave Analysis for the 4-hour chart highlights an ongoing impulsive trend. The market's current phase is Navy Blue Wave 3, with the key focus on Orange Wave 5, which signals continued upward momentum.

Detailed EURUSD Currency Pair Analysis

It appears that Orange Wave 4 has completed, transitioning into Orange Wave 5. This suggests that the corrective phase is over, and the market will likely maintain its bullish trajectory. Once Orange Wave 5 finishes, the market is expected to enter Navy Blue Wave 4, a corrective wave that could slow down the upward movement.

The wave cancellation level remains at 1.10009. If the price dips below this point, the current wave count would be invalidated, and a new structural analysis would be required. As long as the price stays above this level, the bullish trend fueled by Wave 5 should persist.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Summary

In conclusion, both the daily and 4-hour charts of EURUSD suggest that the market is in an impulsive upward trend, currently in Orange Wave 5. The bullish momentum is expected to continue unless the price falls below the invalidation level of 1.10009.