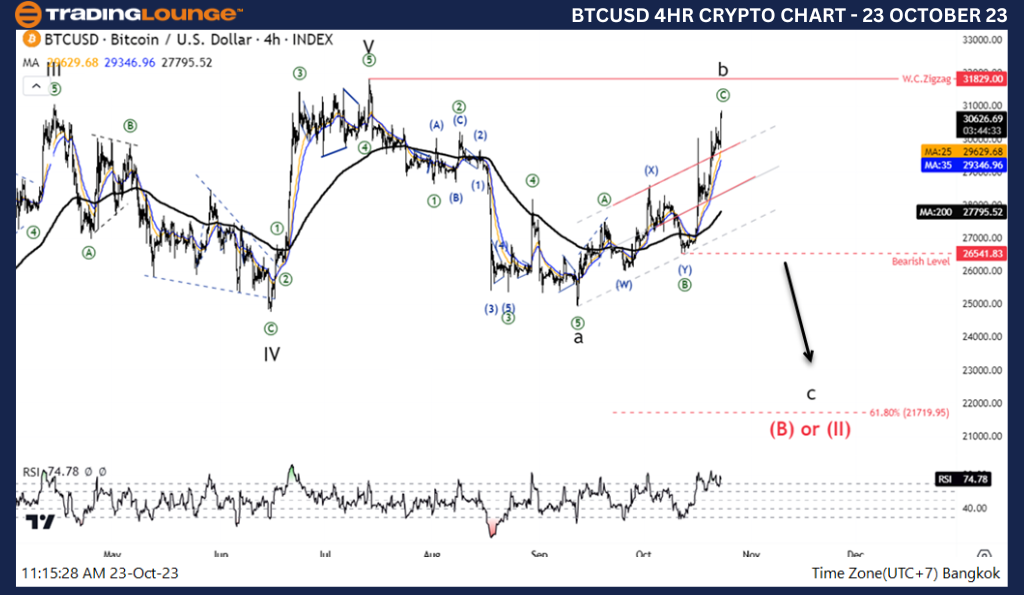

Elliott Wave Analysis TradingLounge Daily Chart, 23 October 23,

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave((B))

Direction Next higher Degrees: wave (B) or (II)

Wave Cancel invalid level: 15473

Details: the increase of wave B before decline in wave C

Bitcoin/U.S. dollar(BTCUSD)Trading Strategy: Although we are seeing a good recovery for Bitcoin from the 26541 level, the price structure is a bearish rally. The three waves moving within the channel are corrective, giving us a bearish view of Bitcoin. watch out the increase above 31829 will break the Zigzag Pattern

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

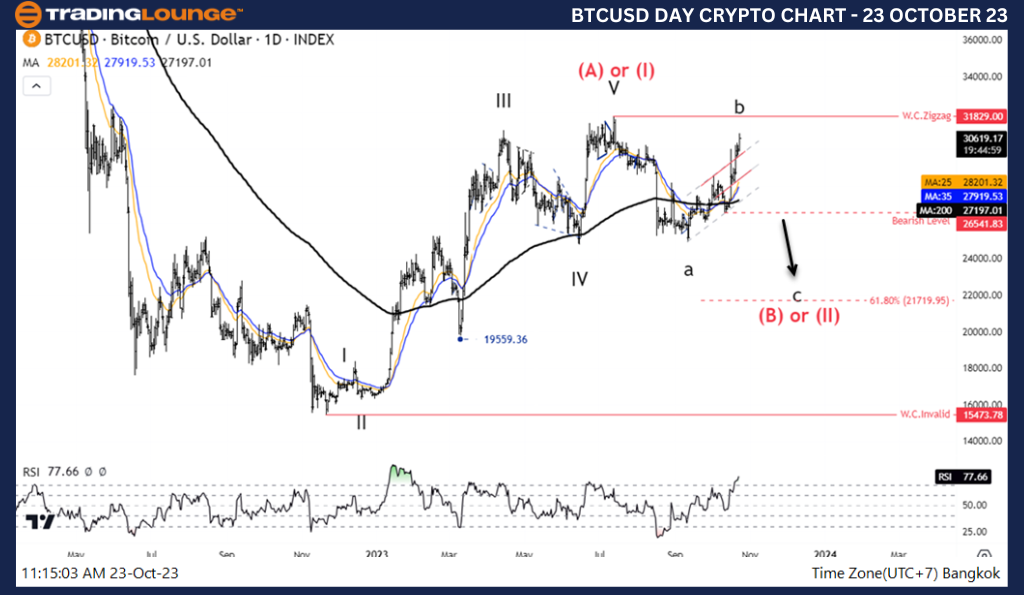

Elliott Wave Analysis TradingLounge 4H Chart, 23 October 23,

Bitcoin/U.S. dollar(BTCUSD)

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave((B))

Direction Next higher Degrees: wave (B) or (II)

Wave Cancel invalid level: 15473

Details: the increase of wave B before decline in wave C

Bitcoin/U.S. dollar(BTCUSD)Trading Strategy: Although we are seeing a good recovery for Bitcoin from the 26541 level, the price structure is a bearish rally. The three waves moving within the channel are corrective, giving us a bearish view of Bitcoin. watch out the increase above 31829 will break the Zigzag Pattern

Bitcoin/U.S. dollar(BTCUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.