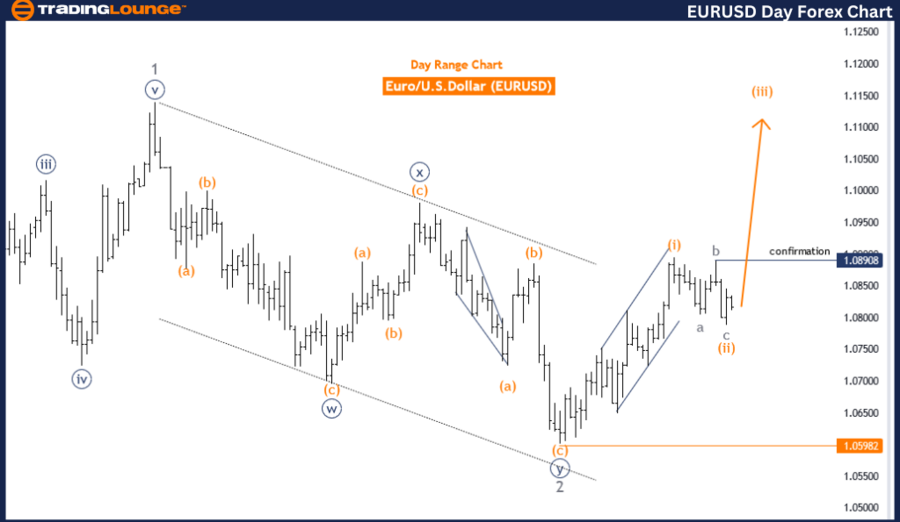

EURUSD Elliott Wave Analysis Trading Lounge Day Chart

Euro/U.S. Dollar (EURUSD) Day Chart Analysis

EURUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Orange wave 2 appears completed; orange wave 3 may start soon.

Wave Cancel Invalid Level: 1.05982

The EURUSD Elliott Wave Analysis on the day chart offers a comprehensive view of the market trend through Elliott Wave Theory. The observed movement functions as a trend, showing a clear market direction. This trend is impulsive, indicating a strong, sustained movement rather than a corrective phase.

The wave structure being analyzed is orange wave 3, part of a larger sequence starting with navy blue wave 1. This suggests a significant upward movement within the broader trend, marking a crucial phase in the impulsive wave series.

The current position in this wave sequence is navy blue wave 1, indicating an early stage in a significant upward trend. This stage signifies the completion of the first major wave in the larger trend sequence, with the market likely moving into the third wave. In Elliott Wave Theory, the third wave is typically the most powerful, indicating strong bullish momentum.

Key details note that orange wave 2 appears completed, signaling the end of a corrective phase and the potential start of orange wave 3. The beginning of orange wave 3 suggests a robust upward movement, offering a strong directional bias for traders.

The wave cancel invalid level is 1.05982. Breaching this level would invalidate the current wave count, requiring a reevaluation of the wave structure. Staying above this level is vital for maintaining the current wave count and the expected continuation of the upward trend.

Summary: The EURUSD Elliott Wave Analysis on the day chart indicates a strong impulsive trend, particularly in orange wave 3 of navy blue wave 1. The analysis shows the completion of orange wave 2 and the potential start of orange wave 3, suggesting a strong upward movement. The invalidation level of 1.05982 is crucial for maintaining the current wave count, guiding traders' strategic decisions based on Elliott Wave Theory principles.

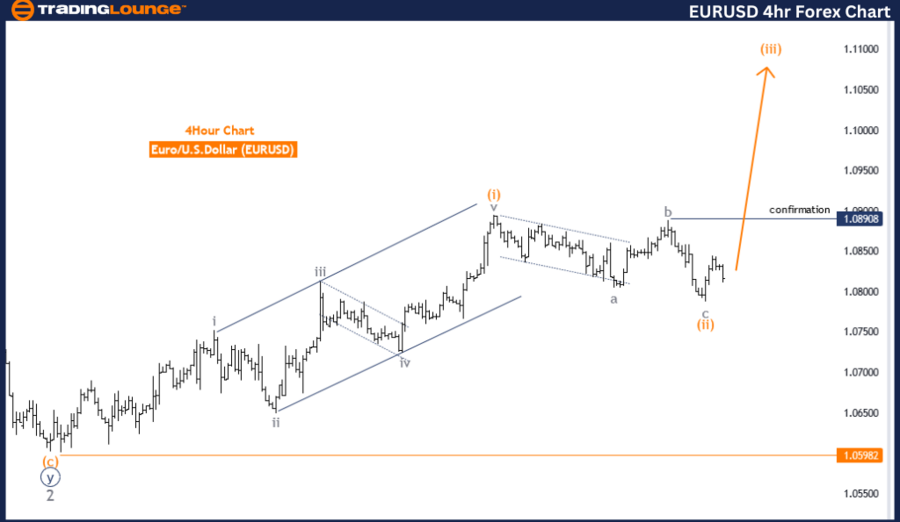

EURUSD Elliott Wave Analysis Trading Lounge 4-Hour Chart

Euro/U.S. Dollar (EURUSD) 4 Hour Chart Analysis

EURUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Orange wave 2 appears completed; orange wave 3 may have started.

Wave Cancel Invalid Level: 1.05982

The EURUSD Elliott Wave Analysis on the 4-hour chart provides a detailed look at the current market trend using Elliott Wave Theory. The primary function of the observed market movement is a trend, showing a clear market direction. This trend is classified as impulsive, indicating strong and sustained movement in one direction.

The wave structure under analysis is orange wave 3, part of a larger wave sequence starting with navy blue wave 1. This indicates a significant upward movement within the broader trend, suggesting a strong continuation of the current direction.

The position within this wave sequence is navy blue wave 1, indicating the initial stages of a significant upward trend. This phase suggests that the first major wave in the larger trend sequence has completed, and the market is now progressing into the third wave, typically the most powerful and extended wave in Elliott Wave Theory.

A critical detail in the analysis is that orange wave 2 appears completed, and orange wave 3 may have started. This marks the end of the corrective phase and the beginning of a new impulsive move. The initiation of orange wave 3 suggests a robust upward movement, providing a strong directional bias for traders.

The wave cancel invalid level is set at 1.05982. Breaching this level would invalidate the current wave count, requiring a reevaluation of the wave structure. Staying above this level is crucial for maintaining the current wave count and the expected trend continuation.

Summary: The EURUSD Elliott Wave Analysis on the 4-hour chart reveals a strong impulsive trend, specifically in orange wave 3 of navy blue wave 1. The analysis shows the completion of orange wave 2 and the potential start of orange wave 3, suggesting a strong upward movement. The invalidation level of 1.05982 is crucial for maintaining the current wave count, guiding traders' strategic decisions based on Elliott Wave Theory principles.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: British Pound/U.S.Dollar(GBPUSD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support