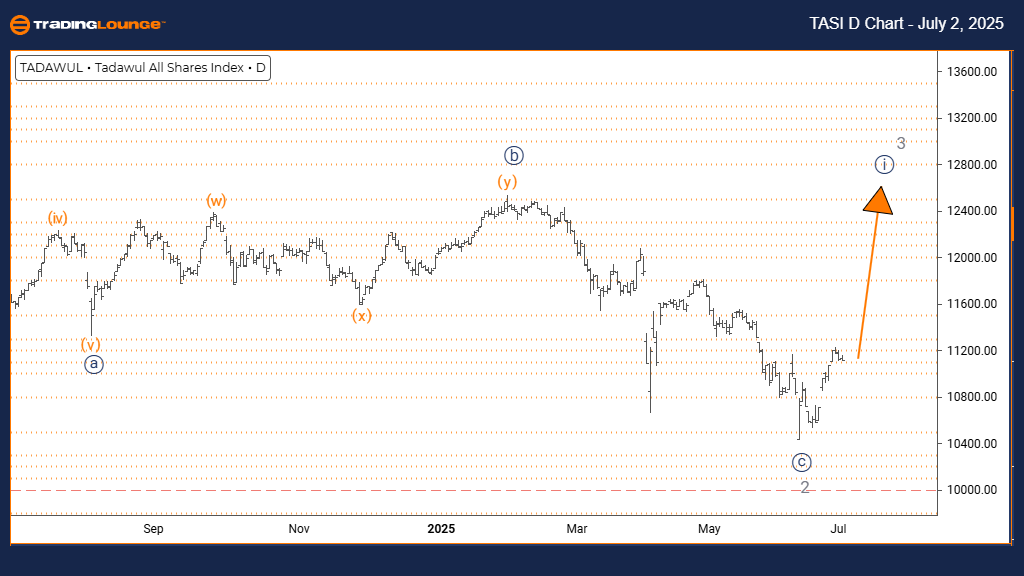

TASI INDEX – Elliott Wave Analysis (Daily Chart) – Trading Lounge

TASI Technical Analysis Overview

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

NEXT LOWER DEGREE DIRECTION: Navy Blue Wave 2

DETAILS: Completion of Gray Wave 2 appears confirmed. Navy Blue Wave 1 of 3 has started.

The TASI INDEX daily chart indicates a bullish Elliott Wave structure, with price movement showing an impulsive trend upward. The market is currently forming Navy Blue Wave 1, embedded within a broader Gray Wave 3 sequence. This configuration points to the initiation of a stronger upward cycle.

With Gray Wave 2 completed, the trend suggests the beginning of Navy Blue Wave 1 of 3, part of a classic Elliott Wave impulse. A corrective phase (Navy Blue Wave 2) is expected after the current wave finalizes, preparing for the continuation of the long-term bullish momentum.

Technical signals support this upward trend. Strong buying interest underlines the momentum, reinforcing the Gray Wave 3 advance and suggesting the TASI INDEX is positioned for continued growth.

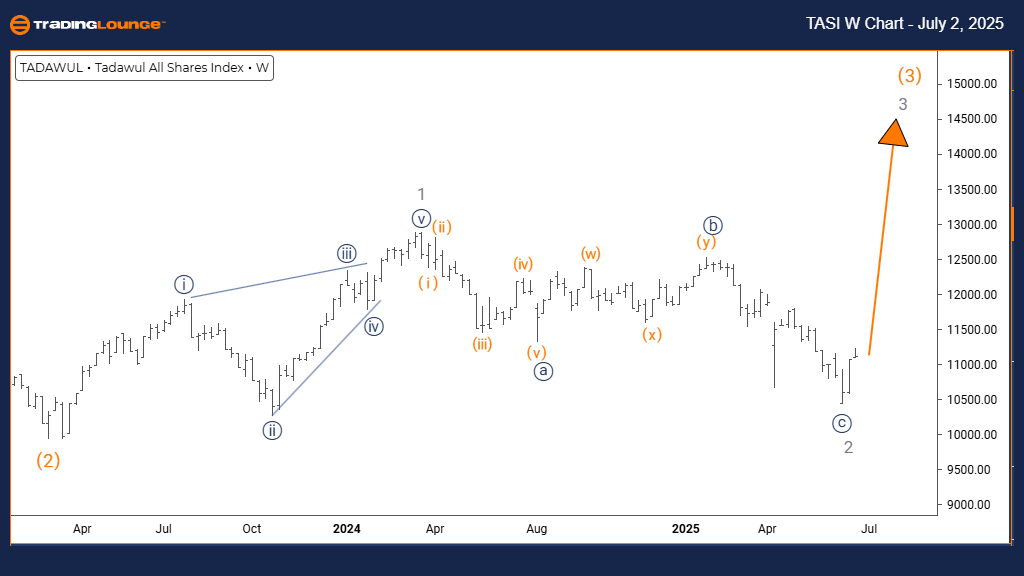

TASI INDEX – Elliott Wave Analysis (Weekly Chart) – Trading Lounge

TASI Technical Analysis Overview

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

NEXT HIGHER DEGREE DIRECTION: Gray Wave 3 (In Progress)

DETAILS: Gray Wave 2 likely completed. Gray Wave 3 of Orange Wave 3 is developing.

The weekly chart of the TASI INDEX confirms a strong bullish Elliott Wave pattern. The current formation marks the expansion of Gray Wave 3 within Orange Wave 3, commonly associated with aggressive bullish runs. The impulsive setup signals the market is in a high-momentum growth phase.

As Gray Wave 2 concludes, market action indicates Gray Wave 3 of 3 is unfolding—often the most powerful segment in an Elliott Wave sequence. This wave typically experiences rapid price movement with minimal pullbacks.

Technical analysis suggests a supportive framework for ongoing upside. The TASI INDEX forecast remains optimistic, with room for strong bullish continuation in the next stages of Gray Wave 3.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Shanghai Composite Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support