COCHLEAR LIMITED - COH Elliott Wave Technical Analysis for TradingLounge

Greetings! Today, our Elliott Wave analysis focuses on COCHLEAR LIMITED - COH, listed on the Australian Stock Exchange (ASX). Our insights reveal that ASX:COH is nearing the completion of wave (2)-orange, setting the stage for an upward move with wave (3)-orange. Below, we outline key validation points to determine the onset of the new trend.

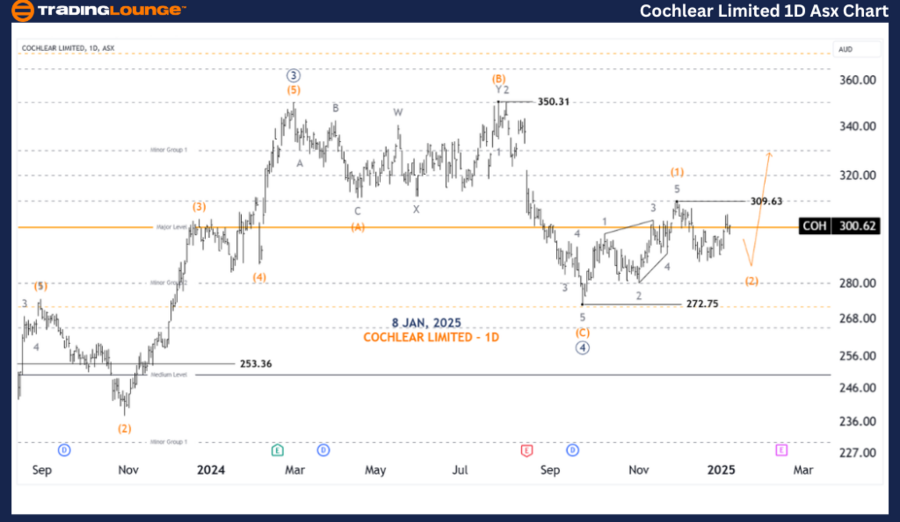

COCHLEAR LIMITED - COH 1D Chart (Semilog Scale) Analysis

Function: Major trend (Primary degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (2)-orange of Wave ((5))-navy

Details:

- Wave (1)-orange completed as a Diagonal.

- Wave (2)-orange is likely to move slightly lower before wave (3)-orange initiates a push higher.

- A pending buy order at the top of wave (1) is advisable.

- A strong breakout above 309.63 would confirm the start of wave (3)-orange.

Key Points:

- Invalidation Level: 272.75

- Confirmation Level: 309.63

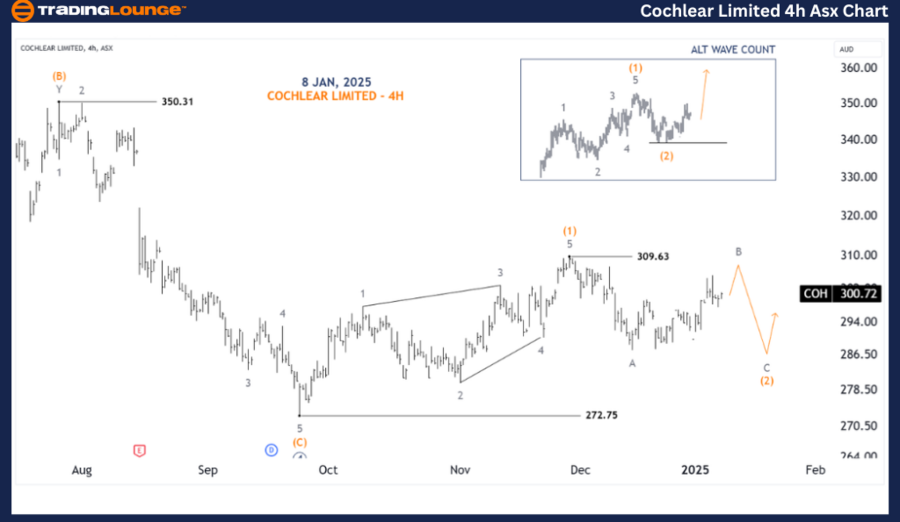

COCHLEAR LIMITED - COH 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (y)-orange of Wave ((2))-navy

Details:

- Wave (2)-orange appears to be unfolding as a Flat labeled A, B, C-grey.

- Expect further downside with wave C-grey before wave (3)-orange moves higher.

- A sharp breakthrough above 309.63 would directly suggest that wave (3)-orange is unfolding in the ALT alternative scenario.

Key Points:

- Invalidation Level: 17.80

- Confirmation Level: 19.65

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: GOODMAN GROUP – GMG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for COCHLEAR LIMITED - COH delivers a comprehensive perspective on short-term and contextual trends. By focusing on critical price levels, such as invalidation and confirmation points, we aim to improve confidence in identifying wave patterns. This approach empowers traders to align strategies effectively with market conditions and capitalize on emerging opportunities.