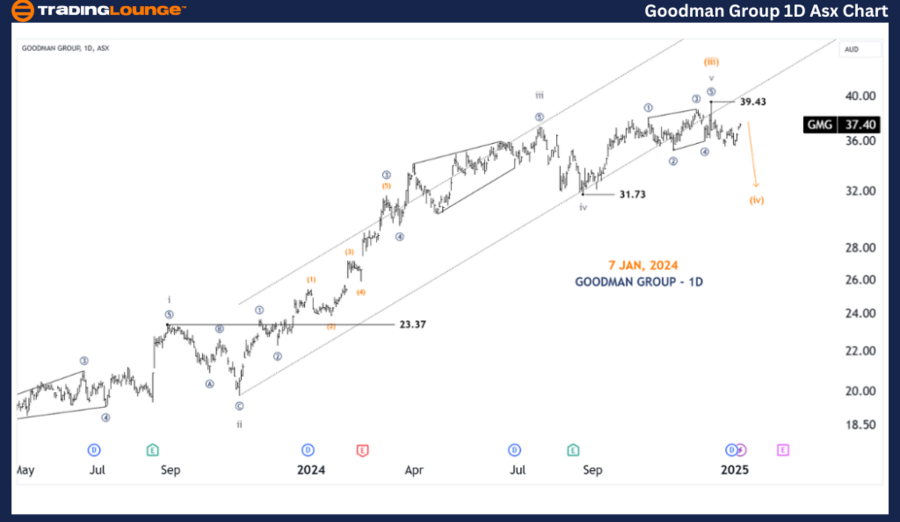

ASX: GOODMAN GROUP – GMG Elliott Wave Technical Analysis TradingLounge

Greetings! This Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) GOODMAN GROUP – GMG. Our assessment suggests ASX:GMG is trending lower with wave (iv)-orange and may potentially advance higher with wave (v)-orange. The report highlights key points to identify when a bullish trend begins or a bearish trend becomes invalid.

ASX: GOODMAN GROUP – GMG 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Subminuette degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (iv)-orange

Details:

- Wave (iii)-orange appears to have completed.

- Wave (iv)-orange is unfolding downward, with a potential target near 31.73.

- A movement above 39.43 will require reevaluation of the bearish outlook.

Key Points:

- Target Area: Around 31.73 for wave (iv)-orange.

- Invalidation Point: 39.43.

- Bullish Signal: Price action above 39.43.

ASX: GOODMAN GROUP – GMG 4-Hour Chart Analysis

Function: Major Trend (Subminuette degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave b-grey of Wave (iv)-orange

Details:

- The 4-hour chart remains consistent with the 1D chart analysis.

- Wave (iv)-orange continues downward, with wave b-grey advancing slightly higher.

- Expectation of wave c-grey completing the corrective phase within wave (iv)-orange.

Key Points:

- Target Area: Continuation of downward trend within wave (iv)-orange.

- Invalidation Point: 39.43.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: FORTESCUE LTD – FMG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis offers actionable insights into ASX: GOODMAN GROUP – GMG market trends. By providing specific validation and invalidation price points, our outlook aims to enhance trading confidence. The focus remains on identifying short-term opportunities while maintaining an objective, professional perspective on broader market trends.