Elliott Wave Insights for MCD: Navigating the Counter Trend

Welcome to our MCD Elliott Wave Analysis Trading Lounge, where we analyze McDonald’s Corp. (MCD) using Elliott Wave Technical Analysis. Let's delve into the market dynamics on the Daily Chart

MCD Elliott Wave Technical Analysis

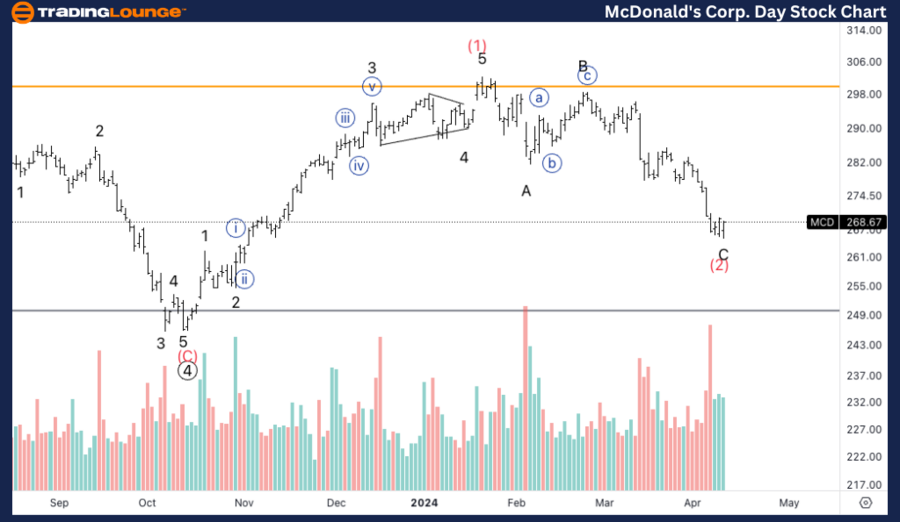

McDonald’s Corporation (MCD) Daily Chart Analysis

- Function: Counter Trend

- Mode: Corrective Phase

- Structure: Flat Correction

- Current Position: Intermediate Phase of Wave (C)

- Direction: Anticipating a Bottom in Wave (2)

In-depth Analysis:

The current Elliott Wave analysis of McDonald’s Corp. (MCD) on the daily chart points towards a crucial juncture in the stock's trajectory. We are witnessing signs that suggest a potential bottom forming in the C wave of correction (2). This observation is further supported by volume indicators hinting at a shift. For a bullish reversal to gain momentum, MCD’s stock price needs to find robust support at the TL3 marker, positioned at a pivotal $300 price point.

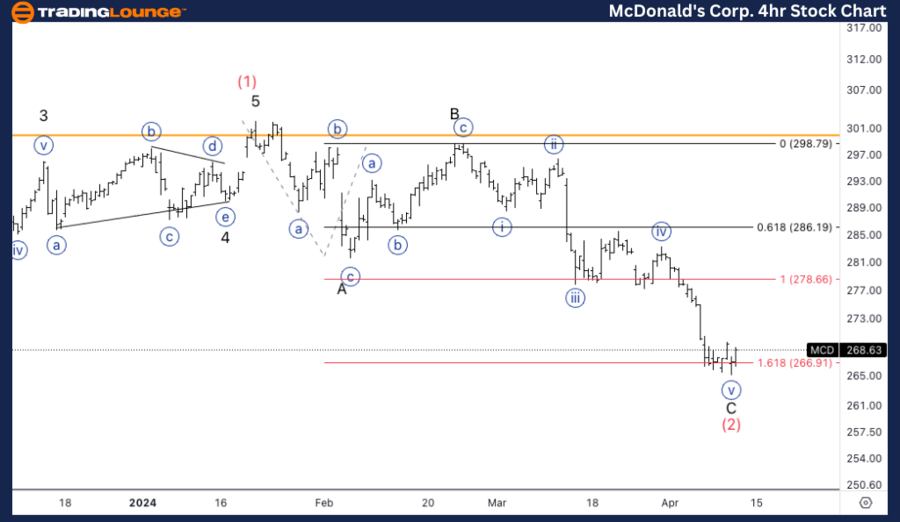

McDonald’s Corporation (MCD) 4-Hour Chart Overview

Elliott Wave Forecast for MCD: Detailing the Counter Trend Movements

- Function: Counter Trend

- Mode: Corrective Phase

- Structure: Flat Correction

- Position: In the Fifth Wave {v} of Wave C

- Direction: Towards a Bottom in Wave C

Detailed Examination:

On the 4-hour chart, McDonald's Corp. (MCD) reveals a fascinating progression in its Elliott Wave pattern. The analysis shows a descent through a five-wave structure that might signify the culmination of wave C. This phase is notably recognized by its support found just above the 1.618 Fibonacci retracement level of C versus A, indicating a critical support zone that traders and investors should monitor closely.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Meta Platforms Inc. (META)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE