Elliott Wave Analysis of Meta Platforms Inc. (META): Daily and 4-Hour Charts Insights

META's Daily Chart Elliott Wave Overview

In the realm of technical analysis for Meta Platforms Inc. (META), the Elliott Wave principle offers a nuanced view of the stock's current trajectory and potential future movements. Focusing on the daily chart, the analysis situates META within a crucial juncture of its price evolution.

META Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minor 5

DIRECTION: Upside in wave 5 of (5).

DETAILS: Looking for continuation higher towards equality of 5 vs. 1 at 600$.

Our analysis reveals a trending function characterized by impulse mode and motive structure, positioned in Minor 5. The direction indicates upside movement in wave 5 of (5). We anticipate further upward continuation, targeting the equality of 5 vs. 1 at $600.

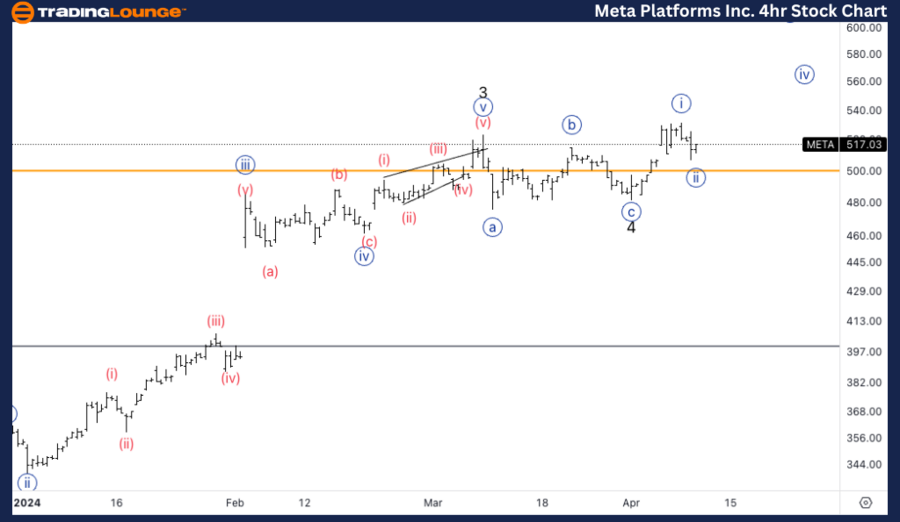

META Elliott Wave Analysis Trading Lounge 4Hr Chart,

Expanding the analysis to the 4-hour chart of Meta Platforms Inc. (META) enriches the understanding of its short-term movements and provides investors with critical insights into immediate trends.

Meta Platforms Inc., (META) 4Hr Chart Analysis

Elliott Wave Technical Analysis of META Stock

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Wave {iii} of 5.

DIRECTION: Acceleration higher into wave {iii}

DETAILS: Looking for further upside into wave {iii}, with an invalidation level at 480$, we are now sitting at the previous higher of around 520 and we need to take off from Miner Group 2 at 530$ to then start aiming for an upside target at 600$.

Conclusion: Prospects for Meta Platforms Inc. (META)

The comprehensive Elliott Wave analysis of Meta Platforms Inc. (META) across both daily and 4-hour charts underscores a pronounced bullish sentiment. With the stock anticipated to progress through critical phases of its Elliott Wave formation, investors and traders are advised to monitor these key levels closely. The potential for META to achieve and even surpass the $600 price target hinges on its ability to navigate upcoming wave milestones effectively. As always, staying attuned to the intricacies of Elliott Wave patterns can provide valuable foresights into the stock's future direction.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Alphabet Inc., (GOOGL)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE