PayPal Holdings Inc. (PYPL) Elliott Wave Analysis - Daily and 1-Hour Charts

This comprehensive Elliott Wave analysis for PayPal Holdings Inc. (PYPL) explores both daily and 1-hour charts, providing crucial insights into the potential price direction and structural trends of PYPL. This report is designed to offer traders valuable information on potential market opportunities.

PYPL Elliott Wave Analysis - Daily Chart

PayPal (PYPL) Daily Chart Overview

Technical Elliott Wave Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3 or C

Direction: Upside in wave 3/C

Analysis Details:

The current analysis suggests a potential upward trajectory within wave 3 or C, which is expected to manifest in a five-wave structure. At present, it appears that the price action is within wave {iii} of this sequence.

Daily Chart Technical Analysis

PayPal (PYPL) is advancing within wave 3 or wave C, which, if the movement remains impulsive, should unfold as a five-wave pattern. Current price action indicates that PYPL is progressing within wave {iii}, suggesting further upward potential as the wave structure continues to evolve. Confirmation of this wave count will depend on whether the movement remains impulsive, characterized by clear subdivisions into five distinct waves.

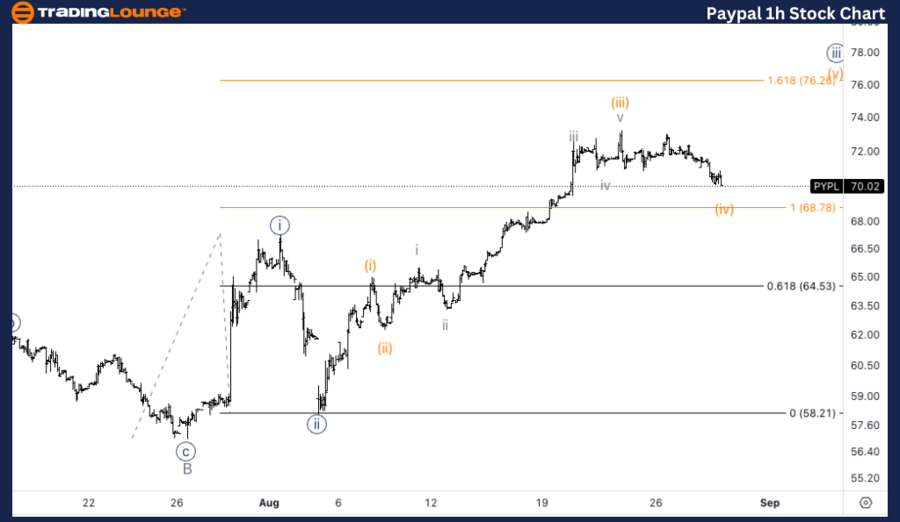

PYPL Elliott Wave Analysis - 1-Hour Chart

PayPal (PYPL) 1H Chart Overview

Technical Elliott Wave Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 3/C

Direction: Upside in wave {iii}

Analysis Details:

A correction is anticipated within wave (iv) of {iii}, as the price has yet to reach the 1.618 extension of wave {iii} relative to wave {i}.

1-Hour Chart Technical Analysis

On the 1-hour chart, PayPal (PYPL) continues to move within wave {iii} of 3 or C, displaying strong upward momentum. However, a correction is expected in wave (iv) of {iii} before further gains are realized. The target for wave {iii} is likely to align with 1.618 times the length of wave {i}, a common extension in Elliott Wave theory. Following the anticipated wave (iv) correction, another upward move is expected to complete wave {iii}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: CRM Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support