Unlock the potential of Visa Inc. (V) with our in-depth Elliott Wave Technical analysis from Trading Lounge. Dive into the daily and 4Hr charts to grasp the intricate patterns and trends that could shape your trading decisions.

Visa Inc. (V) Daily Chart Elliott Wave Analysis

Function: Trend

Mode: Impulse

Structure: Motive

Position: Minor wave 5 of (1)

Direction: Top in wave 5

Are you prepared for Visa Inc.'s potential upswing? Our analysis indicates that we're currently navigating minor wave 5 of (1), poised at a critical juncture. While the trend remains upward, it's crucial to monitor the RSI bearish divergence signaling a possible impending top. Additionally, an alternative count is suggesting the presence of waves 1 and 2, potentially affecting our outlook on current waves 3 and 4.

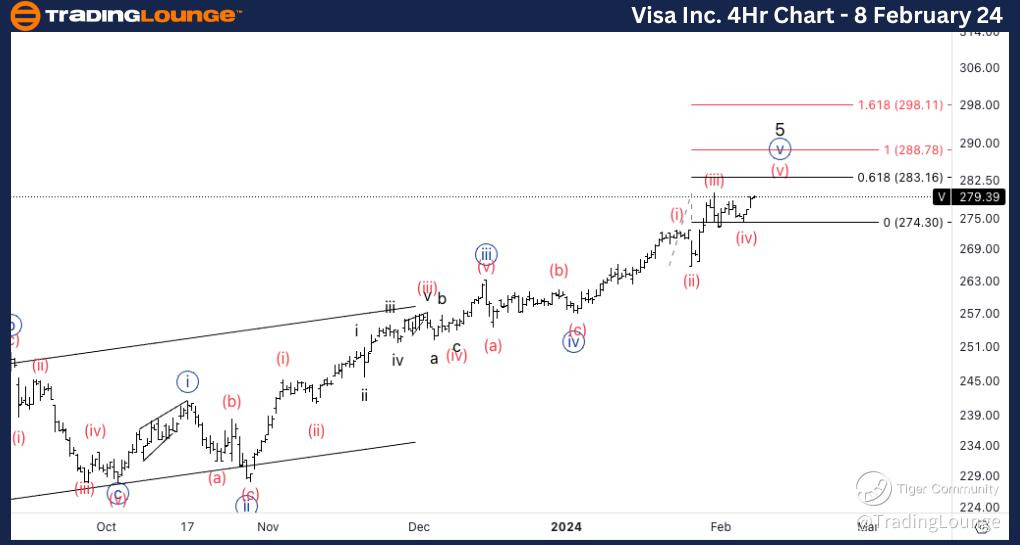

Visa Inc. (V) 4Hr Chart Elliott Wave Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (v) of {v}

Direction: Upside into wave (v)

Don't miss out on the potential upside momentum indicated by our 4Hr chart analysis for Visa Inc. (V). We're currently tracking wave (v) of {v}, highlighting a strong upward trend. It's essential to note that wave (iii) was shorter than wave (v), suggesting a crucial validation level at 288$. Keep a close eye on the resistance levels, with MG2 marking a significant barrier at 280$ and TL3 presenting a potential milestone at 300$.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Berkshire Hathaway Inc. (BRK.B)

Welcome to our V Elliott Wave Analysis Trading Lounge, your premier destination for in-depth analysis of Visa Inc. (V) through Elliott Wave Technical Analysis. As of the Daily Chart on 8th February 2024, we unravel crucial insights into market trends.

*V Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we observe a prevailing impulse function with a motive structure. The current position is in Minor wave 5 of (1), indicating a potential top in wave 5. Our focus lies in monitoring the remaining upside potential. Notably, we identify an RSI bearish divergence, hinting at a looming top. Additionally, an alternative count suggests the current wave 3 and 4 might be wave 1 and 2, adding complexity to the analysis.

*V Elliott Wave Technical Analysis – 4H Chart*

Here, the wave function maintains its impulsive nature with a motive structure. The present position is in Wave (v) of {v}, signaling an upside movement into wave (v). Notably, to maintain wave count integrity, wave (v) must be shorter than wave (iii), with an invalidation level set at $288. Key resistance levels include the end of MG2 at $280 and TL3 at $300.