ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG) Elliott Wave Technical Analysis – TradingLounge

Greetings,

Our Elliott Wave analysis today focuses on INSURANCE AUSTRALIA GROUP LIMITED (IAG) on the Australian Stock Exchange (ASX).

Currently, ASX:IAG shares remain in a corrective wave pattern and may continue moving lower before a potential bullish reversal.

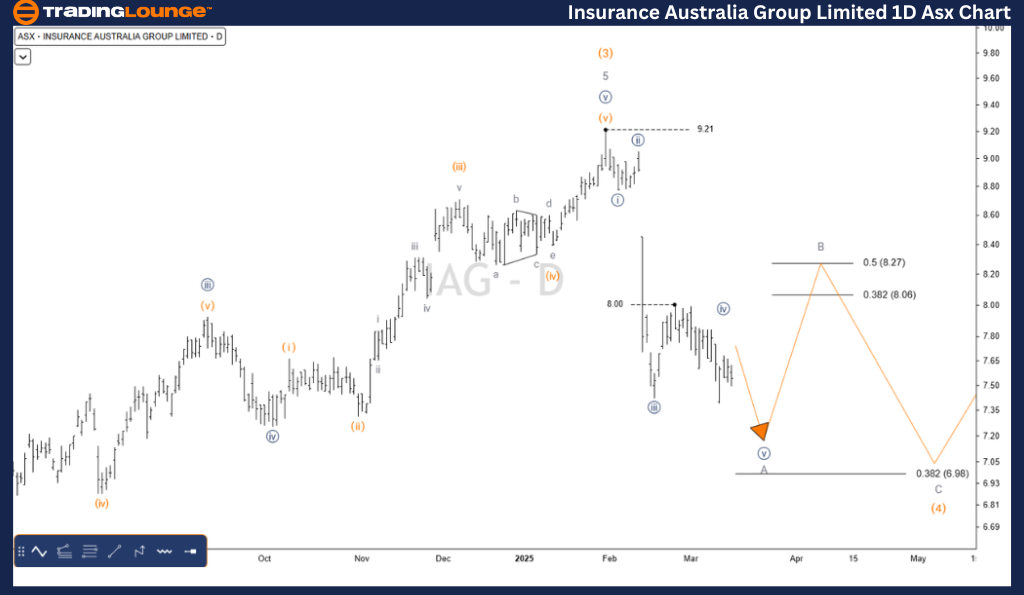

ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG) Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Key Analysis

Function: Major trend (Primary degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (4) - orange

Details:

✅ Wave (3) - orange recently completed as a five-wave sequence, labeled 1-grey to 5-grey.

✅ Wave (4) - orange is likely pushing lower, with 6.982 as the next key target.

✅ A long-term bullish Wave (5) - orange remains uncertain at this stage. Instead, the market may have completed the first phase of an ABC Zigzag within Wave (4) - orange.

❌ Invalidation point: 9.210

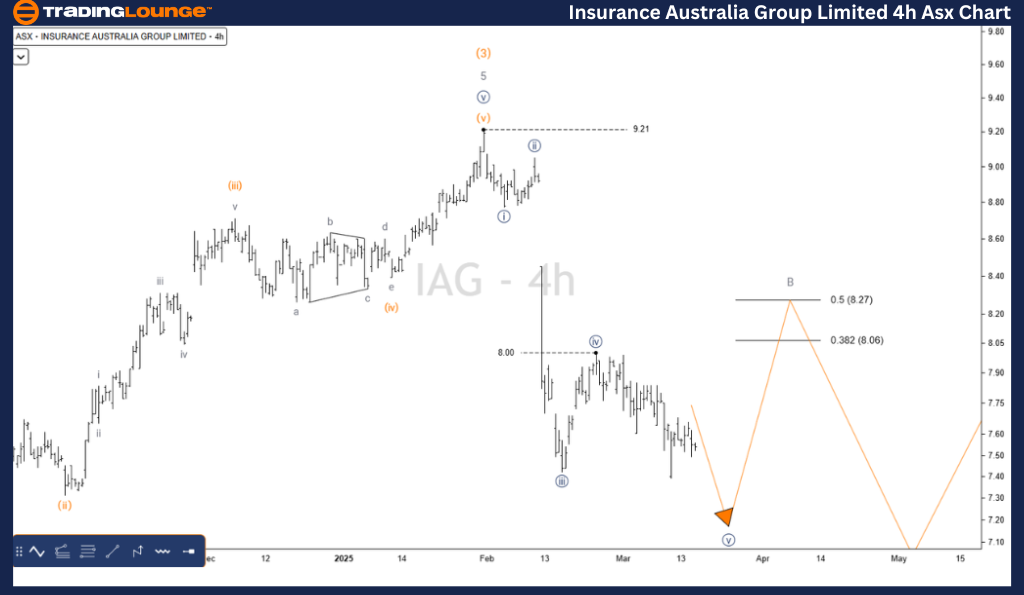

ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG) Elliott Wave Technical Analysis – 4-Hour Chart

Key Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave A - grey of Wave (4) - orange

Details:

✅ Wave (4) - orange continues unfolding lower, indicating further downside.

✅ The pattern resembles an A-B-C correction (grey), with Wave A - grey nearly complete.

✅ Further decline is expected with Wave C - grey extending lower.

❌ Invalidation point: 9.210

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous:JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG) provides key market insights for traders and investors.

- By identifying price validation and invalidation levels, we improve confidence in the wave count and help traders make data-driven decisions.

- The current trend suggests further corrective movement before any potential bullish reversal.

- Our technical analysis remains objective and data-backed, offering a professional perspective on market trends.