MSFT Elliott Wave Analysis Trading Lounge Daily Chart, 20 February 24

Welcome to our MSFT Elliott Wave Analysis Trading Lounge, your ultimate destination for comprehensive insights into Microsoft Inc. (MSFT) using Elliott Wave Technical Analysis. As of the Daily Chart on 20th February 2024, we delve into significant trends guiding the market.

MSFT Elliott Wave Technical Analysis

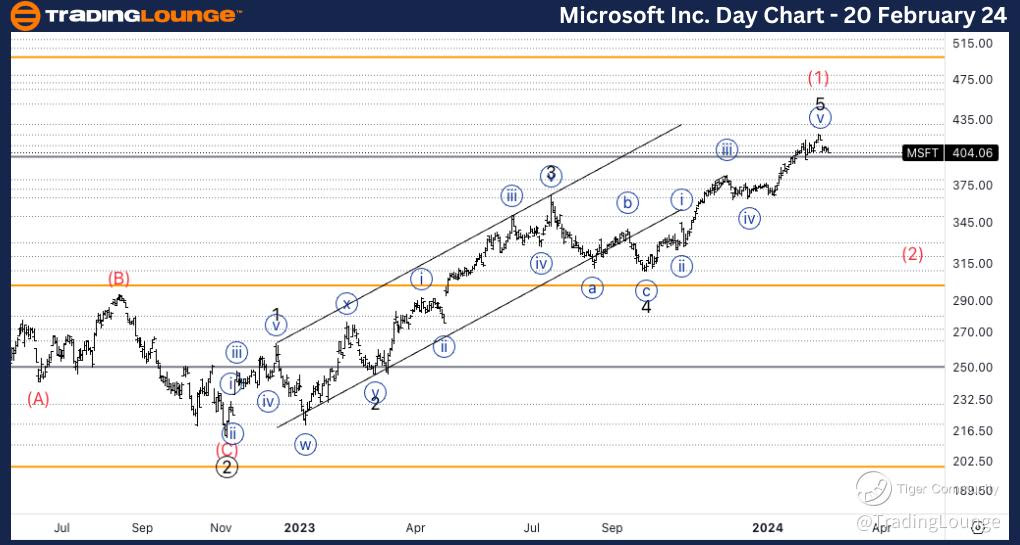

Microsoft Inc., (MSFT) Daily Chart

Embarking on a detailed Elliott Wave technical analysis of Microsoft Inc. (MSFT), we delve into the intricacies of its current market trends. The observed functionality suggests a counter-trend trajectory within a corrective mode characterized by a zigzag structure. Presently, the stock is positioned at Minor Wave 5 of (1), manifesting a downside trajectory within Wave A of (2).

In the wake of an impressive rally resembling wave (1), indications point towards the conclusion or imminent termination of this upward movement. A distinct five-wave pattern substantiates this perspective, complemented by discernible resistance encountered around the Medium Level of $400.

MSFT Elliott Wave Analysis Trading Lounge 4Hr Chart, 20 February 24

Microsoft Inc., , (MSFT) 4Hr Chart

Microsoft Inc. Elliott Wave Technical Analysis

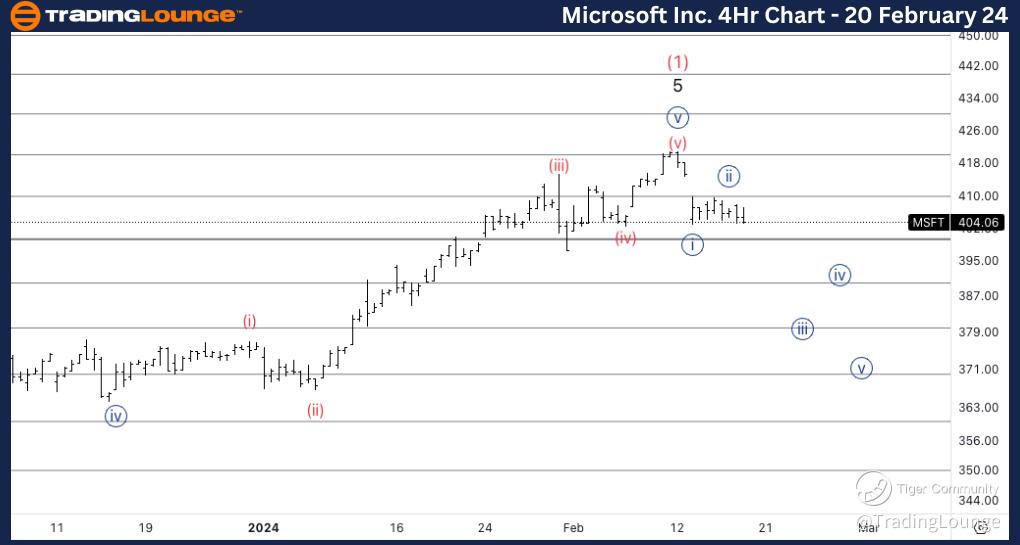

The 4-hour chart for Microsoft Inc., (MSFT) continues to unravel noteworthy insights through an Elliott Wave technical analysis. The prevailing market dynamics reveal a counter-trend scenario operating within a corrective mode, characterized by a zigzag structure. The current positioning is identified as Wave {i} of A, signifying a continuation lower into the impending wave {iii}.

A meticulous examination of recent price action unveils a corrective pullback marked as wave {ii}, hinting at a probable descent in the forthcoming wave {iii}. Anticipating further downside, our focus is set on the target within wave A, aligning with the previous wave {iv}, pinpointed at the $370 mark.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: META Platforms Inc. (META)

In summary, the Elliott Wave analysis for MSFT on both the daily and 4-hour charts signals a prevailing counter-trend sentiment, governed by a corrective mode typified by zigzag structures. The nuanced wave counts and distinctive patterns suggest an impending downside trajectory, with the daily chart pointing towards Minor wave 5 of (1) and the 4-hour chart indicating the continuation of Wave {iii} within the corrective sequence. Investors and traders are advised to remain vigilant, considering the potential developments in line with the outlined Elliott Wave framework for MSFT.