ASX: WASHINGTON H SOUL PATTINSON & COMPANY LIMITED - SOL Elliott Wave Technical Analysis TradingLounge

Greetings:

Today's Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) for WASHINGTON H SOUL PATTINSON & COMPANY LIMITED (SOL). Our outlook suggests significant upside potential for ASX:SOL with the development of wave 3-grey.

ASX: WASHINGTON H SOUL PATTINSON & COMPANY LIMITED - SOL 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey of Wave (3)-orange

Details:

Wave 2-grey appears to have concluded as an Expanded Flat, labeled ((a)), ((b)), ((c))-navy, bottoming out around 32.52. This indicates that wave 3-grey could be in progress, pushing the price significantly higher.

- Invalidation Point: 32.52

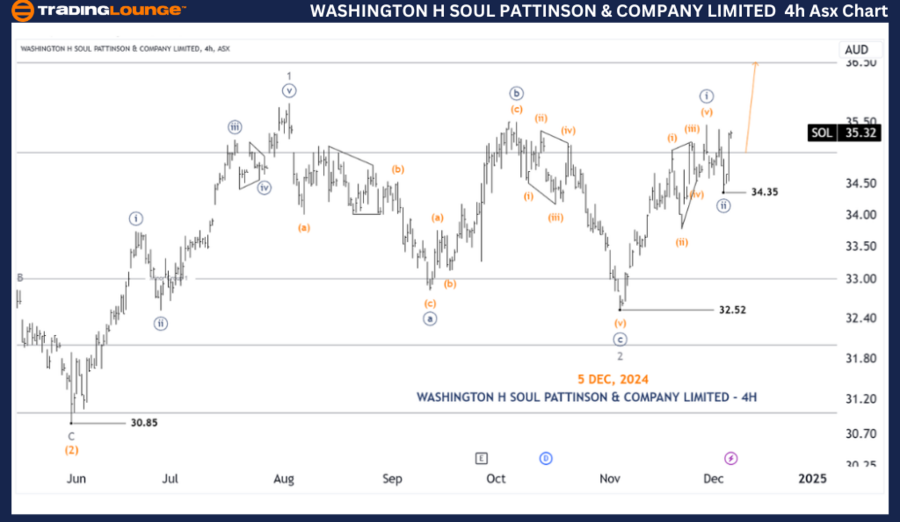

ASX: WASHINGTON H SOUL PATTINSON & COMPANY LIMITED - SOL 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details:

Since the low at 32.52, wave ((i))-navy seems to have concluded as a Leading Diagonal, labeled from wave (i)-orange to wave (v)-orange. Following this, wave ((ii))-navy is moving lower. Typically, diagonals are succeeded by strong impulsive movements, but such signals have yet to materialize, raising questions about whether wave ((iii))-navy is actively unfolding. Confirmation may take a few more days, requiring the price to remain above 34.35 to uphold the current uptrend.

- Invalidation Point: 34.35

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis provides an updated forecast and insight into the contextual and short-term trends for ASX: WASHINGTON H SOUL PATTINSON & COMPANY LIMITED - SOL. By highlighting specific price points for validation and invalidation, we aim to boost the reliability of our wave count and market outlook. These insights are intended to empower traders with an objective and actionable understanding of market dynamics.