ASX: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis TradingLounge

Greetings! This Elliott Wave analysis provides an updated perspective on the Australian Stock Exchange (ASX) and its V300AEQ ETF UNITS – VAS. The analysis identifies a bullish trend with ASX:VAS currently advancing in wave ((iii))-navy. However, a short-term retracement with wave (ii)-orange is anticipated before wave (iii)-orange resumes its upward momentum.

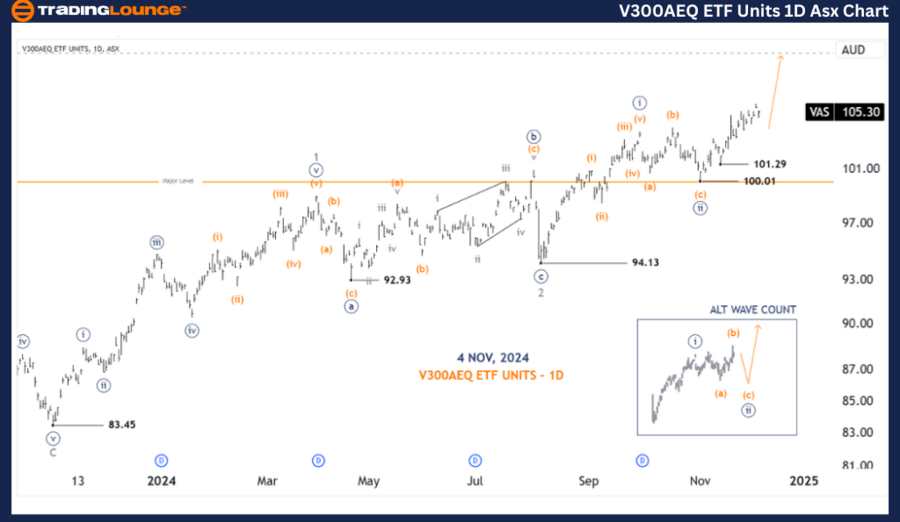

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details:

Wave ((iii))-navy is progressing higher, with a critical support level at 101.29. A breach below this level would suggest that the ALT (Alternate Wave Count) is in effect, implying wave ((ii))-navy has not yet concluded, leaving room for further downside movement.

Invalidation Point: 101.29

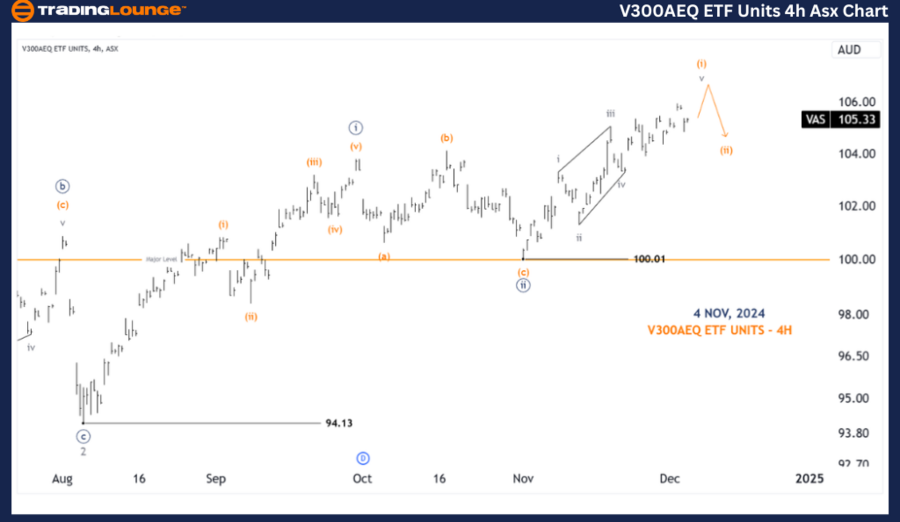

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave v-grey of Wave (i)-orange of Wave ((iii))-navy

Details:

From the recent low at 100.01, wave (i)-orange appears to be unfolding, albeit with overlapping structures indicative of a potential diagonal pattern. A pullback lower with wave (ii)-orange may occur before wave (iii)-orange drives the trend further upward.

Invalidation Point: 100.01

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: XERO LIMITED - XRO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis delivers a comprehensive overview of the trends and potential price movements for ASX: V300AEQ ETF UNITS – VAS, offering actionable insights for traders. Validation and invalidation price levels are provided to bolster the reliability of the wave count, enhancing confidence in our forecast. By combining contextual trends with precise technical analysis, we aim to equip readers with the tools needed for informed trading decisions.