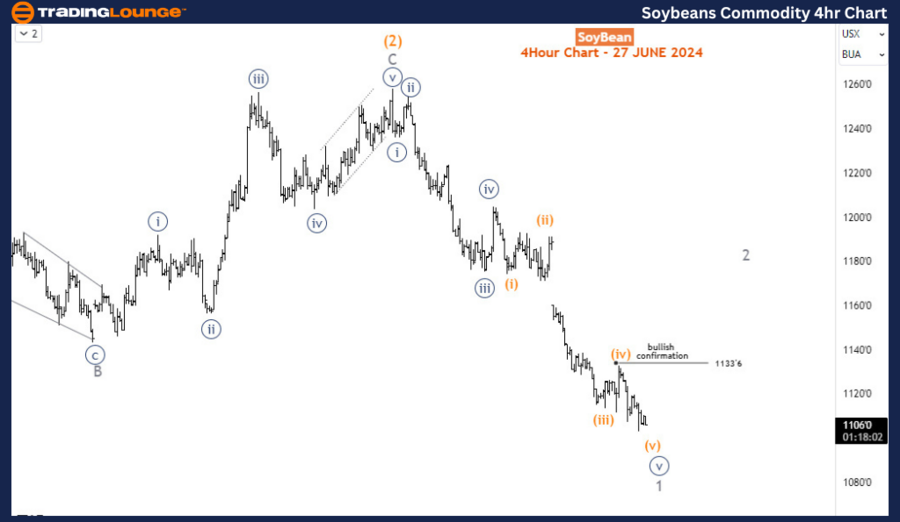

Soybeans Elliott Wave Analysis

Function - Trend

Mode - Impulse

Structure - Impulse for wave (3)

Position - Wave 1 of (3)

Direction - Wave 1 of (3) is still in play

Details - Wave 1 extends lower. No signs of a bullish correction yet. Still anticipating wave 2 to begin but first confirmation is expected above 1133’6.

Soybean Elliott Wave Technical Analysis

Since late May 2024, soybean prices have declined by over 12%, continuing the long-term sell-off that began in June 2022. The price has retraced completely from the recovery phase between late February and May 2024, after breaking below 1129. This breakdown suggests that soybean prices will likely continue to fall in the coming weeks. However, a rebound may occur soon to correct the current decline from May.

Daily Chart Analysis

On the daily chart, the price is following an A-B-C (circled) pattern in the primary degree. Wave A started in June 2022 at 1785 and ended with a diagonal at 1249 in October 2023. Wave B then followed, finishing at 1398 in November 2023, marking the beginning of the current wave C. Since November 2023, Wave C has been developing into an impulse wave. Wave (1) of C was completed at 1129 in late February 2024, followed by a corrective bounce for wave (2) that reached 1258 in May 2024. From the May 2024 high, wave (3) has been unfolding and could extend to the 891-829 range. Currently, the price is nearing the completion of wave 1 of (3), and a pullback for wave 2 is expected to begin soon.

H4 Chart Analysis

On the H4 chart, wave 1 is finishing an impulse wave structure, though no reversal signs are present yet. The fifth sub-wave of wave 1 is also completing an impulse, indicating that wave 1 is close to completion. A corrective bounce for wave 2 is anticipated to emerge, especially if there is a bullish reaction above 1133. After wave 2 concludes, the dominant bearish trend is expected to resume with wave 3 of (3).

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous:Silver Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support