AMCOR PLC – AMC Elliott Wave Technical Analysis TradingLounge

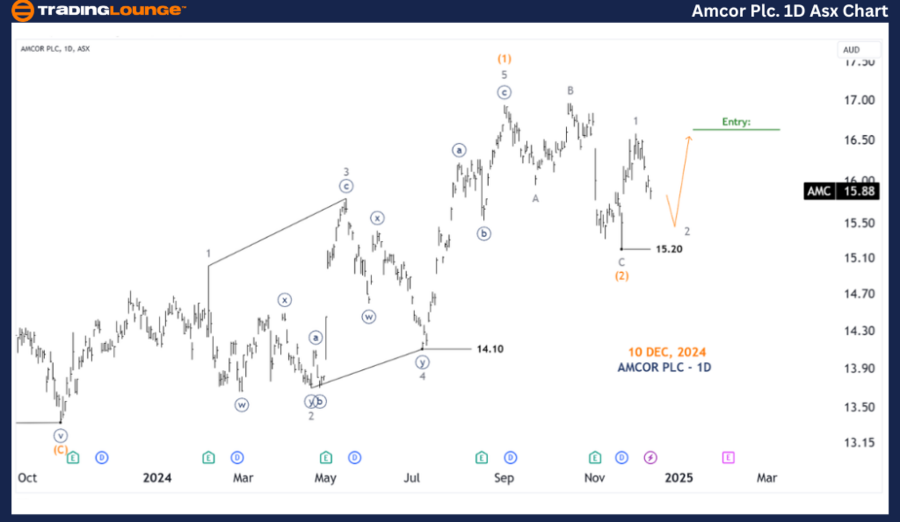

Greetings, this analysis offers an updated Elliott Wave perspective on the Australian Stock Exchange (ASX) with AMCOR PLC – AMC. The analysis suggests ASX:AMC could push slightly lower in the short term before initiating a potential upward movement with a 3-grey wave pattern.

AMCOR PLC – AMC 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree)

Mode: Motive

Structure: Impulse

Position: Wave 2-grey of Wave (3)-orange

Details:

- Wave 1-grey has concluded, and wave 2-grey appears to be dipping slightly lower.

- Following this, wave 3-grey may resume an upward trajectory.

- A pending buy position can be strategically placed at the peak of wave 1-grey.

Invalidation Point: 15.20

AMCOR PLC – AMC 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 2-grey

Details:

- Since the 15.20 low, wave 1-grey recently completed.

- Wave 2-grey is currently moving slightly lower; as long as the price does not breach the 15.20 level, the projection of wave 3-grey returning upward remains valid.

- A waiting buy position is advisable above the peak of wave 1-grey.

Invalidation Point: 15.20

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: WISETECH GLOBAL LIMITED - WTC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis provides insights into AMCOR PLC – AMC’s Elliott Wave trends, offering actionable price points that act as validation or invalidation signals. These insights enable traders to approach market movements with greater confidence and precision. By leveraging key wave counts and critical levels, the analysis ensures an objective and professional perspective on market trends.